Social Security is already confusing. Navigating Social Security widows benefits after the death of a loved one can feel even more complicated. But you don’t have to navigate your finances and benefits alone. We break down everything you need to know about survivors benefits. Understanding how the Social Security Administration distributes benefits to families after the loss of a worker can help reduce the financial stresses of that loss, so you can focus on what matters.

What are survivor benefits?

While many people associate Social Security benefits with payouts to retired workers, the Social Security Administration in fact distributes several different kinds of beneifts. These include both benefits for the families of a deceased worker, as well as benefits for people who are disabled and so unable to work.

Social Security survivor benefits (often referred to as “widows benefits”) provide an important source of income for family members whose workers have passed away. As long as the deceased worker would have been eligible to collect Social Security benefits upon their retirement, their family members will be able to collect them in their stead.

Who is eligible for survivor benefits from Social Security?

Survivor benefits are not limited to the surviving spouse. The following people can receive survivor benefits:

- A widow or widower age 60 or older (age 50 or older if disabled) who was married to the deceased for at least nine months and did not remarry before age 60

- A surviving divorced spouse who was married to the deceased for at least 10 years (and meets the following other conditions)

- A widow or widower of any age caring for the deceased’s child who is under 16 or disabled and receiving benefits on their record

- An unmarried child of the deceased who is: younger than age 18 (or up to 19 if a full-time student in elementary or secondary school) or age 18 or older with a disability that began before 22

- Parents of the deceased worker who are 1) at least 62; 2) were dependent on the deceased for at least half of their income, and 3) whose own Social Security benefit is not larger than that of their deceased child

How are Social Security survivor benefits calculated?

When a worker pays into the Social Security system over the course of their life, they accumulate credits. A worker can receive up to four credits a year. For example, in 2020, workers will receive one credit for every $1,410 they earn. When your spouse has earned $5,640, they have earned their four credits for the year.

In order to claim retirement, a worker needs 40 credits. However, the number of credits required to provide survivor benefits for the worker’s family depends on the worker’s age when they die. This means that the younger a person is when they pass away, the fewer credits they will need for their family members receive survivor benefits.

When someone retires, or when they die, the amount of their benefit is calculated based on their earnings over their lifetime. This is the amount that survivors will receive all or part of. To calculate their benefit, Social Security adds up the worker’s income during the years they made the most money. They then index that total against average wages across the country during those years. This results in the worker’s “Average Indexed Monthly Earnings” (AIME). The Social Security Administration only includes the portion of a worker’s income up to the maximum taxable earnings limit. This is the amount that is taxed for Social Security—in 2020, that’s $137,700. If your spouse earned more than that, the higher earnings will not be included in the calculation because these monies were not taxed by Social Security.

Social Security then applies a formula to that monthly amount to determine how much your spouse would have received at full retirement. In 2020, that formula is:

- 90% of the first $960 of your AIME;

- plus 32% of any amount over $960 up to $5,785;

- plus 15% of any amount over $5,785.

The resulting number is the worker’s primary insurance amount (PIA). This is the amount they would have received if they applied for retirement benefits when they reached their full retirement age—not before or after.

How much will you receive in survivor benefits?

After the passing of the worker, Social Security pays a one-time death benefit of $255 which can be collected by the widow or child.

Then there is the (ongoing) monthly Social Security survivor benefit. That benefit is based on the Social Security benefit the worker was receiving (or would have received).

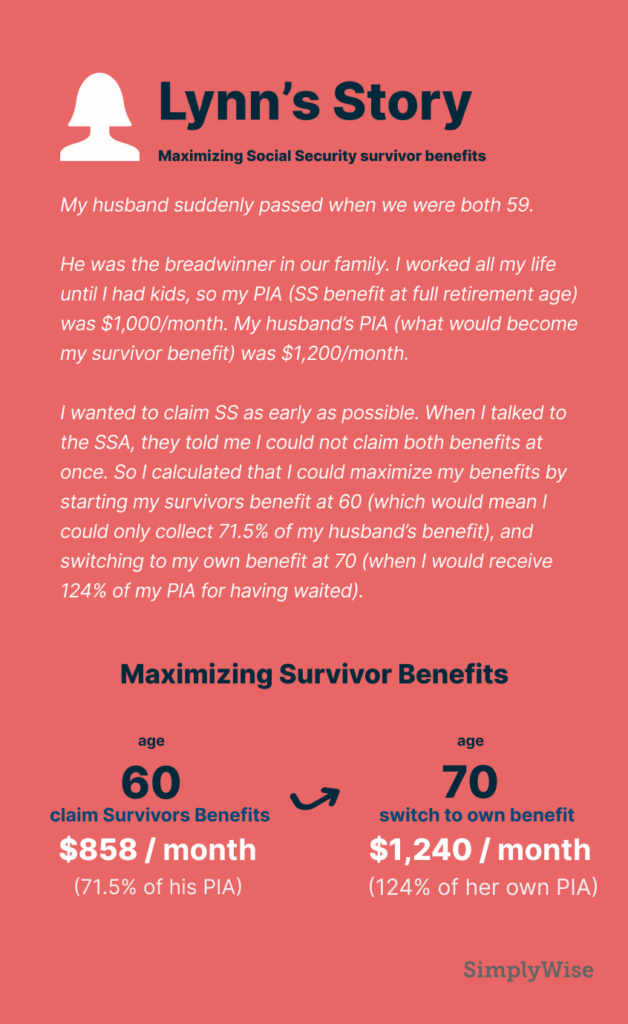

The benefit can be up to 100% of what your spouse would have received at full retirement. If the benefit you would receive as a survivor is higher than the benefit you receive on your own, Social Security will pay you the higher of the two amounts, not the two combined. However, survivor benefits, unlike spousal benefits, don’t have to be claimed at the same time as your own retirement benefits. You can, in many cases, receive one benefit for a time and then file for the other one later. This is a common strategy for widows to take to maximize their benefits.

Reductions to benefits

The earliest a widow or widower can apply for survivor benefits is age 60. (Note that if the widow is disabled, and began receiving disability payments before, or within, seven years of the worker’s death, they may apply at age 50. Social Security uses the same definition of disability for survivors as it does for workers.)

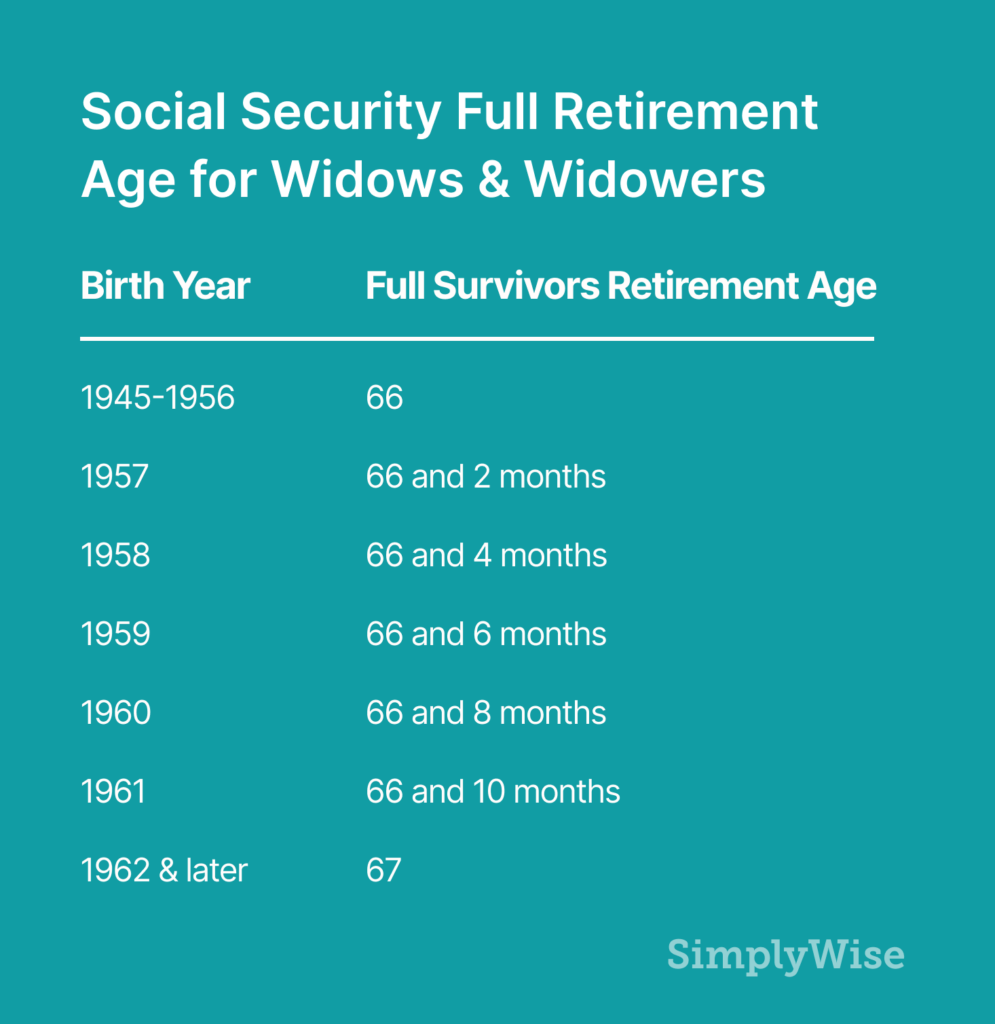

Widows can claim benefits at any time between 60 and their survivor full retirement age. However, if a widow files for benefits before they have reached their survivor full retirement age (FRA), those benefits will be reduced a fraction of a percent for each month claimed “early”. (Calculate your survivor FRA using the table below. Note that your survivor full retirement age is different from your own full retirement age.)

The Primary Insurance Amount (PIA) is the number Social Security uses to determine survivor benefits. If you apply before your survivor full retirement age, you will receive between 71.5% and 99% of your spouse’s benefit (PIA). A disabled widow or widower aged 50 to 59 would receive 71.5% of their spouse’s benefit. The percentage scales up for each month that you wait until your survivor full retirement age. However, if you wait to claim survivor benefits until survivor full retirement age, you are eligible for 100%.

How much can you earn and still collect survivor benefits?

If you’ve reached Full Retirement Age, you can earn any amount of money without impacting your Social Security benefit.

But if you are earning money and taking Social Security benefits before Full Retirement Age, your benefits will be reduced. In 2020, that amount is $18,240. For every $2 you earn over that amount, Social Security will reduce your benefit by $1 (though that amount will be replaced when you reach full retirement). So, if you take survivors benefits at age 60, but earn $50,000 a year, you will have earned $32,000 over the limit. Social Security would reduce your benefit by $16,000. If your benefit is below $16,000 a year, you will not receive benefits.

Survivors benefits if you have children

If your spouse dies and you have children with them under the age of 16, then (regardless of your own age), you can receive up to 75% of your spouse’s benefit. Similarly, if your spouse has children under 16 by a previous marriage, that spouse may receive up to 75% of your spouse’s benefit. Also, each child, up to the age of 18, or 19 if still in secondary school or disabled—may also receive up to 75%.

The maximum a family can receive is up to 180% of the worker’s PIA. If ex-spouses receive benefits, it does not in any way impact the amount a current spouse will receive (and vice versa). However, if you qualify because you have the worker’s child in your care, your benefit will affect the amount of the benefits of others on the worker’s record.

If a spouse or former spouse is not caring for the children of the deceased worker, they may still apply for benefits on their own, if they are at least 60 (or 50 if disabled).

Survivors benefits if you are divorced

An ex-spouse is eligible to receive the same benefits as a current spouse if they were married to the deceased worker for at least 10 years and are not currently married. However, if the living ex-spouse remarries before age 60, they forfeit their right to their deceased former spouse’s Social Security—unless that subsequent marriage ended in death, divorce, or annulment. If the living ex-spouse remarries after age 60, this rule doesn’t apply.

How much a spouse or former spouse receives depends on several factors including when they file for benefits and whether they are still working and earning money.

Maximizing your benefit

Many people ask “can I collect my deceased spouse’s social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts. While it can seem unfair to not be able to claim both full benefits, there are claiming strategies you can use to maximize the total Social Security benefits you receive. This includes switching from one benefit to the other. See an example from one of our users directly below.

Making the right decision on how to maximize your own benefits depends on how much your own retirement benefit vs. survivor benefit would be, and how long you think you will be living and needing the money. It also depends on whether you’re working. Below we outline a few additional scenarios, and different strategies and considerations for each.

- If your retirement benefit is less than the one you would receive as a survivor… you can apply to receive the higher amount even if you are receiving retirement benefit payments.

- If you are over 60 and remarried, and your current spouse is a Social Security beneficiary… you may apply for spousal benefits on your current spouse’s record or opt to take your former spouse’s survivor benefits. Depending on whichever is higher (your own and either your spousal benefits or your survivor benefits), you can decide to claim a combination of benefits equal to the higher amount.

- If you are already receiving your own retirement benefits when your spouse dies… then the optimal strategy depends on how long you have been receiving your own benefits. If you have been receiving your retirement benefit for less than 12 months when your spouse dies, you couldwithdraw your retirement application and only take your survivors benefit now (and later switch back to your own benefit). If you have been receiving your retirement benefit for more than 12 months when your spouse dies, you can only apply for survivors benefits if the benefit of your spouse’s account is more than the benefit you receive on your own.

- If you are already receiving spousal benefits when your spouse dies… Social Security will convert your benefit to survivors benefits, which are up to 100% of your late spouse’s full retirement benefit (compared to 50% for spousal benefits).

How to apply for survivor benefits

A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You must call Social Security at 1-800-772-1213 (TTY number at 1-800-325-0778.) Alternatively, you can go in person to your local Social Security field office.

To apply for Social Security survivor benefits, you must have the following documents:

- Proof of death (either from a funeral home or a death certificate—note that it must be a certified copy)

- Both your own Social Security number and that of the deceased worker

- Your birth certificate

- Your marriage certificate (if you are a widow or widower)

- Your divorce certificate (again, if you are a widow or widower—and note that it must be a certified copy)

- Dependent children’s Social Security numbers, if available, and birth certificates

- Deceased worker’s W-2 forms or federal self-employment tax return for the most recent year

The bottom line

Many Americans depend on Social Security as a critical source of income, particularly in retirement. This is especially true for people who have lost a spouse. Yet if you do not know the facts around Social Security benefits, it’s easy to lose money depending on when you claim. But while Social Security can feel complicated, you are not alone. Our team of experts is here to help. When you’re ready, we recommend using a Social Security calculator that accounts for survivor benefits. With a comprehensive understanding of what you are owed and how Social Security works, you can navigate the next chapter of your life with the confidence and financial security you deserve.