Social Security is much broader than just the benefits provided to retired workers. In fact, the Social Security Administration (SSA) provides an important source of retirement income for many Americans, including the spouses, ex-spouses, widows, widowers, and dependent children of workers. We break down everything you need to know, and how to apply for spousal benefits.

Table of contents

What are Social Security spousal benefits?

Who is eligible for spousal benefits from Social Security?

How are spousal benefits calculated for Social Security?

When can a spouse claim spousal benefits?

What is the difference between spousal and survivor benefits?

How do I apply for spousal benefits?

What are Social Security spousal benefits?

Social Security spousal benefits are a part of a worker’s retirement or disability benefit given to their spouse. Spousal benefits are based on the income earned during a qualifying worker’s life, as well as the retirement age of both the worker and their spouse.

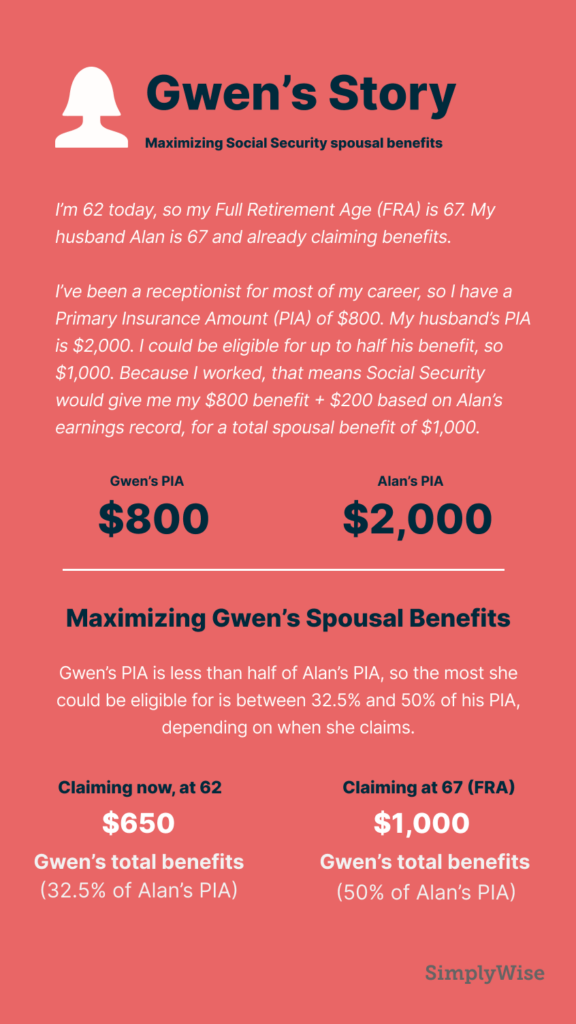

If you qualify for Social Security spousal benefits, the size of your benefit can be up to 50% of your spouse or ex-spouse’s primary insurance amount (PIA). PIA is the amount of Social Security benefits that your spouse is entitled to at his or her full retirement age (which is based on birth year, and could be between age 65 and 67 – see table in “How are spousal benefits calculated for Social Security?” section). So if your spouse’s PIA is $1,000, you could receive a maximum of $500 in spousal benefits.

If you’ve worked enough to qualify for your own Social Security retirement benefits, you will not get both benefits added together. Instead, you will receive whichever benefit is higher. If the spousal benefit is more than your own, you’ll get your own earned benefit plus an additional amount to bring you up to that higher spousal benefit amount.

Who is eligible for spousal benefits from Social Security?

We are often asked “How do you qualify for spousal benefits from Social Security”? Indeed, to claim Social Security spousal benefits, you’ll need to meet certain criteria. Your spouse or ex-spouse also must be living (if they are not, you may be eligible for survivors benefits).

The criteria for spousal benefits varies depending on whether you’re married or divorced:

If you’re married, to qualify for spousal benefits you must:

- Be married for at least one year

- Have a spouse that is already collecting their Social Security benefits

- Have an earned benefit that is lower than your potential spousal benefit

- Be age 62 or taking care of a child who is age 16 or younger or disabled, who is the child of your spouse and who is also receiving Social Security benefits based on the spouse’s work record

If you’re divorced, your benefits aren’t connected in the same way, so you can claim spousal benefits even if your ex isn’t collecting Social Security yet. Note that you do not need the consent of your ex-spouse. Both of you, however, must be at least age 62. If you’ve been divorced more than once, your benefit can be based on your highest-earning spouse if that marriage meets the qualifications. If you’re divorced, to qualify for spousal benefits you must:

- Have been married to the relevant ex-spouse for at least 10 years

- Be unmarried (your ex, however, can be remarried)

- Have been divorced for two years before you claim

- Be age 62 or taking care of a child who is age 16 or younger or disabled, who is the child of your spouse and who is also receiving Social Security benefits based on the spouse’s work record

How are spousal benefits calculated for Social Security?

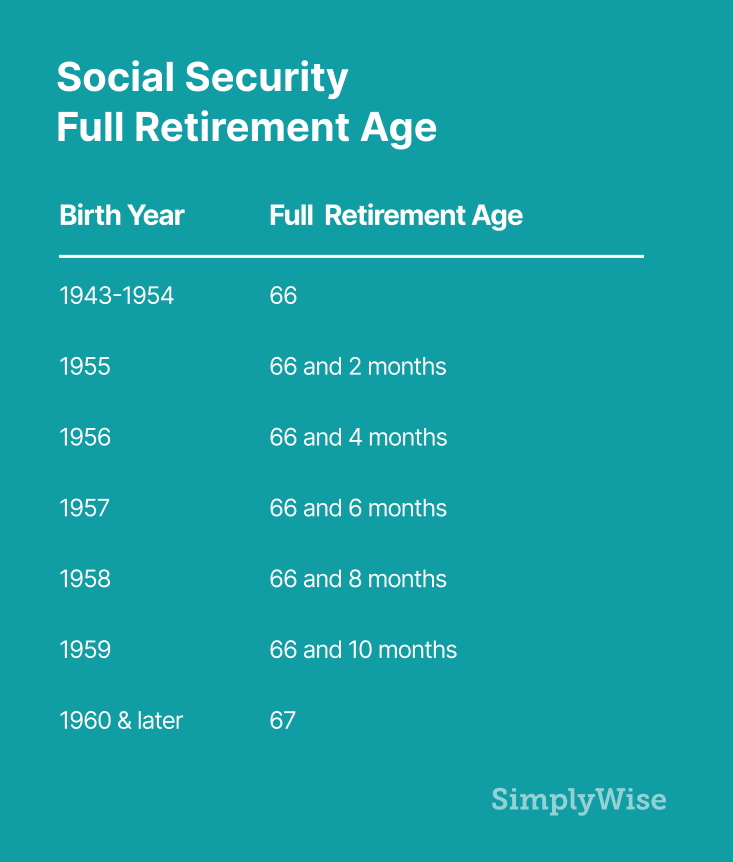

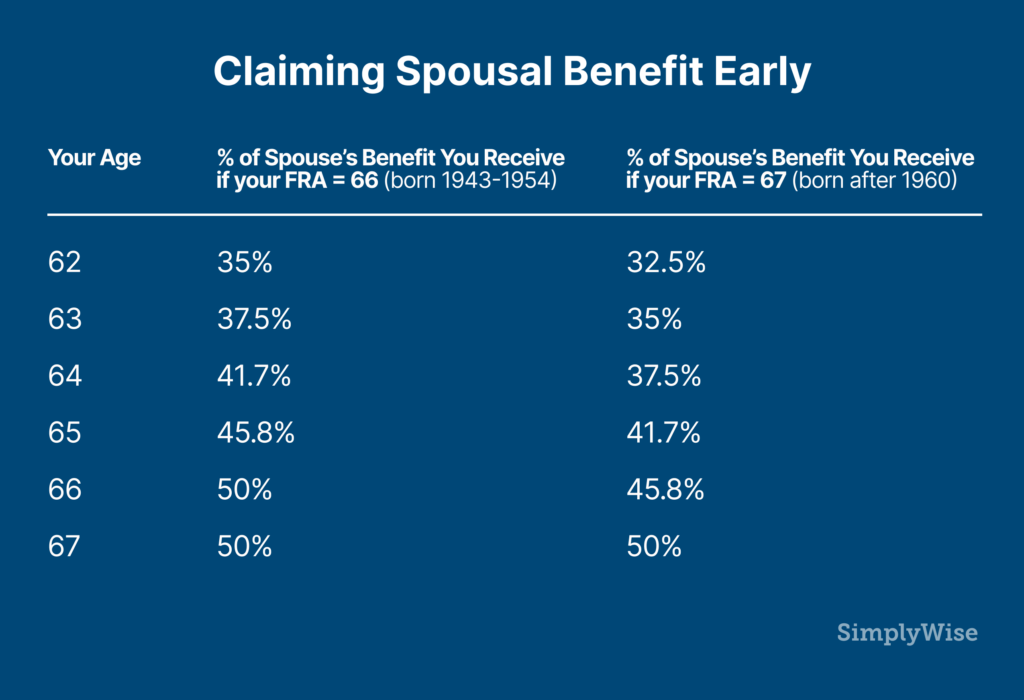

The amount of your spousal benefit depends on 1) your spouse’s earnings history and 2) how old you are when you claim your benefits. If you claim benefits before your full retirement age (table directly below), your benefits will be permanently reduced based on the number of months until you reach that age. However, your benefit does not depend on when your spouse claims.

Here’s what you need to know about how the Social Security Administration calculates spousal benefits

1. First, the Social Security Administration (SSA) calculates the benefits owed on your own earnings record (if you qualify). Typically, that means you’ve paid into Social Security for at least 10 years over the course of your life.

2. Next, the SSA calculates 50% of your spouse’s PIA. That 50% is the most you could be eligible for—but as with earned benefits, you’ll receive less if you claim before your full retirement age.

3. If you claim benefits before your Full Retirement Age, they will reduce your spousal benefits. You are eligible to begin retirement and spousal benefits starting at age 62. However, spousal benefits are reduced by 25/36 of 1% for each month before your full retirement age, up to 36 months early. Benefits that are taken more than 36 months early are reduced an additional 5/12 of 1%. Claiming early permanently reduces your benefits.

4. If you continue to work while receiving benefits, the retirement benefit earnings limit still applies until you reach full retirement age. For 2020, the earnings test limit is $18,240. Before you reach full retirement age, the Social Security Administration deducts $1 from your benefits for every $2 you earn above the annual limit.

5. If you receive a pension based on work not covered by Social Security (for example government work), you can still collect Social Security spousal benefits, but the amount will be reduced. The Government Pension Offset rule reduces spousal benefits by one-third of the public pension amount.

The many rules can feel confusing, and the best way to calculate your own benefit is to use a Social Security benefits calculator.

When can a spouse claim spousal benefits?

Social Security spousal benefits loophole

A recent law changed the way many people can claim spousal benefits. The Bipartisan Budget Act of 2015 closed two Social Security spousal benefits loopholes mainly used by married couples.

Deemed filing

Prior to the law change, people who were eligible for earned benefits and spousal benefits were required to file for both at the same time, a practice known as deemed filing. But that was only until they reached full retirement age. Once they hit full retirement age, if they hadn’t claimed any benefits, they could claim just their spousal benefits first, and delay taking their own earned benefits. That allowed them to rack up delayed retirement credits until they turned 70.

The 2015 law, however, changed the rules so that anyone born on or after Jan. 2, 1954 is affected by deemed filing even after he or she reaches full retirement age. So when someone files for one benefit, they must file for both, and will only receive the higher of the two amounts, with no opportunity to switch later.

People born on Jan. 1, 1954 or earlier, however, can still file a restricted application for just one benefit until they’ve reached full retirement age.

There are two exceptions where deemed filing doesn’t apply:

- If you’re taking care of a child who is younger than 16 or who is disabled

- If you receive spousal benefits and are also entitled to disability. In those cases, you can file a restricted application for spousal benefits without also applying for earned benefits.

File and suspend

The second loophole that the law ended was a practice called file and suspend. File and suspend was a popular method used by married couples to get the most out of their Social Security benefits. In that scenario, the higher earning spouse would file for earned retirement benefits when he or she reached full retirement age, but then suspend those benefits. His or her spouse, however, was still allowed to start collecting spousal benefits. Meanwhile, the higher earning spouse would delay taking Social Security for as long as possible to grow their earned benefits.

Under the new law (which affected everyone going forward, regardless of birth year) if your spouse suspends his or her earned benefits, your spousal benefits also will be suspended. The one exception is divorced couples. People receiving spousal benefits based on ex-spouses will continue to get their benefits even if the spouse suspends theirs.

Can I file for my Social Security at 62 and switch to spousal benefits later?

If your spouse is not yet receiving retirement benefits, you can claim your own Social Security starting at 62, and later switch to spousal benefits when your spouse files.

However, if your spouse is already collecting Social Security (and if you were born on or after Jan. 2, 1954), then when you claim benefits, you are subject to “deemed filing”. Again, this means you will not have a choice about waiting and switching. When you apply for benefits, Social Security will automatically consider you to be applying for both your own benefits and any spousal benefits.

Maximizing your spousal benefits

The earliest you can claim spousal benefits is 62—but how early you claim plays an important role in maximizing your benefits. If you claim before you reach your full retirement age, you will permanently lower your monthly benefit and even your survivor benefit.

While the Bipartisan Budget Act of 2015 ended some of the strategizing around spousal benefits, but there are still ways to maximize your spousal benefits:

- If you were born before Jan. 2, 1954, and haven’t claimed your own benefits yet, you are still able to take advantage of the loophole. You can file a restricted application for spousal benefits at your full retirement age. For this to work, your spouse must have already filed for their benefits. This strategy would let you start receiving spousal benefits, while delaying taking your earned benefits, causing them to grow. When you turn 70, you would then switch to those earned benefits (assuming they are larger).

- If you were born on Jan. 2, 1954 or later, and you are married, the higher earning spouse may consider delaying claiming their benefits until age 70 to increase the benefit with delayed retirement credits. Keep in mind, this would mean delaying when you can take your own spousal benefits, thus missing out a few years of those payments.

- If you’re divorced, you’ll get the maximum spousal benefit, 50%, if you wait to reach your full retirement age. But you have the advantage of not needing to wait for your ex to file for his or her own benefits first.

Spousal benefits can play an important role in a comfortable retirement. In most cases, if you can afford to, it pays to wait until you reach your full retirement age to claim your benefits. But if you’re married, you’ll also have to run some calculations and consider and decide when you and your spouse should start collecting benefits based on varying income history, age, health, and life expectancy.

What is the difference between spousal and survivor benefits?

There are many differences between spousal benefits and survivor benefits. In order to be eligible for spousal benefits, your spouse or ex-spouse must still be living. Survivor benefits are for people whose spouse or ex-spouse has passed away.

If your spouse or ex-spouse dies and has earned benefits that are higher than yours, you could be eligible for survivor benefits.The size of survivor benefits is based on 1) Your spouse or ex-spouse’s earnings; 2) Your full survivors retirement age; and 3) Whether your spouse or ex was receiving reduced benefits (meaning they started taking Social Security before their full retirement age). Note that the full retirement age for survivors is different than the full retirement age for Social Security retirement benefits.

The earliest you can claim survivor benefits is age 60 (whereas the earliest you could be eligible for retirement or spousal benefits is age 62). There are also other scenarios where you can claim survivor benefits at a younger age (and a reduced percentage), including if you are taking care of a child under the age of 16 or you are disabled.

With survivor benefits, you also are allowed to file a restricted application (applying just for your own earned benefits or just for survivor benefits). However, with spousal benefits, you have to apply for both your own earned benefit and spousal benefit at the same time. (Note: there is an exception to this rule for spousal benefits – see the loophole directly below).

How do I apply for spousal benefits?

You can file for spousal benefits the same way you would earned benefits: on the Social Security Administration website, by phone at 1-800-772-1213, or by visiting your local Social Security field office. Once approved, you will receive monthly payments by check or direct deposit.

When you apply for Social Security spousal benefits, they may ask you to provide the following documents to confirm you are eligible:

- Birth certificate (or another proof of birth)

- Marriage certificate (and if applying as a divorced spouse, you’ll need a certified copy of the final divorce decree.)

- Proof of U.S. citizenship. If you were not born in the U.S., you will need to show lawful alien status

- U.S. military discharge papers if you served before 1968

- W-2 forms(s) and/or self-employment tax returns for last year

Applying and ensuring you claim the right benefit at the right time for your personal finances can be confusing. When you’re ready to apply, we recommend using a checklist to ensure you take the right steps and have the right documentation.