In 2019, 64 million Americans were estimated to have received Social Security benefits, and for more than half of elderly beneficiaries, Social Security represented over 50% of their income. Nonetheless, a recent SimplyWise survey found that less than one in eight Americans aged 60 to 70 considered themselves “very knowledgeable” on the topic.

Worse, only one out of 300 people asked knew the correct answer to all five of the following questions. These questions are fundamental and confusions lead to people missing out on income they desperately need. Whether you’re single, divorced or married and looking to maximize your retirement income, familiarizing yourself with the rules is paramount to a relaxed retirement.

Question 1: Claiming at which age maximizes your monthly earned Social Security benefit?

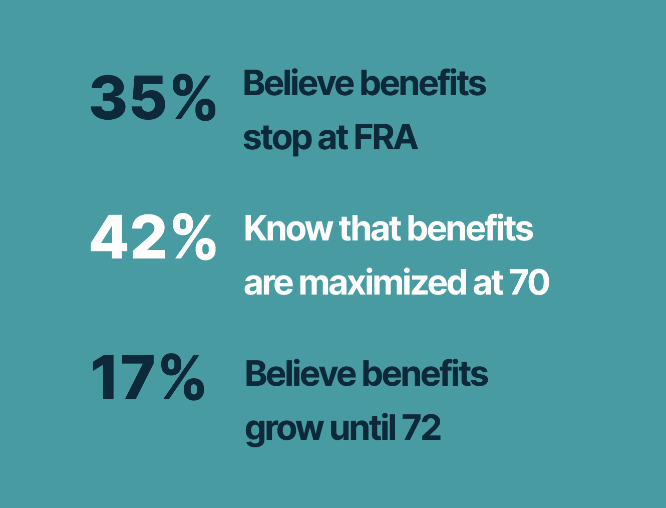

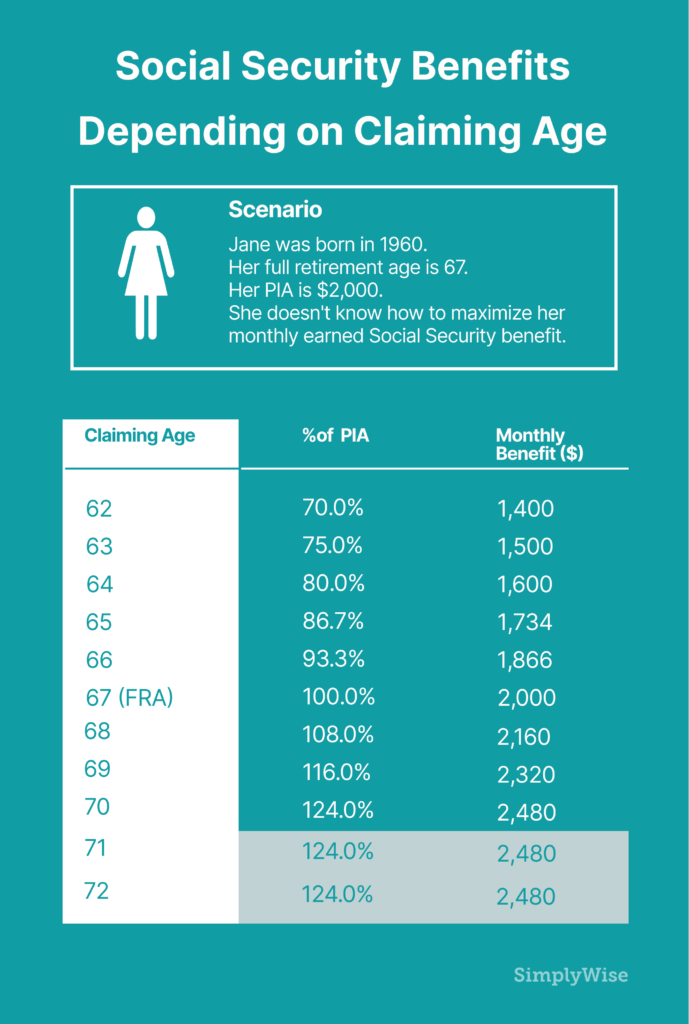

Correct answer: 70. While non-disabled people can begin collecting their Social Security benefits at 62, the monthly benefit amount will increase for every month they wait until turning 70 years old. After that, the benefit does not increase.

How many people got it right: 42%.

Most common wrong answer: 35% of people believe that you earn the maximum monthly benefit at full retirement age. Full retirement age entitles you to 100% of your PIA (Primary Insurance Account), which is the amount you’ve earned based on your working record, but waiting past your full retirement age will earn you delayed retirement credits and result in an increased benefit amount.

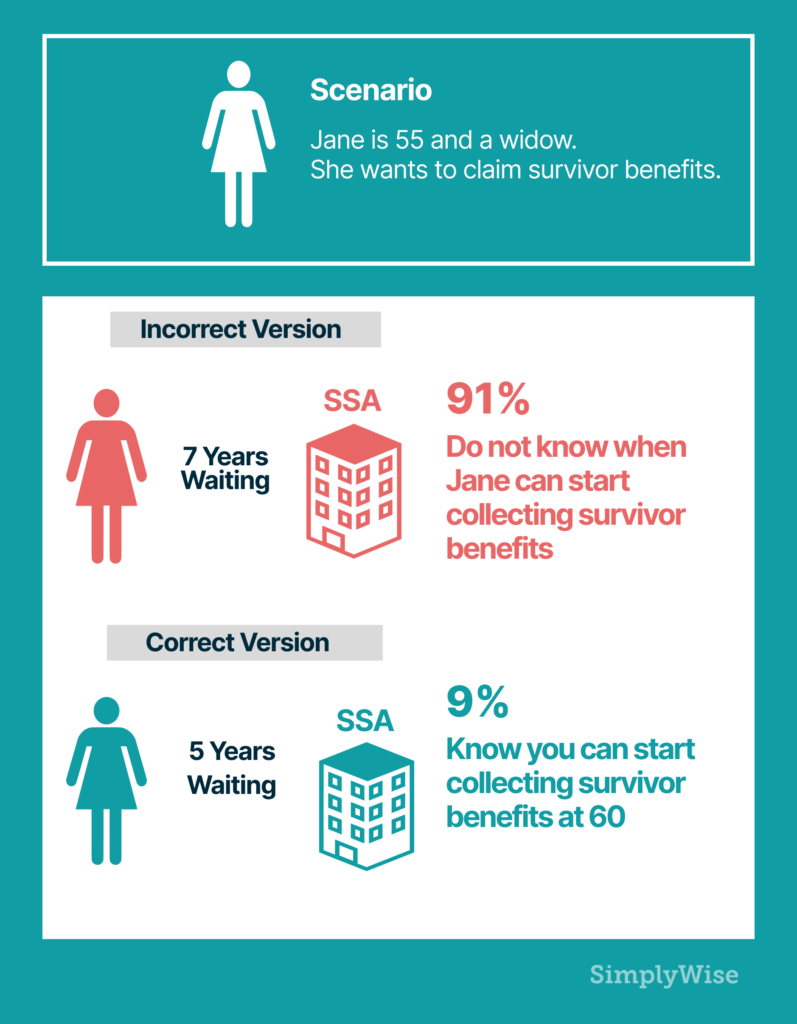

Question 2: For non-disabled people, what is the earliest age you can receive survivors benefits?

Correct answer: 60.

How many people got it right: 9%.

Most common wrong answer: 21% of people believe that the age is 62. In the case of earned benefits and spousal benefits, this is correct, but the age drops for survivor benefits. Similar to earned and spousal benefits, waiting past the earliest age can increase the monthly benefit amount.

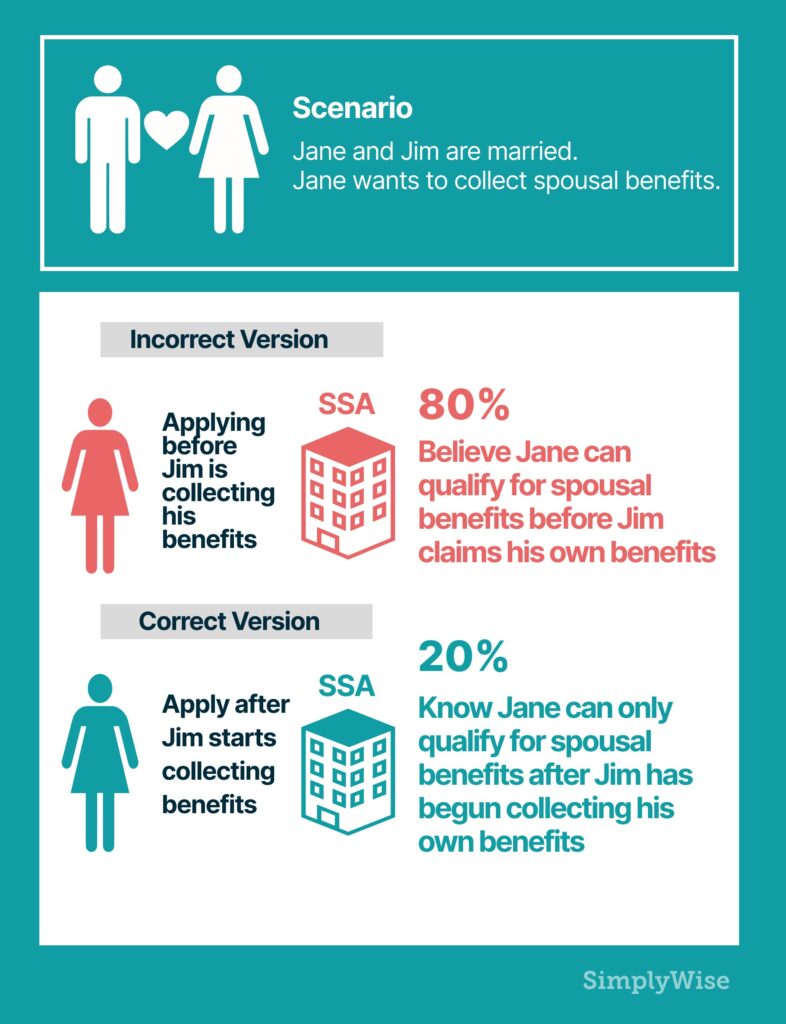

Question 3: Does your spouse need to be receiving Social Security benefits for you to qualify for spousal benefits?

Correct answer: If you intend to collect Social Security benefits based on your current spouse’s earnings record, your spouse must already be collecting his or her Social Security earned benefits. When it comes to collecting spousal benefits on an ex-spouse’s record, however, this is not necessary.

How many people got it right: 20%.

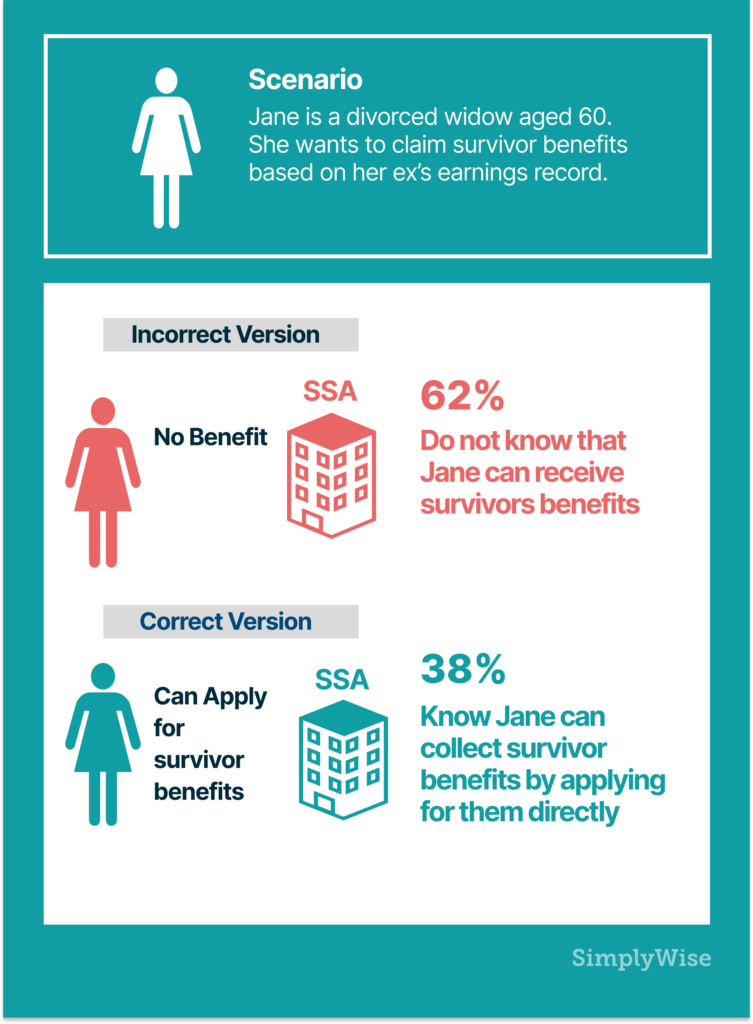

Question 4: Can divorced spouses receive survivor benefits?

Correct answer: Yes. The criteria differ slightly from those of married spouses – for example, the marriage must have lasted for at least 10 years and there are rules around remarriage – but divorced spouses can collect survivor benefits in relation to a deceased ex-spouse.

How many people got it right: 38%.

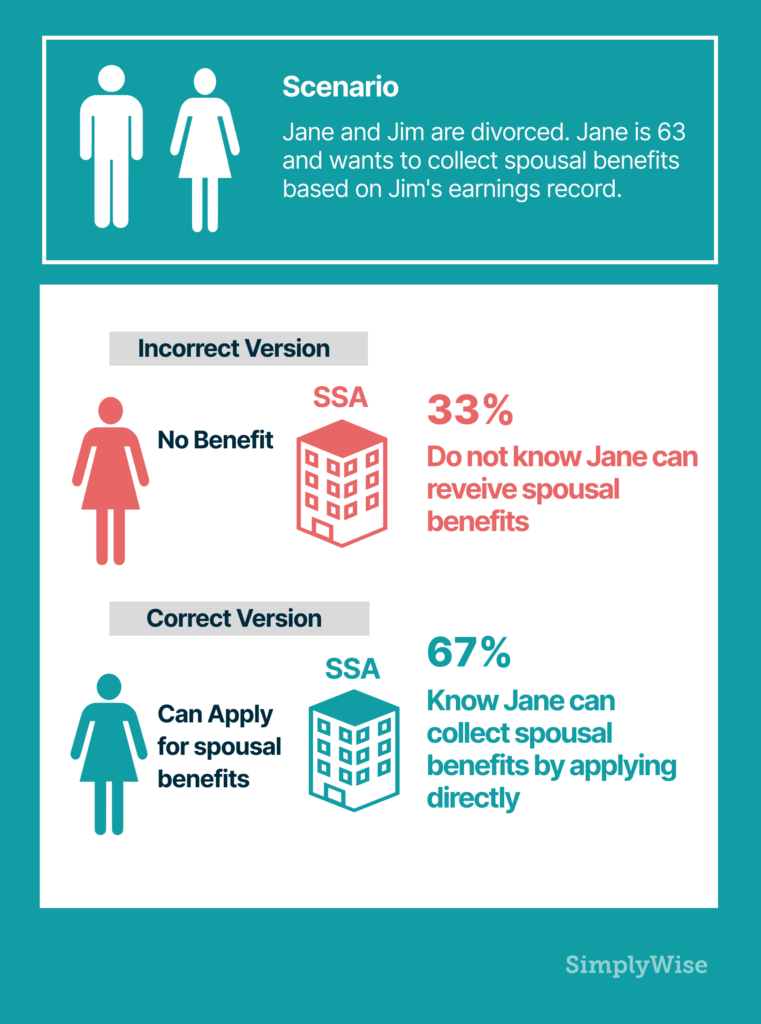

Question 5: Can divorced spouses receive spousal benefits?

Correct answer: Yes. As is the case for survivor benefits, some differences do exist when applying Social Security rules to divorcees as opposed to married couples, but divorced spouses are eligible for spousal benefits.

How many people got it right: 67%.

Takeaways

Millions of Americans have paid into the Social Security system. Unfortunately, confusion is common, highlighted by misconceptions around spousal benefits, survivors benefits, child benefits, taxes on Social Security, maximizing Social Security while working, cost of living increases, how to apply and more. Some of these mistakes can cost recipients upwards of $80,000.

Increasingly, online Social Security blogs and free calculators are emerging to help people avoid costly mistakes. Hopefully, with better education around the topic, Americans can maximize what they’ve earned.