Most of us spend years dreaming of retirement, but we might not start thinking about Social Security until the last minute. Yet understanding benefits — from the best age to claim Social Security to how much you’ll collect — is critical to making the most of what your retirement savings.

Social Security payments are a nearly universal part of retirement — approximately nine in 10 retired Americans age 65 and older receive these benefits. For many older Americans, it makes up a huge part of the income they rely on. Among elderly recipients, 50% of married couples and 70% of unmarried people receive at least half of their income from Social Security. Even so, misunderstandings about the program frequently cause people to lose out on money they are owed.

We lay out exactly what Social Security is, who is eligible to receive Social Security retirement benefits, how the amount you receive is determined, and the best ways to maximize your benefits.

Table of contents

What are Social Security benefits?

Collecting Social Security: Who is eligible for retirement benefits?

How are Social Security benefits calculated?

How work affects your benefits

How much is Social Security taxed when you retire?

How to maximize your Social Security benefits

SSI vs. SSDI

Do you need a Social Security calculator?

How to apply for Social Security retirement benefits

How to make an appointment at a Social Security office

What are Social Security benefits?

When the Social Security Act was signed into law in 1935, American workers could suddenly look toward a more secure financial future. While retirement for many once meant poverty or relying entirely on family for support, the act created a process that let workers pay into the system during their employment years, then benefit from those payments when they retired. Later, the system added disability coverage, dependent benefits and survivor benefits.

In 2020, over 65 million Americans received Social Security benefits. In fact, the Social Security Act is credited with keeping more Americans out of poverty than any other program.

How does Social Security work?

While you’re employed, your employer automatically deducts taxes from your paychecks for Social Security.

The current tax rate for Social Security is 6.2% for the employee, and another 6.2% for the employer. The Social Security Administration uses those funds to pay benefits to current retirees, people who are disabled, survivors of workers who have died and dependents of beneficiaries. Any extra money goes back into the Social Security trust fund.

The Social Security Administration tracks how much you earn during your life using your Social Security number. At retirement, your benefits will depend on how much you earned. More earnings mean higher benefits. You’ll need at least 10 years of work to qualify for retirement benefits.

As you near retirement, you can decide when you want your benefits to start. You must be at least 62 years old, but waiting longer will result in higher benefits.

Full retirement age is the age when you’re eligible to receive 100% of your retirement benefits, and is dependent on your birth year. If were born before 1960, your full retirement age is 65; if you were born in 1960 or later, your full retirement age is 67. (See table in “How are Social Security benefits calculated? section to find your full retirement age.)

You’ll receive monthly Social Security payments electronically, usually through a direct deposit to your bank account. In 2020, the average retiree earned $1,503 a month in Social Security benefits. The payments continue for the rest of your life.

What are the different types of Social Security benefits?

When people think of Social Security, it’s usually earned benefits that come to mind. Those are the benefits you personally earn through working. But Social Security also extends benefits in some cases to spouses, ex-spouses and children.

The three main types of Social Security retirement benefits are:

1. Earned benefits

You’re eligible for these benefits starting at age 62 if you have paid Social Security taxes for 10 years or more over your lifetime.

2. Spousal benefits (whether married or divorced)

If you meet certain criteria, you may be entitled to spousal benefits based on your spouse’s earnings. To qualify: 1) your spouse must already be collecting Social Security benefits; 2) you have to be married for at least one year; and 3) you must be at least 62 years old. The spousal benefit can be considered a supplement to your earned benefit, but at most you can receive half of your spouse’s PIA. If your earned benefit is more than half of your spouse’s benefit, it’s unlikely you will receive spousal benefits. (Of course, you’ll still receive your own benefits). If you earned about the same amount as your spouse, you won’t receive spousal benefits, though you’ll still receive your own benefits.

Note that even if you are divorced, you could still be eligible for spousal benefits based on your former spouse’s earnings record. You must be: 1) divorced, in a marriage that lasted at least 10 years; 2) age 62 or older (and your spouse must be 62 or older as well); and 3) have not remarried (your former spouse can be remarried). Again, if your earned benefit is more than half of your ex’s benefit, it’s unlikely you will receive spousal benefits. (Of course, you’ll still receive your own benefits). If you were divorced multiple times, your benefit can be based on the highest-earning spouse.

3. Survivor benefits

If your spouse or ex-spouse dies and has earned benefits that are higher than yours, you may be eligible for survivor benefits. You must meet certain criteria to qualify for survivor benefits. This includes being at least 60 years old (50 if disabled), or caring for a child of the deceased who is under 16 or disabled. One big difference with survivor benefits is that the Full Retirement Age is different than for other Social Security benefits.

Collecting Social Security: Who is eligible for retirement benefits?

If you’re a U.S. citizen or legal resident who has paid Social Security taxes for at least 10 years over your work career, you are eligible for earned benefits starting at age 62. Specifically, you receive one credit for each $1,360 of annual earnings, as of 2019, up to a maximum of four credits per year. You need 40 credits to be eligible for retirement benefits. This means even part-time workers often earn enough credits to be eligible.

Additionally, three groups of people can be eligible for benefits, even if they did not work enough to qualify or pay any Social Security taxes at all: spouses, former spouses and children of those who are eligible for benefits.

Of course, not every worker pays into Social Security and there are some who are not eligible for Social Security benefits when they retire. That includes some teachers; some employees of state and local governments; most federal employees hired before 1984; and railroad employees with more than 10 years of service. These employees often receive a pension from their employer.

People who worked or retire abroad can still be eligible for benefits

It’s important to note that even if you retire abroad, you can still collect your Social Security benefits. And if you worked part of your life abroad and don’t have the required 40 credits, you still may be able to collect benefits under “totalization agreements” that the United States has with some other countries. This situation requires you to have at least six credits of work in the United States, but the remaining 34 can come from another country. The specific countries and more details can be found here on the Social Security Administration website.

How are Social Security benefits calculated?

Social Security retirement benefits are calculated based on your own earnings record or that of your spouse, ex, or—in some cases—parent or child. We break down how earned, spousal and survivor benefits are formulated by the Social Security Administration.

How to calculate your Social Security retirement benefits

Your earned benefits are based on your age, your earnings and when you claim your benefits.

The Social Security Administration adds your earnings for the 35-highest-earning years of your career, after adjusting for inflation. If you worked less than 35 years, all your working years will be used. The maximum amount of earnings you can use toward Social Security changes every year, but is $137,700 for 2020.

This 35-year number is then divided by 12 to reach the average indexed monthly earnings. That figure is then used in a formula. In 2020, to calculate your benefits, you multiply the first $960 of average indexed monthly earnings by 90%, and the remaining earnings up to $5,785 by 32%.

Any earnings over $5,785 are multiplied by 15%. These amounts are summed to determine your primary insurance amount (PIA). Your PIA is what your monthly benefit would be if you started collecting Social Security at your full retirement age.

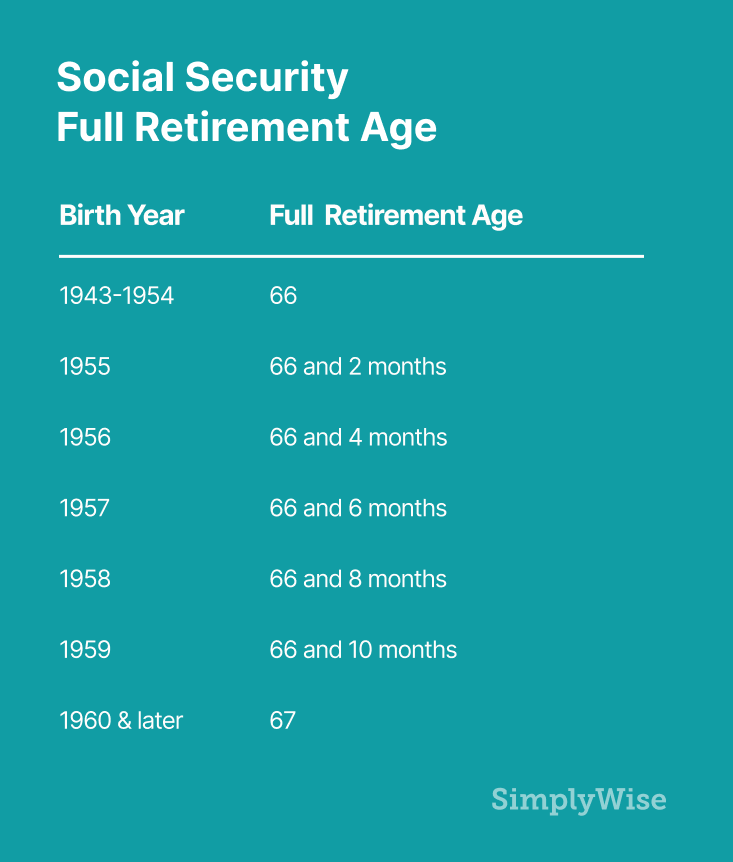

Your full retirement age is calculated based on your birth year:

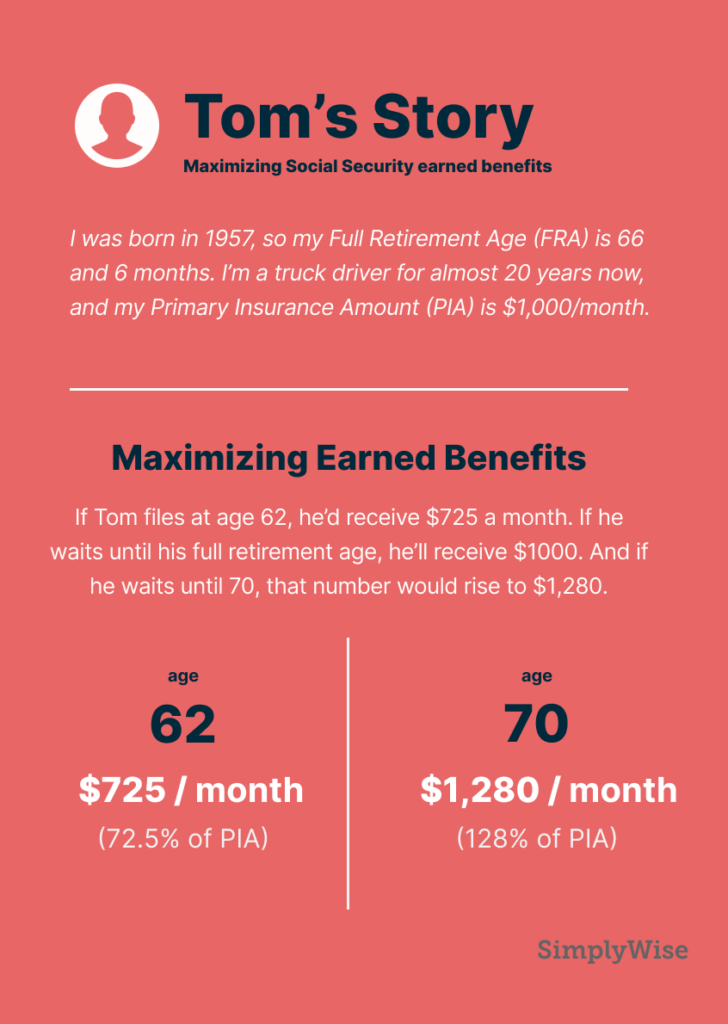

You can claim earned benefits as early as age 62, but if you claim before your full retirement age, your monthly benefits will be lower. If you claim later than full retirement age, your benefits will be higher. Every year you wait to retire, your retirement credits go up 8%.

How to calculate spousal Social Security benefits if you are married

Spousal benefits are based on your spouse’s earnings and when you claim.

The Social Security Administration first pays out benefits on your own earnings record (see “Calculating earned benefits” above).

It then calculates half of your spouse’s PIA and adjusts it based on when you claim benefits. (As with earned benefits, you’ll receive less than the full spousal benefit if you decide to claim before your full retirement age. But unlike earned benefits, you don’t receive more if you wait to claim spousal past full retirement age. In fact you’ll actually be forfeiting some money by waiting longer.) Note that spousal benefits are only based on your spouse’s PIA and your age when claiming them. That means that (as long as your spouse is at least 62 and already claiming Social Security) the amount you get is not affected by whether they claim their own benefits before or after full retirement age. Moreover, any benefits you receive as a spouse won’t decrease your spouse’s retirement benefit.

If your earned benefit is more than half of what your spouse earned, it is unlikely you will receive spousal benefits. You will only receive your own earned benefit.

You can claim spousal benefits between age 62 and your Full Retirement Age. There used to be a loophole where a couple could file for earned benefits and spousal benefits separately, but Congress closed that for anyone born after 1953. Now when you file for benefits, you have to file for all benefits you are entitled to (this is called “deemed filing”). That means that if you file for your spousal benefit, you have to file for your earned benefit at the same time, and vice versa. However, there are numerous strategies you can consider when trying to maximize your benefits as a married couple.

How to calculate spousal Social Security benefits if you are divorced

If you are divorced, your spousal benefits are based on your former spouse’s earnings and when you claim.

The Social Security Administration first pays out benefits on your own earnings record (see “Calculating earned benefits” above).

It then calculates half of your ex’s full retirement amount (or disability benefit) and adjusts it based on when you claim benefits. (As with earned benefits, you’ll receive less than the full spousal benefit if you decide to claim before your full retirement age. But unlike earned benefits, you don’t receive more if you wait to claim spousal past full retirement age. In fact you’ll actually be forfeiting some money by waiting longer.) So, again, there is no reason to wait to claim these benefits after your full retirement age. Moreover, the spousal benefits you receive don’t reduce the amount your former spouse will receive.

If you continue to work while receiving benefits, the retirement benefit earnings limit still applies until your full retirement age. If you also receive a pension based on work not covered by Social Security, such as government work, your Social Security benefit on your ex-spouse’s record may be affected.

The major difference with spousal benefits if you are divorced is that your ex-spouse doesn’t have to file for retirement benefits for you to be able to collect spousal benefits. That means you can claim spousal benefits as long as both you and your ex are at least 62 years old.

How to calculate widows Social Security benefits

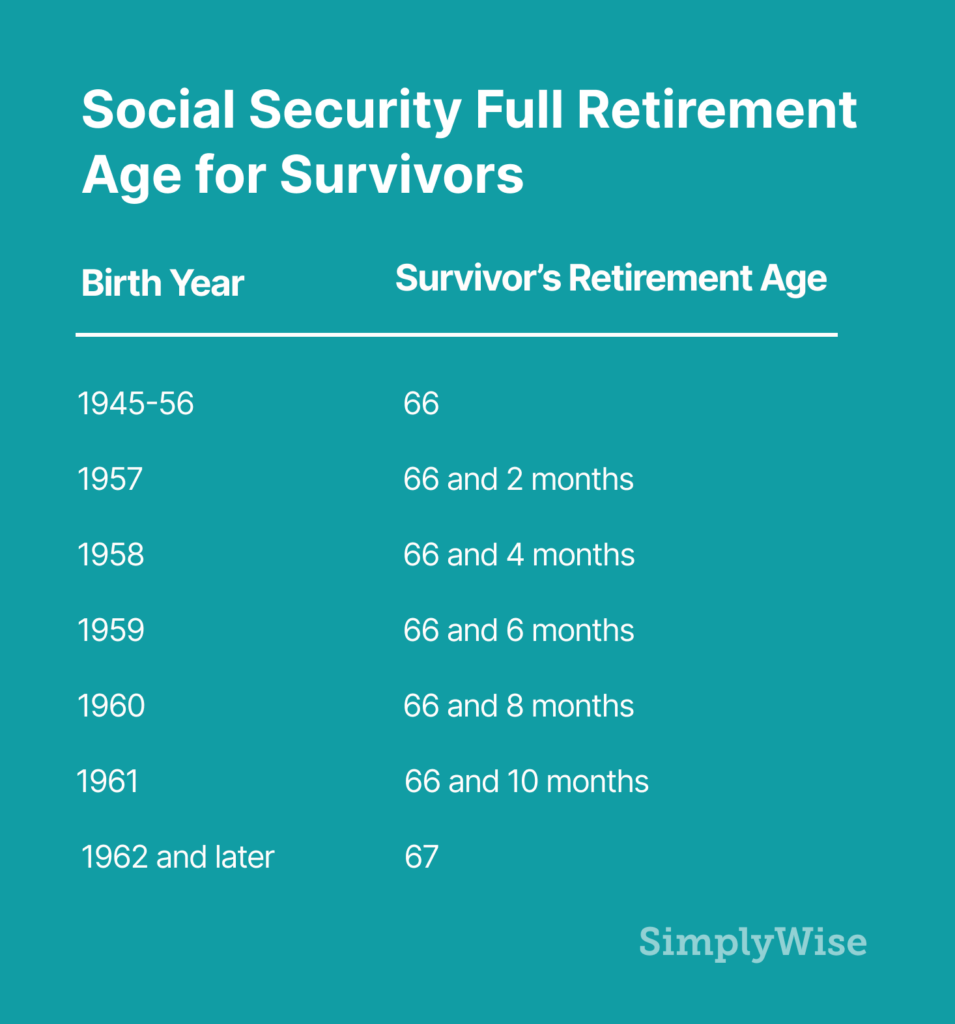

If your spouse or ex-spouse dies and has earned benefits that are higher than yours, you may be eligible for survivor benefits. One big difference with survivor benefits is that the full retirement age is different than for other Social Security benefits.

The survivors full retirement age by birth year is as follows:

You can claim survivors benefits as early as age 60 (50 if you are disabled), but you’ll receive more if you wait until full retirement age. If you qualify for retirement benefits under your own earnings record, you can switch to those benefits at age 62 or later.

Your survivor benefit depends on the earnings of your spouse, your age and whether the spouse was receiving reduced benefits. A few examples:

- A spouse or ex-spouse who has reached full retirement age or older would receive 100% of the deceased worker’s benefit amount.

- A spouse or ex-spouse between age 60 and full retirement age would receive between 71.5% and 99% of the deceased worker’s basic amount.

- A disabled spouse or ex-spouse between ages 50 and 59 would receive 71.5%.

- A spouse or ex-spouse of any age who is caring for a child under age 16 would receive 75%.

- In addition, a surviving spouse can receive a special lump-sum death payment of $255 in certain circumstances.

How to calculate Social Security survivor benefits for children

In some cases, children under age 18 (or up to 19 and still in high school) can be eligible for Social Security benefits. That is if their parent is disabled or retired and entitled to Social Security benefits, or if the parent died after paying Social Security taxes for a set amount of time.

More, in some circumstances, stepkids, grandkids and adopted kids can be eligible for benefits. If a child under 18 is disabled, two other programs could help: Supplemental Security Income for low-income families and/or Social Security Disability Insurance if a parent paid into Social Security for a long enough period.

If the parent is retired or disabled, a child can receive up to half of the parent’s full retirement or disability benefit. If the parent has died, a child can receive up to 75% of the late parent’s basic Social Security benefit. However, there is a limit on the amount of Social Security a family can receive. The maximum family payment can be from 150% to 180% of the parent’s full benefit amount. If the total amount payable to all family members exceeds this limit, each person’s benefit is reduced (except the parent’s) until the total equals the maximum allowable amount.

How work affects your benefits

Great news: you can work during retirement and still collect full benefits as long as you’ve reached Full Retirement Age. Before Full Retirement Age, your benefit may be reduced if you earn over a certain amount. Here’s how it works:

- If you are collecting Social Security early and not going to reach Full Retirement Age this year: Take your wages over $18,240 (for 2020 – the figure can change each year) and divide that number by 2. This is the amount that will be withheld in benefits.

- If you are collecting Social Security early and are reaching Full Retirement Age this year: Take any wages over $48,600 (for 2020) and divide the number by 3. This is the amount that will be withheld in benefits.

In both cases, the Social Security Administration will recalculate your benefits after you reach Full Retirement Age, and you’ll receive credit for the time you didn’t receive a benefit because your earnings were too high. In addition, the years you worked and collected Social Security could count toward your 35 highest-earning years, therefore raising your eventual benefit.

Working during retirement could also affect spousal benefits. The benefits could be withheld if either the person receiving the benefits, or the person whose earnings record the benefits are based on, is working.

How much is Social Security taxed when you retire?

About 40% of people who get Social Security benefits have to pay federal taxes on their benefits. This usually happens only if you have significant income, a pension, IRA or 401(k) withdrawals or other taxable income, in addition to your Social Security benefits. The good news is that if you do owe taxes on your benefits, only 85% of your benefits are taxable.

How much will my Social Security be taxed if I’m single?

To calculate the taxes on your Social Security if you’re single, first take your adjusted gross income. Then add on your tax-exempt interest (for example, interest from municipal bonds). Add to that half of your Social Security benefit.

- If the resulting number is less than $25,000 (as of 2020), you won’t owe taxes on your benefits.

- If the number is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits.

- If the number is over $34,000, up to 85% of your benefits may be taxable.

How much will my Social Security be taxed if I’m married?

To calculate the taxes on your Social Security if you’re married, first take your combined household adjusted gross income. Then add on your tax-exempt interest (for example, interest from municipal bonds). Add to that half of your Social Security benefits.

- If the resulting number is less than $32,000 (as of 2020), you don’t have to pay taxes on your benefits.

- If the number is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits.

- If the number is more than $44,000, up to 85% of your benefits may be taxable.

In addition, the following states also impose a tax on Social Security in some cases: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah and West Virginia. Contact your state tax agency for more details.

Unlike with many Social Security matters, your age doesn’t matter when it comes to paying taxes on your benefits.

For everything you need to know on Social Security and taxes, we recommend reading more here.

How to maximize your Social Security benefits

Perhaps the most complicated but critical consideration of your Social Security payments is how to maximize your benefits. In general, one of the best ways to get the most out of your benefits is to delay claiming.

For example, every month you wait to retire between ages 62 and 70 boosts the amount of your monthly payment. If your full retirement age is 67 and you retire at that time, you’ll get 100% of your retirement benefits. If you wait to claim until age 70 (the last year when you get late retirement credits), your benefit will continue to go up. If you were born in 1943 or later, you can get a delayed retirement credit of up to 8% for every year you delay retirement from age 62 to age 70.

There are several strategies you can pursue to maximize Social Security benefits:

- Work for at least 35 years. Because Social Security is based on the highest 35 years of your salary, working for less than 35 will lower your average.

- Earn more. While that’s easier said than done, that could merely involve staying in a high-paying job an extra year or two. That would allow you to replace some previous lower-earning years when Social Security computes your highest-earning 35 years.

- Delay receiving your benefits. Again, you can start receiving benefits when you are 62 years old. However, you’ll receive more if you wait until your full retirement age—and even more if you wait until 70. After age 70, there’s no financial reason to delay taking benefits.

- If you’re single, research has found that—if you can afford it—it can pay off to delay receiving benefits until you’re age 70.

- If you’re married: One strategy is for the lower-earner spouse to claim their own benefit early, and the higher earner to delay for as long as possible, up to age 70.

- If you’re eligible for survivor benefits: If you haven’t claimed your own benefit, it may pay to take the survivor benefit early and delay taking your own benefit for as long as possible, up to age 70.

SSI vs. SSDI

Apart from retirement benefits, the Social Security Administration also manages two programs that provide benefits for people who are disabled: the Social Security Disability Insurance (SSDI) program and the Supplemental Security Income (SSI) program. Some people are eligible for both. To qualify, you must be unable to do the work you did before and unable to adjust to other work because of your medical condition. In addition, your disability must be expected to last at least a year, or to eventually be fatal. Note that the programs do not cover short-term disability.

SSDI provides benefits to people who worked long enough and paid Social Security taxes but became disabled before their full retirement age. Benefits are based on your earnings. Your dependents may also be eligible based on your earnings. In general, you need 40 credits, 20 of which came in the last 10 years. But younger workers could qualify even if they don’t have the 40 credits. Note that your benefits could be reduced if you receive workers’ compensation or other disability benefits.

You are allowed to do some work while you receive SSDI, but for 2020, you can’t earn more than $1,260 a month, or $2,110 if you’re blind. There’s usually a cost-of-living (COLA) increase to your benefit each year.

Keep in mind that you can’t collect Social Security retirement benefits and SSDI at the same time. Instead, your SSDI will automatically convert to retirement benefits at your retirement age, though the amount will be the same.

The SSI program, on the other hand, makes payments to people who are over 65, blind or disabled (including children) who have very limited resources. Over 8 million people get monthly payments from the SSI program, and it’s funded from general taxes, not Social Security. Eligibility is not based on someone’s earnings record. Instead, to get SSI, a person’s belongings—not including their home and household goods—must be worth no more than $2,000; a couple’s resources can be worth up to $3,000.

Here’s how the SSI benefit is calculated:

- Start with the 2020 federal benefit rate of $783 for an individual ($1,175 for a couple). This figure typically adjusts every year, based on the cost of living.

- Compute total income, minus deductions allowed by the Social Security Administration, for a “countable income.”

- Subtract the countable income from the federal benefit rate.

- The base SSI payment is reduced by one-third if a person or couple is living in another person’s home and getting food and shelter from that person.

All states except Arizona, Mississippi, North Dakota and West Virginia supplement the federal SSI with additional funds. Depending on the state, these funds either arrive with the federal payment or separately.

Unlike SSDI, it is possible to receive both SSI and some Social Security retirement benefits at the same time.

Do you need a Social Security calculator?

Social Security calculators are easy to use, requiring only some numbers around your income and marriage. They’re important to use to help understand how much you can claim at each age, and the optimal time to start collecting.

Of course, there are many calculators out there, so it’s important to find one that is comprehensive. You should ensure all life and income factors are taken into account in calculating your benefits. A good Social Security benefits calculator will include:

- All major Social Security benefits

- Retirement insurance benefits

- Spouse’s insurance benefits

- Divorced spouse’s insurance benefits

- Widow(er)’s insurance benefits

- Divorced widow(er)’s insurance benefits

- Child’s insurance benefits

- All major Social Security benefits rules

- Early benefit reductions

- Delayed retirement credits

- The earnings test

- Adjustment of the reduction factor after FRA when benefits are reduced for earnings

- Re-computation of benefits

- Family maximum

- Combined family maximum

- RIB LIM on widow(er) benefits when deceased spouse claimed early

- Windfall Elimination Provision (WEP)

- Government Pension Offset (GPO)

How to apply for Social Security retirement benefits

The easiest and quickest way to apply for retirement benefits or spousal benefits with the Social Security Administration is online. However, you can also call them, at 1-800-772-1213 (TTY 1-800-325-0778) or visit a local Social Security office. The documents and information you’ll need to provide include:

- Your place and date of birth

- Your citizenship status

- Your Social Security number, and whether you have ever used any other Social Security number

- The name, Social Security number and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death (if applicable)

- The account number and routing number for your bank account

- Whether you or anyone else has ever filed for Social Security benefits, Medicare or Supplemental Security Income on your behalf

- If you are applying for retirement benefits, the month you want your benefits to begin

- If you are within three months of age 65, whether you want to enroll in Medicare Part B

- The name and address of your employer(s) for this year and last year

- The amount of money earned last year and this year. If you are filing for benefits in the months of September through December, you will also need to estimate next year’s earnings.

- A copy of your Social Security Statement or a record of your earnings

- The beginning and ending dates of any active U.S. military service you had before 1968

- Whether you became unable to work because of illnesses, injuries or conditions at any time within the past 14 months.

- Whether you or your spouse have ever worked for the railroad industry

- Whether you have earned Social Security credits under another country’s social security system

- Whether you qualified for or expect to receive a pension or annuity based on your employment with the federal, state or local government.

Other documents, such as a birth certificate or W-2, might be necessary. If you apply online, you’ll receive a letter in the mail with the Social Security Administration’s decision.

How to make an appointment at a Social Security office

It is not possible to schedule an appointment at a Social Security office online. However, keep in mind that you do not need an appointment to file for benefits or appeal a disability decision. You can file for the following benefits online:

If you do not want to apply for benefits online, or you need to speak to a Social Security representative for any other reason, you can schedule an appointment by:

- Calling 1-800-772-1213 (TTY 1-800-325-0778) between 7 a.m. and 7 p.m., Monday through Friday; or

- Contacting your local Social Security office.

If you think Social Security benefits will be a key part of your retirement plans, it’s important to figure out how much you will receive, which benefits you’re eligible for, the optimal time to claim your benefits and how much money you will need each month to live. Arming yourself with knowledge is a great step to making smart decisions about your benefits.