Nearly every American worker depends on Social Security (SS) for some or all of their income in retirement. In fact, more than 48 million Americans currently receive Social Security retirement benefits.

But the Social Security Administration (SSA) also provides both a one-time death benefit as well as ongoing monthly survivors benefits (also known as ‘widows benefits’) for family members of deceased workers. Together, this lump sum payment and the monthly paycheck provide a critical source of income following the death of a spouse or parent. Six million family members receive survivors benefits, which function almost like a life insurance policy.

As with retirement benefits, there are choices to be made about claiming survivors benefits. Read on to learn how to navigate your options so you can make the most of what you are owed.

Table of Contents

What are Social Security survivor benefits?

Social Security survivors benefits eligibility

How are survivor benefits calculated?

How do I apply for survivor benefits?

What are SS survivor benefits?

Social Security survivor benefits are available to spouses, ex-spouses, children and dependent parents of someone who worked and paid into the Social Security system. The amount depends on 1) the beneficiary’s age, 2) their relationship to the deceased, and 3) the lifetime earnings of the deceased. The more the deceased worker earned, the higher the survivor benefits will be.

Spousal benefits vs survivor benefits

The most important distinction between spousal and survivors benefits is that spousal benefits are based on a living spouse’s work history. Survivors benefits, on the other hand, are based on the earnings of a deceased spouse or parent.

Spousal benefits can be up to 50% of your spouse’s primary insurance amount (PIA). Their PIA is the size of the retirement benefit they are eligible for when they reach full retirement age. While survivors benefits are also based on the worker’s earnings over their lifetime, survivors can collect up to 100% of their deceased spouse’s benefit. However, the surviving spouse must be at least full retirement age to claim 100%.

If you are already receiving spousal benefits when your spouse dies, the SSA will automatically convert your benefits to survivors benefits, after the death is reported.

You cannot receive both spousal and survivors benefits at the same time. And, as with spousal benefits, you cannot simply add together your survivor benefit and your own retirement benefit. Instead, Social Security pays you the higher of the two amounts.

Social Security survivors benefits eligibility

To qualify for survivors benefits, you must be one of the following:

- Widow or widower, age 60 or older (age 50 if you are disabled), who was married to the deceased for at least nine months, and did not remarry before 60

- Widow or widower at any age who is caring for a deceased worker’s child who is younger than age 16 or disabled

- Divorced spouse of the deceased

- Minor or disabled child

- Stepchild or grandchild of the deceased (in some cases)

- Dependent parent of the deceased age 62 or older (in some cases)

The worker who died must have paid into the Social Security system during his or her career. Workers earn up to four credits a year (in 2020, $1,410 in income equals one credit). Once the worker has earned 40 credits, his or her family is fully insured under the program. But the families of workers who have less than 40 credits can still qualify for some survivors benefits. And under a special rule, if someone worked for only a year and a half in the three-year period before their death, their children and spouse can be eligible for benefits.

When can you collect Social Security survivor benefits?

The earliest you can collect survivors benefits is age 60. However, you can collect survivors benefits starting at age 50 if you are disabled and the disability developed within seven years of your spouse’s death.

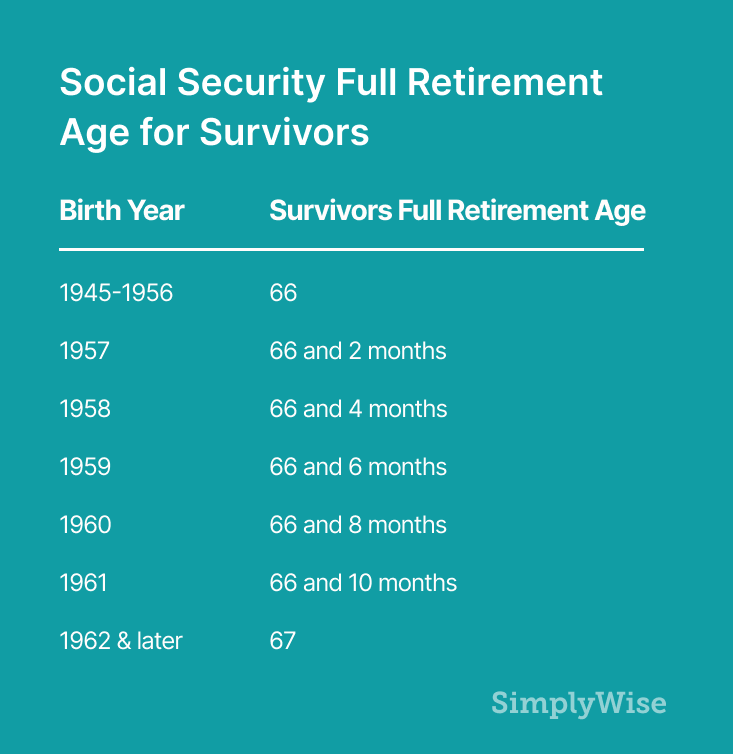

You can increase the size of your survivors benefits by waiting to claim them until your survivors full retirement age. There are two important things to note on survivors full retirement age. First, full retirement age for survivors (see table below) is a little different than the regular Social Security full retirement age. Second, unlike with retirement benefits, survivors benefits don’t increase by waiting to collect after survivors full retirement age.

Survivor benefits and working

You can still earn wages while you’re receiving survivors benefits. However, if you haven’t reached your full retirement age, some of your survivors benefits may be withheld. For 2020, $1 from your survivors benefits will be deducted for every $2 you earn above $18,240.

Note that only wages count—pensions, interest, investment earnings, and other government benefits are not included in that annual limit.

How much does a child get for survivor benefits?

Kids can receive their deceased parent’s Social Security benefits if they are unmarried and younger than 18 (or up to 19 if still in high school). In addition, if the children are disabled, regardless of their age, and the disability occurred before they turned 22, they are eligible for survivors benefits. Adult children who are not disabled are not eligible to receive their parents’ Social Security benefits.

If you’re raising your deceased spouse or ex-spouse’s minor or disabled child, no matter how old you are, you also can receive survivors benefits. The child must be under age 16, unless he or she is disabled.

A child can receive up to 75% of the survivors benefits. Note that there are limits to how much one family can collect in Social Security benefits. These limits can get complicated, but usually a family maximum will be between 150 and 188% of the worker’s basic Social Security benefit. Benefits paid to a divorced spouse don’t count toward the family limit.

Other family members

Adopted children are treated the same as biological children under the survivors benefits guidelines. Stepchildren can receive survivors benefits if they were at least one-half supported by the stepparent who died.

Grandchildren can be eligible for benefits if their parents are disabled or have died and the grandchildren were living with the grandparent who died.

Parents, stepparents or adoptive parents age 62 and older who are not eligible for their own benefits might be eligible for benefits if they were financially dependent on the deceased worker for at least half of their support. Marrying after the child’s death, however, might end your survivors benefits (as it could impact your financial dependence).

Divorced spouses

Former spouses of a worker who dies can receive survivors benefits (at the same percentage as widows and widowers), as long as the marriage lasted at least 10 years. If you remarry before age 60, however, you won’t be eligible for survivors benefits. But remarrying after age 60 won’t affect your eligibility.

How are survivor benefits calculated?

Survivor benefits are based on a deceased workers’ earnings. If the deceased person hadn’t claimed their Social Security benefits before they died, the survivor(s) are entitled to a percentage of the benefit the deceased would have received at full retirement age. If the deceased person lived longer than full retirement age, that amount will be higher because they would have earned delayed retirement credits.

If the deceased person had already started collecting their benefits before they died, their survivors can receive a percentage of the actual benefit the deceased worker received. That amount will vary depending on what age the deceased claimed their benefits.

If a survivor claims these benefits before their survivors full retirement age, the benefits are reduced by a percentage based on birth year and the number of months until full retirement age.

The percentage of benefits survivors can receive based on their age and their relationship to the deceased worker is as follows:

- A widow, widower or eligible divorced spouse, at survivors full retirement age or older: 100%

- A widow, widower, or eligible divorced spouse, age 60+, but younger than survivors full retirement age: 71% to 99%

- A disabled widow, widower, or eligible divorced spouse, aged 50-59: 71.5%

- A widow, widower, or eligible divorced spouse, any age, with a child younger than age 16, or a disabled child: 75%

- An unmarried child younger than age 18 (or 19 if in high school): 75%

- Dependent parents, aged 62+: 82.5% for one surviving parent; 75% each for two surviving parents

The average monthly survivors benefit for a spouse who is not disabled and not raising minor children is $1,431. Like all Social Security benefits, survivor benefits may increase year to year based on the cost of living.

Lump sum death benefit

In addition to other benefits, the SSA provides a lump sum death benefit of $255 to a worker’s surviving spouse or children. To be eligible, you must have lived with the worker at the time of their death—or if you weren’t living together, you must have already been receiving benefits based on the worker’s record or become eligible for benefits on their record with the death of the worker.

If there is not an eligible living spouse, this one-time benefit can be paid to the worker’s child if 1) the child was already receiving benefits on the worker’s record in the month the worker died, or 2) the child became eligible for survivors benefits following the worker’s passing.

How to maximize survivor benefits

The survivor benefit amount depends on whether both the deceased worker and the survivor had already started collecting benefits. Generally, the longer you wait to claim benefits (up to full retirement age), the larger they will be. So if you can afford to, delaying will pay off.

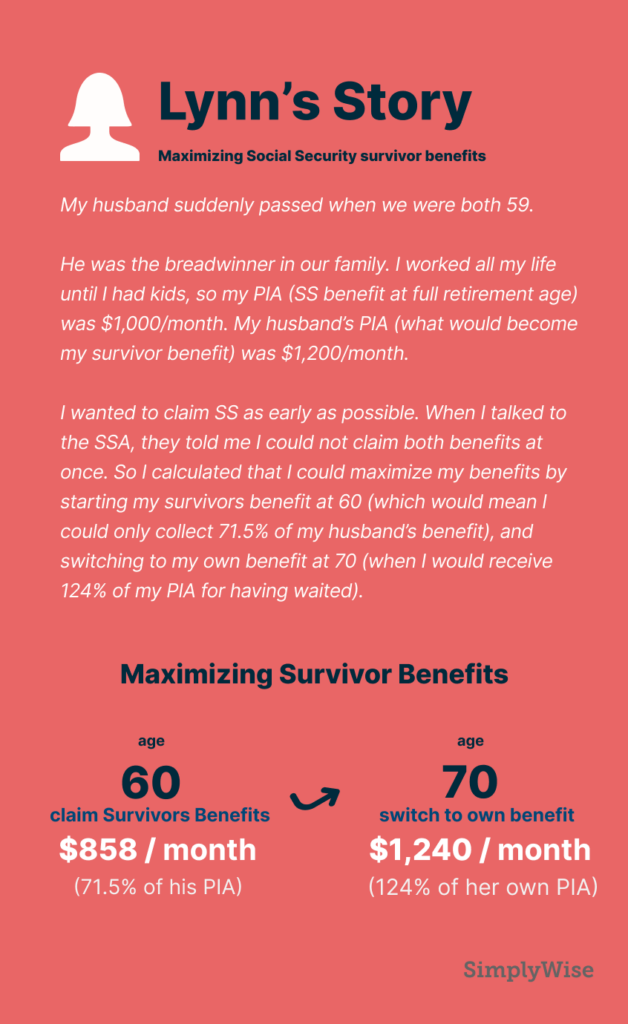

If you have your own earned retirement benefit, there are also strategies to maximize the two benefits. Remember: you cannot simply add together your survivor benefit and your own retirement benefit. Instead, Social Security will pay you the higher of the two. However, you can receive one benefit for a time and later file for the other. If your own retirement benefit would grow to be more at 70 than your survivors benefit, you could claim your survivors benefit first, and later switch to your own. If you’re already receiving retirement benefits and the survivors benefit would be larger, you can switch to survivors benefits. And if you became eligible for retirement benefits within the last 12 months and suffered the loss of a spouse, you might be able to withdraw your retirement application and instead apply for survivors benefits—then reapply for retirement benefits later, when they will be worth more.

Retroactive Social Security survivor benefits

In some cases, the SSA may pay survivor benefits for months before you filed an application for benefits. Those situations include the following:

- Spouses younger than full retirement age who file for survivor benefits within one month of a spouse or ex-spouse’s death can receive one month of retroactive benefits.

- Widows or widowers who wait to file after they reach full retirement age can receive up to six months of retroactive benefits back to the month they reached full retirement age.

- Disabled widows and widowers who file before age 61 are eligible for up to 12 months of retroactive survivor benefits.

How long do you get survivor benefits?

Surviving spouses and divorced spouses receive survivors benefits until their death.

Benefits for unmarried children who aren’t disabled end at age 18. (Note that if the child is attending elementary or secondary school full time, they can receive survivors benefits up to age 19.)

Disabled children (that were disabled before age 22) can continue to receive survivors benefits for life.

How do I apply for survivor benefits?

If you’re not already receiving Social Security, you can file for survivors benefits by calling 1-800-772-1213 (TTY 1-800-325-0778) or visiting a SSA office. Note that unlike other Social Security benefits, you cannot apply for widows benefits online.

How to report a death to Social Security

Before you can collect widows benefits, the death must be reported to the SSA. Funeral homes typically handle reporting of a death to the SSA. However, you will need to provide the funeral home with the deceased’s Social Security number for them to do so.

If you want to report the person’s death yourself, call the SSA at 1-800-772-1213 (TTY 1-800-325-0778) between 7 a.m. and 7 p.m. Monday through Friday. You can also visit a local Social Security office in person. Deaths can’t be reported online.

It’s best to report the death as soon as reasonably possible, since benefits start only after you apply.

If you were already receiving spousal benefits from Social Security, those benefits will be switched from spousal to survivors benefits. If you were receiving benefits based on your own work record, contact Social Security to see if you’re eligible for higher benefits as a widow

What documents you need for survivor benefits

When you apply for survivor benefits, you may be asked for the following documents:

- Proof of death, either from a funeral home or a death certificate that it must be a certified copy)

- Both your own Social Security number and that of the deceased worker

- Your birth certificate

- Your marriage certificate (if you are a widow or widower)

- Your divorce certificate (again, if you are a widow or widower-and note that it must be a certified copy)

- Dependent children’s Social Security numbers, if available, and birth certificates

- Deceased worker’s W-2 forms or federal self-employment tax return for the most recent year

The bottom line

Survivors benefits can provide stability and support to the family after the passing of a spouse or parents. The income can help to give workers and their families some peace of mind both before and after a loss.

Of course, Social Security can be confusing. But you are not alone. Knowing the facts around survivors benefits is critical to making the most of what you are owed. Our team of experts is here to help. When you’re ready, we recommend using a Social Security benefits calculator that accounts for survivor benefits. And a widows checklist can help to walk you through some of the complexity following a loved one’s passing.

With a comprehensive understanding of what you are owed and how Social Security works, you can navigate the next chapter of your life with the confidence and financial security you deserve.