If you’re thinking about claiming Social Security benefits early given the current economic climate, you may want to consider your other options before deciding.

In fact, there are important factors to weigh as you consider your retirement and when to claim. Your monthly benefit from Social Security can considerably vary depending on what age you choose to start your benefits.

- If you claim your monthly benefit before your Full Retirement Age (and you can start claiming your Social Security benefits as early as 62), your monthly benefit will be lower. However, you will receive it for a longer period of time.

- If you claim your monthly benefit after reaching your Full Retirement Age, you’ll receive what is called “Delayed Retirement Credits”. DRCs translate to a much larger monthly check (though for a shorter period of time).

What are delayed retirement credits and how do they work?

There are a few considerations to make before waiting to claim your Social Security monthly check. Of course, you can simplify your life and use a retirement calculator to help you decide. But it can also be helpful to understand the options for yourself.

First, you must know your Full Retirement Age (FRA), which is based on your birth year (find your FRA here).

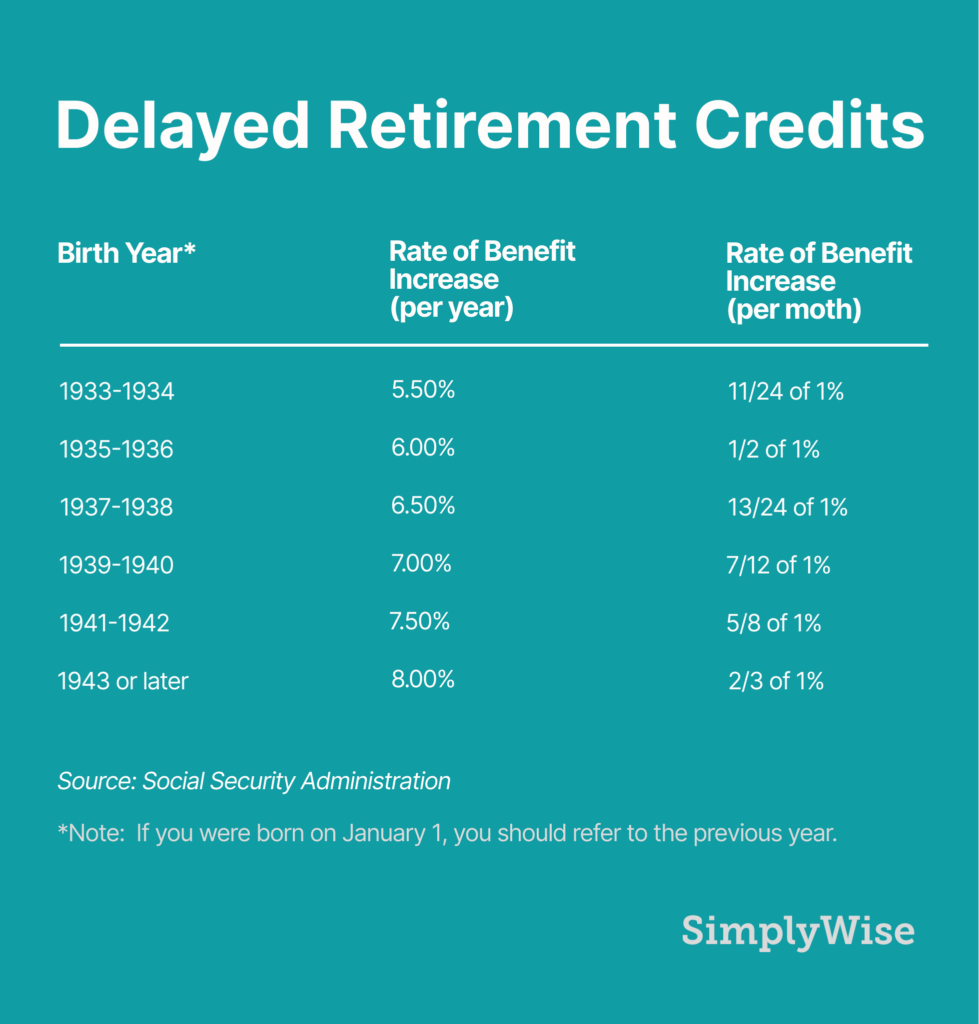

Then use the “Delayed Retirement Credits” table below to calculate how much your monthly benefit would increase each month or year. Note that depending on the year you were born, the rates vary.

If you were born after 1943, then for every month past your FRA that you postpone filing for your benefits, Social Security will increase your benefits by ⅔ of 1%. This comes out to an 8% increase in your benefits for every year that you wait.

You read that right: an 8% per year. Where else can you find such a safe, guaranteed rate?

So, if you can afford it, waiting has its perks.

Note that waiting pays off even if your Social Security benefit is larger than your maximum monthly benefit. That is, even if you expect to receive $3,011 each month (which is the maximum monthly benefit for someone retiring in 2020), you are still able to take advantage of delayed retirement credits. This is true despite the fact that technically, you would be receiving more than the maximum amount

How are delayed retirement benefits calculated?

Let’s take an example, because that chart above can be confusing.

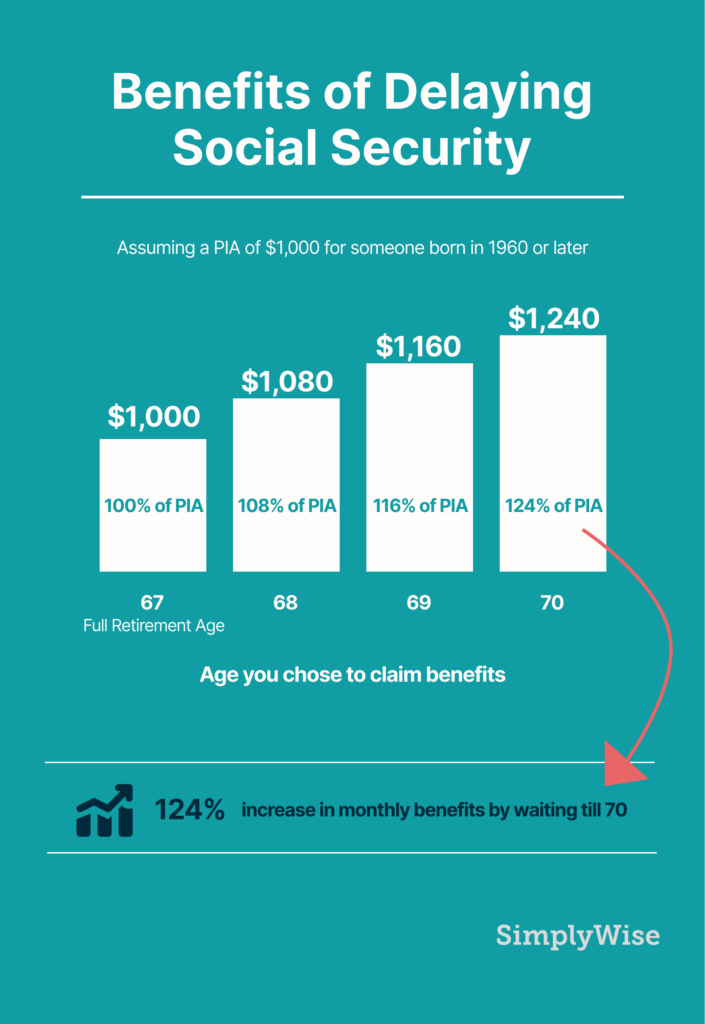

One of our users, who we’ll call Karen, was born in 1960, so as of this writing she is 60 years old. Full Retirement Age for someone born in 1960 (or after) is 67. So Karen could collect her Social Security benefits at 67 and receive her Primary Insurance Amount (PIA) of $1000/month.

However, Karen recently started making additional income from Airbnb’ing her home in Florida. With the extra $1,200 she earns every month renting her condo, she is considering delaying her retirement until 70.

Now let’s do the math. We first must calculate how many additional years/months for which she will benefit from the delay.

If she waits until she is 70, that is 3 years past her Full Retirement Age of 67.

According to the Delayed Retirement Credits table above, because she’s born after 1943, her benefit will increase by 8% per year (or ⅔ of 1% per month). To calculate the amount her benefits will increase from delaying until 70, we multiply her monthly PIA by the 8% increase per year, times the number of years she is delaying. That is: $1000 x 8% per year x 3 years, which comes to $240.

By delaying retiring until 70, her monthly benefit will become $1,240 (vs. $1000). That is 124% larger than it would be if she claimed her benefits at her Full Retirement Age. The table below illustrates how her monthly benefits will increase for every year she waits to collect.

Other considerations to delaying your retirement benefits

Delaying Social Security retirement benefits until 70 might work for Karen, but that doesn’t mean it’s the right path for everyone.

One of the most important considerations to deciding whether to claim benefits early, on time, or delayed is the state of your health and what you believe your life expectancy to be. If you are not in good health, or if you have a life-threatening or terminal illness, it may make sense to claim your benefits earlier.

You should also be sure that you will have enough income to support you if you decide to delay benefits. SimplyWise helps connect people to new sources of income and cost-savings every day, from finding jobs to reducing their debt, so don’t hesitate to reach out to us on chat if we can be helpful.

Finally, if you’re an exceptionally savvy investor, you might even consider the possibility of collecting the money at your FRA and investing it–if you believe you can beat the 8% annual return you’ll receive from waiting. Of course, there are risks associated with any kind of investment strategy, but this is certainly an option.

Delaying Social Security past age 70

Many people ask what their benefit would be if they waited until past the age of 70. So it’s important to point out that there is no reason to wait past the age of 70 to collect your Social Security benefit. The window of gains to be made from delaying Social Security retirement benefits is between your Full Retirement Age and 70 years old. That’s it.

Takeaways

This is certainly a difficult time for everyone, and it can be tempting to go for Social Security benefits first. But you should educate yourself and consider all your options first.

While the Social Security Administration can be confusing to navigate, it allows for some choice around claiming your benefits, and understanding your options will give you greater control over the decisions that are right for you and your finances at this time.

When to begin collecting your benefits depends on your own unique situation. If you have health problems, a disability, or generally need the money right now, it can make sense to claim your benefits early.

On the other hand, if you are in a position where you can afford to wait, it can pay to delay receiving Social Security benefits past full retirement age.

Increasingly, online Social Security blogs and free calculators are emerging to help people avoid costly mistakes (we believe the SimplyWise Calculator is the best). Hopefully, with better education around the topic, Americans can maximize what they’ve earned.