Social Security can be confusing, particularly when you have lost a loved one, and intend to claim benefits for widows based on their working record. Whether they passed recently, or years ago, you don’t have to navigate your finances and benefits alone.

Our widow financial checklist provides a guide to walk you through what you are owed and how to apply for Social Security retirement and survivors benefits.

Social Security: Application Checklist

#6 Choose the right method for how to apply for widow benefits

#1 Report the death to the Social Security Administration as soon as possible

You should report the death of your spouse as soon as possible to the Social Security Administration (SSA). You can either do this directly or have the funeral home report the death (in which case you’ll need to give them your spouse’s Social Security number). You may be eligible for both a one-time “death payment” as well as survivors benefits, based on your spouse’s record. However, if your spouse was already receiving Social Security benefits, you will have to return the benefit received for the month of death any later months.

You can get in touch with the SSA to report the death by calling 1-800-772-1213 (TTY 1-800-325-0778) to speak to a Social Security representative between 8:00 am – 5:30 pm. anytime Monday through Friday. You can also visit your local Social Security office. If you do, we recommend calling ahead to schedule an appointment, as it could greatly reduce the time you spend waiting – which is the last thing you need right now.

To qualify for survivors benefits, you must be a:

- Widow or widower, age 60 or older (age 50 if you are disabled), who was married to the deceased for at least nine months

- Widow or widower at any age who is caring for a deceased worker’s child who is younger than age 16 or disabled

- Divorced spouse of the deceased (in some cases)

- Minor or disabled child

- Dependent parent of the deceased age 62 or older (in some cases)

- Stepchild or grandchild of the deceased (in some cases)

The worker who died must have paid into the Social Security system during his or her career. Workers earn up to four credits a year (in 2019, $1,360 in income equals one credit). Once the worker has earned 40 credits, his or her family is fully insured under the program — most Americans are in this category. But the families of workers who have less than 40 credits can still qualify for some survivors benefits. And under a special rule, if someone worked for only a year and a half in the three-year period before their death, their children and spouse can be eligible for benefits.

If you are collecting Social Security and your own benefit is as much or more as your deceased spouse’s would have been, you likely won’t see an increase in your total benefit. SimplyWise tip: When taking your estimate, confirm that you will actually receive a survivor benefit.

For widows and widowers, there are a few steps to take after the death of a spouse that will facilitate interactions with Social Security. One of the most important things is to obtain the death certificate.

SimplyWise tip: You can get this from the funeral director or county clerk. Get approximately 15 certified copies of the death certificate, as you will need it for other financial housekeeping following their death, beyond just Social Security.

SimplyWise tip: Send a letter to one of the 3 major credit bureaus (Equifax, Experian and TransUnion) to report their death get copies of your spouse’s credit reports. This can be a “shortcut” to ensure you are aware of all existing accounts and debts.

#4 Calculate the best age to claim Social Security benefits

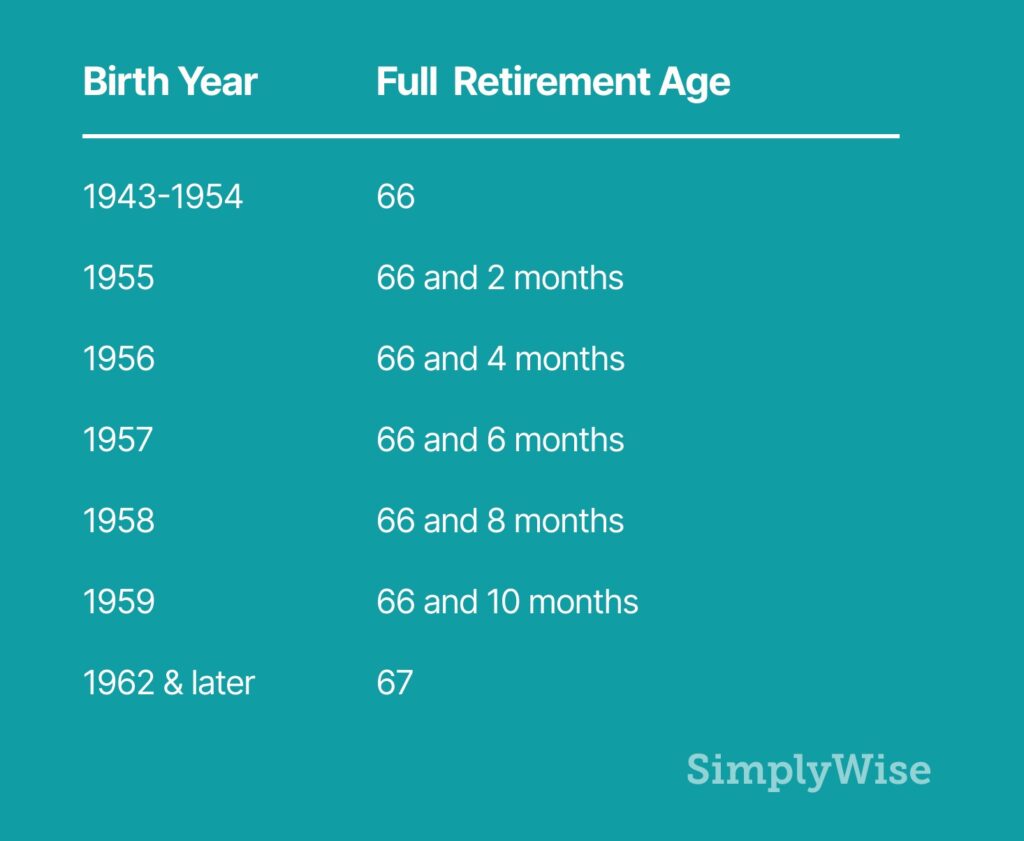

To determine when to start claiming benefits, you should first consult your Full Retirement Age:

Next, use a Social Security benefits calculator to determine the best age for you to claim in order to maximize your benefits (also known as your “claiming strategy”).

Note that you can claim survivor benefits as early as age 60 (or 50 if you are disabled) and retirement benefits as early as age 62, but if you claim before your Full Retirement Age, your monthly benefits will be lower. For widows and widowers, it’s possible to start collecting survivor benefits without claiming earned Social Security benefits.

For your own earned benefits, if you claim later than Full Retirement Age, your benefits will be higher.

#5 Pick the right date to apply

While application processing times are quicker than they were in the past, particularly with the online application, it can still take several weeks to have your application confirmed. It can take longer if there’s a mistake in your application.

Fortunately, the Social Security Administration (SSA) allows you to apply up to four months in advance of when you want to start collecting benefits (three months if you plan to file at the minimum age of 62).

#6 Choose the right method for how to apply for widow benefits

There are three ways to apply for Social Security retirement benefits:

- Online on the Social Security Administration website

- By phone at 1-800-772-1213

- In person at a Social Security office near you

For those applying for survivor benefits (widows benefits), the only options are to do so over the phone or to go into an office. If you go into an office, we suggest making an appointment to avoid long wait times.

If you are widowed but not claiming benefits based on your deceased spouse’s earnings record, we recommend applying online, which is likely the easiest and in many cases has the fastest turnaround time.

#7 Gather necessary documents for your application

We recommend gathering the necessary documents together before you apply for Social Security. The SSA can ask for the following information and documents:

Personal information

- If you were born outside the country, the name of your birth country at the time of your birth

- Your citizen status; if you are not a citizen, you should have your Permanent Resident Card number

- Whether you have used any other Social Security number

- Whether you or anyone else has ever filed for Social Security benefits, Medicare or Supplemental Security Income on your behalf; if so, you should have information on whose Social Security record you applied

- Your Social Security card

- Your original birth certificate, or a certified copy

- The dates and locations of your marriages, and for marriages that have ended, how, when and where they ended

Deceased spouse information

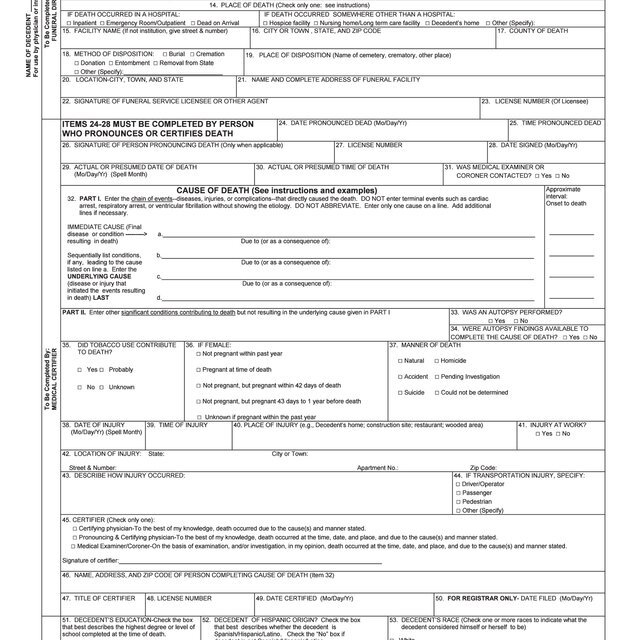

- Proof of death (SimplyWise tip: You can get the death certificate from the funeral director or county clerk)

- Name and gender

- Date of birth and date of death

- Social Security number

- The dates and locations of the deceased’s marriages, and for marriages that have ended, how, when and where they ended

- Whether the deceased spouse filed for Social Security benefits, Medicare or Supplemental Security Income

- The deceased spouse’s most recent W-2

Sample of a death certificate, which must be certified for your survivors benefits application to Social Security

Marriage or divorce information (if applicable)

- Name of current spouse

- Name of prior spouse (if the marriage lasted more than 10 years or ended in death)

- Spouse(s) date of birth and Social Security number (optional)

- Beginning and ending dates of marriage(s) (SimplyWise tip: if you are divorced and applying as a surviving divorced spouse, you will need a certified copy of the official divorce decree — not just a photocopy.)

Children’s information

- Names and dates of birth for children who either i) are under age 18 and unmarried, ii) became disabled prior to the age of 22, or iii) are aged 18 to 19 and attending secondary school full time

Work information

If you’re not self-employed:

- Earnings for current year and prior two years or a copy of your Social Security Statement. Note that even if you don’t have a record of your earnings or aren’t sure they are correct, you can still fill out the application. (SimplyWise tip: If you are going to apply online, you can find this inside your my Social Security account.)

- Employer name

- Employment start and end dates

- Whether you or your spouse have ever worked for the railroad industry

- Whether you qualified or expect to receive a pension or annuity based on your own employment with the Federal government of the U.S. or one of its states or local subdivisions

If you are self-employed:

- Business type

- Total net income

Direct deposit information

- Account type

- Account number

- Bank routing number

#8 Create a “my Social Security account”

You will need a my Social Security account to apply for Social Security benefits online. But even if you apply for retirement benefits over the phone or in person, having a my Social Security account can still make things easier. The SSA’s online account is free, and allows you to set up your direct deposit to receive benefits, check your application status, request a new Social Security card, and more.

When you’re ready, head to the my Social Security account website and click “Create an Account”. When you reach the next screen, click again on “Create New Account”. After agreeing to the Terms of Service, you will be asked to fill in personal information, such as your:

- Name

- Social Security number

- Address

- Phone number

- Email address

Additionally, you may be prompted to answer questions about your credit history or your history of addresses or phone numbers in order to verify your identity. You will have to create a username and password, which you can use to log back into your account at any time.

Note that you can also use your account to:

- View your Social Security earned benefit estimate

- Review your earnings history (SimplyWise tip: review carefully and notify the SSA if you find any discrepancies.)

- Request a new Social Security card

- Change your contact information (phone # or address)

- Set up / change your direct deposit to receive benefits

#9 Submit application

As mentioned above, we would normally recommend that you apply online, as it’s the easiest and quickest way to apply. However, if part or all of your application is towards survivor benefits, you’ll have to apply over the phone or in person. Here we have laid out instructions for each.

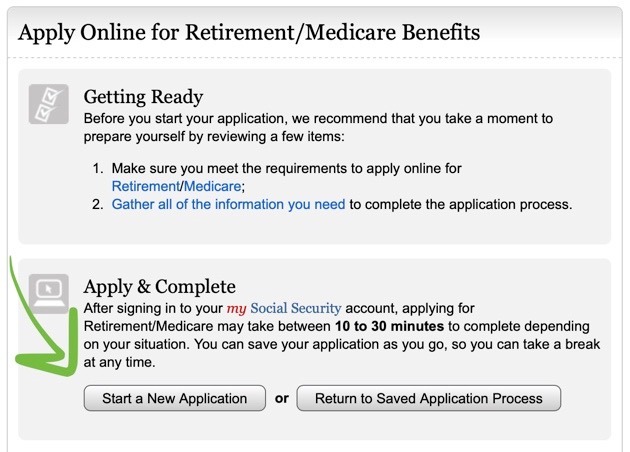

Applying online

1. Be sure of your claiming strategy

2. Go to the Social Security application page, agree to the terms and start a new application

3. Follow the instructions on the screen to fill out the application (SimplyWise tip: Write down the application number you are given near the beginning of the process and keep it in a safe place, in case you need to refer to it later.)

4. When you get to the section about when you want to receive your benefits, edit it to the date of your choosing (SimplyWise tip: It will be set to the earliest possible date, so if that is not what you want, make sure to adjust it.)

5. When you have responded to all of the questions, you will see a summary of your answers; review them critically and if necessary, click “edit” to make alterations

6. Give your digital “signature” to complete and submit the application

Applying by phone

1. Be sure of your claiming strategy (SimplyWise tip: The agent helping you with your call will only be able to assist you with application and process questions.)

2. Clear a few hours on your schedule; we estimate that the application itself will take around 30 minutes, but there may be a wait time (SimplyWise tip: Call volumes are higher at the beginning of the month and the beginning of each week, so you may want to avoid those days if possible.)

3. Have the materials listed above on hand

4. Call the SSA at 1-800-772-1213 anytime from 8:00am – 5:30 pm on Monday through Friday (as long as it’s not a holiday)

5. When the time comes, be clear to the representative the date at which you intend to claim; otherwise, the earliest date possible will be selected for you

6. Confirm to the agent your intent to submit the application; this will count as your “signature”

Applying in person

1. Be sure of your claiming strategy

2. Call the SSA to schedule an appointment at 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday, 8:00am – 5:30 pm (as long as it’s not a holiday). (SimplyWise tip: when you go in, budget a few hours, since you may have trouble finding parking and the office may be busier than expected.)

3. Gather the materials listed above and bring with you to the Social Security office

4. When the time comes, be clear to the representative the date at which you intend to claim; otherwise, the earliest date possible will be selected for you

5. Confirm to the agent your intent to submit the application; this will count as your “signature”

#10 Check application status

Once you have applied for Social Security retirement benefits, you can check the status of your application: online, by phone, or in person. (SimplyWise tip: Checking online through a my Social Security account is typically the easiest way to get your update.)

Check your Social Security application status online

To check your application status online, you must either have (or create) a my Social Security account. You can login there and check the Status of Your Application online.

Your application status online will show:

- Your Re-entry number for pending online benefit application or online appeal that has not been submitted;

- The date the SSA received your application or appeal;

- Scheduled Hearing date and time;

- Current claim or appeal location including the address of the office processing your application; and

- If a decision has been made.

Check your Social Security application status by phone

To check your application status by phone, call the SSA at 1-800-772-1213 (TTY 1-800-325-0778). Their hours are Monday through Friday, 8:00am – 5:30 pm. (SimplyWise tip: Call volumes are higher at the beginning of the month and the beginning of each week, so you may want to avoid those days if possible)

Check your Social Security application status in person

To check your application status in person, locate your nearest office.

#10 Update direct deposit information or address (as necessary)

Social Security needs your address to send you communications and information on Medicare, among other things. So it’s important to be sure they have your current details on file.

If you need to change either your address or the bank account where your Social Security benefits are deposited, you can change and update your information online, by phone, or in person. (SimplyWise tip: Making changes online through a my Social Security account is typically easiest.)

Change your info with Social Security online

To make the changes online, you must either have (or create) a my Social Security account. If you already receive benefits (retirement, survivors, or disability) and you have a bank account, you can start or update your direct deposit by using the My Profile Tab in my Social Security. In addition, you can decide when your change will take effect.

Change your info with Social Security by phone

To make the changes by phone, call the SSA at 1-800-772-1213 (TTY 1-800-325-0778). Their hours are Monday through Friday, 8:00am – 5:30 pm. (SimplyWise tip: Call volumes are higher at the beginning of the month and the beginning of each week, so you may want to avoid those days if possible.)

Change your info with Social Security in person

To make the changes in person, locate your nearest office.