Many people mistakenly believe that if you’re divorced, you can’t claim Social Security benefits earned by your ex-spouse. However, the Social Security Administration has made provisions for spousal Social Security benefits after divorce where the spouse was married at least 10 years to a worker who is eligible for benefits. For people who fit that description, the rules are largely the same as those for married couples, with some important differences.

Basic rules for Social Security and divorce

In order to receive benefits as an ex-spouse you must remain unmarried until age 60. However, if you did remarry but your second marriage ended by death, divorce, or annulment, you could still be eligible for your ex’s benefit. The rules for claiming benefits as an ex-spouse are slightly different if you claim when reaching retirement age versus as a survivor whose former spouse has died.

The rules are also different for people born before Jan. 2, 1954. If you were born before that date, you could receive spousal benefits at full retirement age and choose to delay your own retirement benefit until later. That option is not available for people filing for spousal benefits who were born after this date. If you were born after Jan. 2, 1954 and you file for one retirement benefit, you are automatically considered to be filing for all retirement benefits.

How much Social Security does an ex spouse get?

The amount an ex-spouse receives depends on a few factors, including:

- The age when you file

- How much your former spouse earned

- The Social Security benefit you yourself are due as an individual worker (separate from any marriage-related benefits)

- Whether you’re filing for spousal vs. survivor benefits

If one or more ex-spouses receive a benefit, that does not in any way reduce the amount that the worker or their current spouse receive. It also does not affect what any other dependents are eligible to receive.

How earnings are calculated for Social Security

The Social Security administration measures benefit eligibility in terms of credits. Each year, a worker can earn up to four credits. A credit equates to a certain amount of dollar earnings. In 2020, a person receives one credit per $1,410 in earnings.

Once someone has acquired 40 credits, they are eligible for Social Security retirement benefits. Workers may become eligible with fewer credits if they become disabled at a young age—or their survivors may receive benefits, even if they have fewer credits, if they die at a young age..

Social Security after divorce: what you’re owed

If you’re entitled to retirement benefits on your own work record, you will receive those benefits first. If your own benefit is larger than the benefit you would receive as an ex-spouse, you will receive no spousal benefit.

But if your benefit as an ex-spouse is larger, Social Security will increase your benefit to the larger amount. For example, if your ex-spouse’s benefit would be $2,000 a month, you would be entitled to $1,000 a month as an ex-spouse. If your own benefit as a worker is $700 a month, Social Security would increase your benefit to $1,000 a month.

The maximum spousal benefit—for spouses or ex-spouses—is 50% of the worker’s benefit at full retirement. If your ex-spouse does not claim benefits until after full retirement age—say age 70—they will receive delayed retirement credits, but your spousal benefit will not increase.

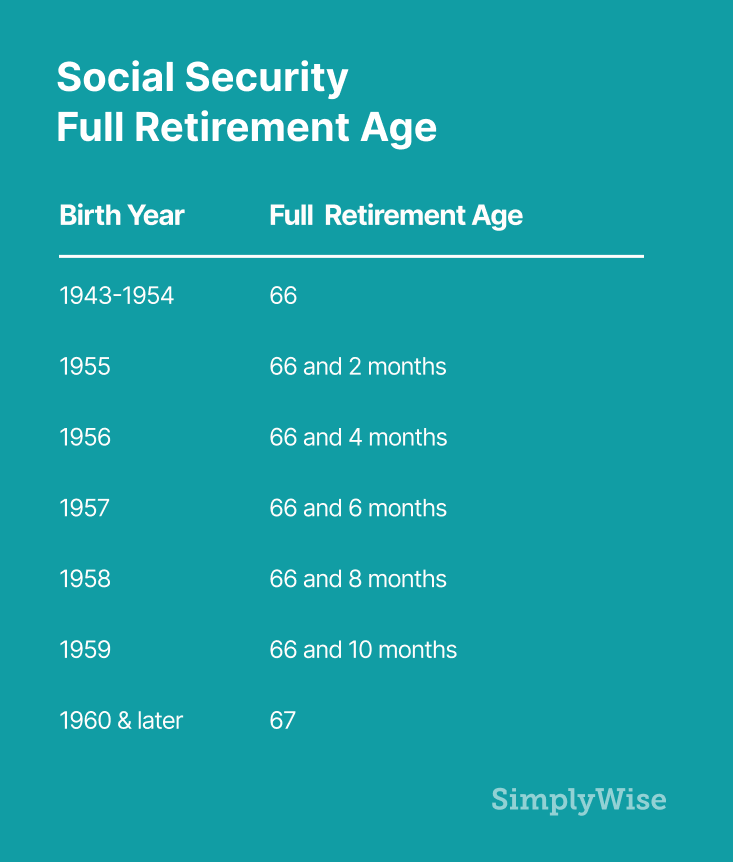

If you claim benefits earlier than full retirement, the amount you receive will be permanently reduced. For example, if you claim your benefit at age 62, instead of receiving 50% of your former spouse’s benefit, you will receive only about 35% of their benefit. Your full retirement age is based on your birth year. Find yours in the table below.

Your benefits could also be impacted if you continue working while collecting. If you file for benefits before full retirement age, and you are still working, a portion of your earnings will be exempt. For 2020, that portion is $18,240. For every $2 you earn above that amount, until the year of your retirement, Social Security will reduce your benefit by $1, although that reduction will be restored when you reach full retirement age. In this case, the best way to maximize Social Security may be to continue working, but claim later.

If your former spouse is eligible to receive their benefit but has not filed, you can still file for their benefits if you have been divorced at least two full years.

Survivor benefits and divorce

If your ex died, you may be eligible for their survivor benefits (which can be up to 100% of their benefits). You are eligible for survivor benefits at any age if a child of the deceased worker lives with you and is under age 16 or is disabled. Otherwise you would become eligible for survivor benefits starting at age 60, or age 50 if you are disabled. In all cases, you will only be eligible if you are not remarried—or if your subsequent marriage ended in death, divorce, or annulment.

If you claim your survivor benefit at full retirement age or older, you will generally get 100% of the worker’s basic benefit amount. If you claim your benefit after age 60, you will receive between 71% and 99% of the worker’s basic benefit amount. Marrying after age 60 will not impact your benefit.

Unlike with the spousal benefit, ex-spouses may apply for survivor benefits starting at age 60. You can also claim the survivor benefit, then wait to apply for your own retirement benefit until up to age 70. If you do decide to wait, you can earn delayed retirement credits on your own record. However, working while receiving benefits may impact your benefit amount.

Applying for spousal Social Security benefits after divorce

To apply for benefits as the ex-spouse of an earner, you file for spousal benefits just like earned benefits. That is, you can file on the Social Security Administration website, by phone at 1-800-772-1213, or by visiting your local Social Security field office. Once approved, you will receive monthly payments by check or direct deposit.

When you apply for Social Security spouse benefits based on your ex’s earnings, they may ask you to provide the following documents to confirm eligibility.

Personal information

- If you were born outside the country, the name of your birth country at the time of your birth

- Your citizen status; if you are not a citizen, you should have your Permanent Resident Card number

- Whether you have used any other Social Security number

- Whether you or anyone else has ever filed for Social Security benefits, Medicare or Supplemental Security Income on your behalf; if so, you should have information on whose Social Security record you applied

- Your Social Security card

- Your original birth certificate, or a certified copy

Divorce information

- Name of ex-spouse

- Name of current spouse (if applicable)

- Spouse(s) date of birth and Social Security number (optional). If you don’t have this info, don’t worry: you can instead provide your ex’s name, date, place of birth, and parents’ names.

- Beginning and ending dates of marriage(s) (SimplyWise tip: You will need a certified copy of the official divorce decree — not just a photocopy. You can usually get a certified copy of the decree from the courthouse, in the court clerk’s office.)

Children’s information

- Names and dates of birth for children who either i) are under age 18 and unmarried, ii) became disabled prior to the age of 22, or iii) are aged 18 to 19 and attending secondary school full time

Work information

If you’re not self-employed:

- Earnings for current year and prior two years (SimplyWise tip: If you are going to apply online, you can find this inside your my Social Security account.)

- Name of your employer(s)

- Start and end dates of employment

- Whether you or your ex ever worked for the railroad industry

- Whether you qualified or expect to receive a pension or annuity based on your own employment with the Federal government of the U.S. or one of its states or local subdivisions

If you are self-employed:

- Business type

- Total net income

Direct deposit information

- Account number

- Bank routing number

Applying and ensuring you claim the right benefit at the right time for your personal finances can be confusing. But you’re not alone in navigating Social Security and divorce. When you’re ready to apply, we recommend using a checklist to ensure you take the right steps and have the right documentation.