Introduction

Beyond the health impact, COVID-19 has created unprecedented economic uncertainty. The pandemic has roiled the economy and devastated Americans’ savings and wallets. And it appears there is no end in sight. Amidst the current surge in COVID-19 cases across the country, states have revived restrictions and stay-at home directives. With the unemployment rate remaining above 10%, the rise in cases and updated policies threaten to make the coronavirus-related layoffs and furloughs permanent.

In a country where most people live paycheck to paycheck, this could be devastating. Most Americans lack the savings to last them even three months. Of course, that savings gap is all the more dramatic when it comes to saving for retirement. And with the havoc the pandemic has wrought, that savings gap seems likely to worsen.

Beyond the hit to personal savings, the pandemic is also taking a toll on Social Security’s coffers. The record unemployment rates since March of this year mean that the Social Security fund (which depends on payroll taxes) is taking the hit. More, the CARES Act allows companies to delay paying Social Security taxes. And while this doesn’t affect current beneficiaries, it highlights the pandemic’s impact on the already increasing Social Security funding deficit. As Federal Reserve vice chair Randal Quarles recently said: “There’s probably never been more uncertainty.” So it’s unsurprising that Americans are more worried than ever about their future and what retirement today will look like.

According to the July 2020 SimplyWise Retirement Confidence Index, 62% of Americans are more concerned about retirement today compared to how they were feeling about it a year ago. This is up from 56% in our May 2020 Index. The survey also found that 70% of people in their 50s—who are nearest to retirement—are more concerned about retirement today.

The study was conducted as an online, random sample survey of 1,128 Americans ages 18+ between July 3-6, 2020. It explored how people are looking at retirement, Social Security, and savings today, particularly in light of COVID-19. We break down our findings, from changing rates of postponing retirement to how people are drawing from retirement savings during the pandemic.

Sections

Key Findings

Americans’ concern over retirement today is at an all-time high

More Americans are delaying retirement and Social Security

The coronavirus impact on savings

Racial, gender and age disparities in savings

Americans are pessimistic about their financial future

Methodology

Key Findings

- 62% of Americans more concerned about retirement today compared to a year ago. (This is up from 56% in the May 2020 Index.)

- Half of Americans believe they will outlive their retirement savings.

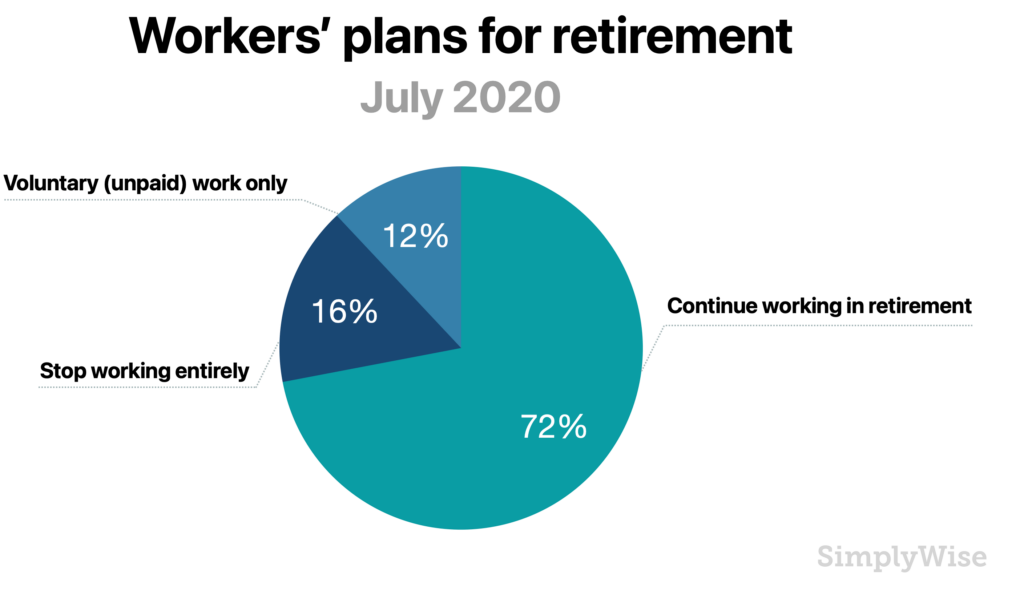

- 72% now plan to work in retirement. (Up from 67% in May.)

- Only 58% of those in workforce are making what they were making prior to COVID-19. (67% for White Americans, 50% for Hispanic Americans, 45% for Black Americans.)

- One in five Americans in their 60s have lost their jobs or been furloughed due to COVID-19.

- 24% are now planning to tap their 401(k), including 41% of those laid off due to COVID-19.

- 63% of Black Americans could not come up with $500 cash today (without selling something or taking out a loan)—compared to 35% of White Americans.

- 1 in 5 Americans could not last more than 2 weeks off their savings.

- 48% of Black Americans and 43% of Hispanic Americans could survive less than a month on savings (versus 33% of White Americans).

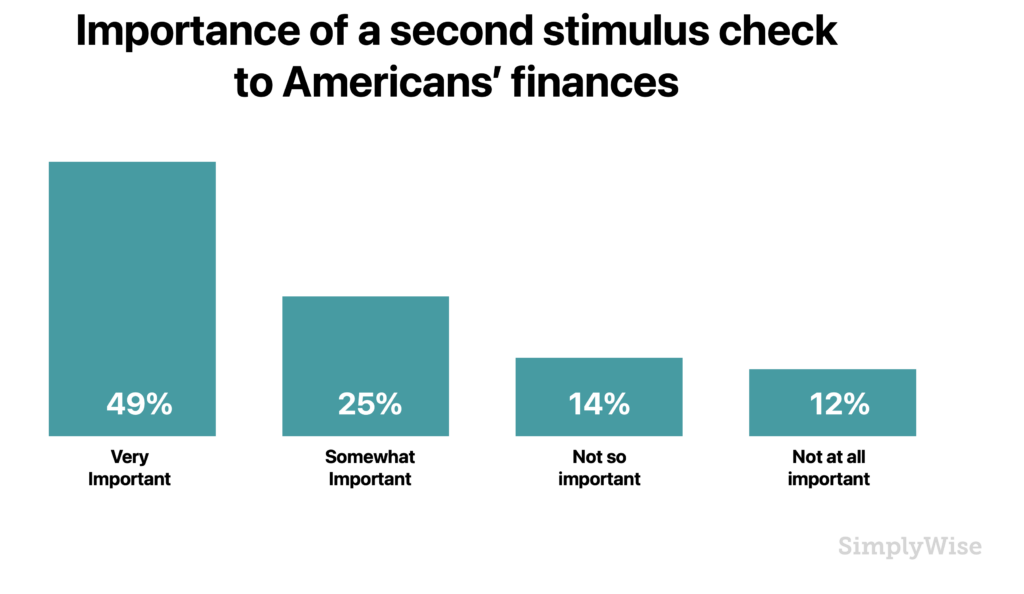

- Half of Americans say another stimulus check is very important to their finances.

- 72% (83% of Democrats vs. 60% of Republicans) believe a recession will continue into the next year.

Americans’ concern over retirement today is at an all-time high

Declining retirement sentiment

An overwhelming 62% of people are more concerned about retirement today, compared to a year ago. That is up from the 56% who reported being more concerned in the May 2020 SimplyWise Index. For those not yet claiming Social Security benefits, financial concerns rank among the greatest anxieties around retirement.

The reported concern was worst for those closest to retirement. For Americans in their 50s, 70% said they are more concerned about retirement than at this time last year. Seniors also expressed increased anxiety about their retirement. Sixty-one percent of people in their 60s are now more concerned than they were a year ago. Compare this to two months ago, when just 50% of people in their 60s said they were more concerned for their retirement. For those in their 70s and 80s, 41% are now more concerned about the rest of their retirement, compared to a reported 34% in May.

There was also a divide along political lines. The Index found that Republicans are somewhat more optimistic about their retirement prospects. In fact, 46% of Republicans feel similarly or better about retirement compared to how they felt at this time last year. That is compared to 31% of Democrats who feel similarly or better compared to this time last year—and 69% of Democrats who are now more concerned about retirement.

And there was a gender divide in retirement sentiment. Two in three women reported feeling more concerned about retirement today. On the other hand, just 56% of men feel more concerned about retirement today.

Financial and medical concerns for retirement

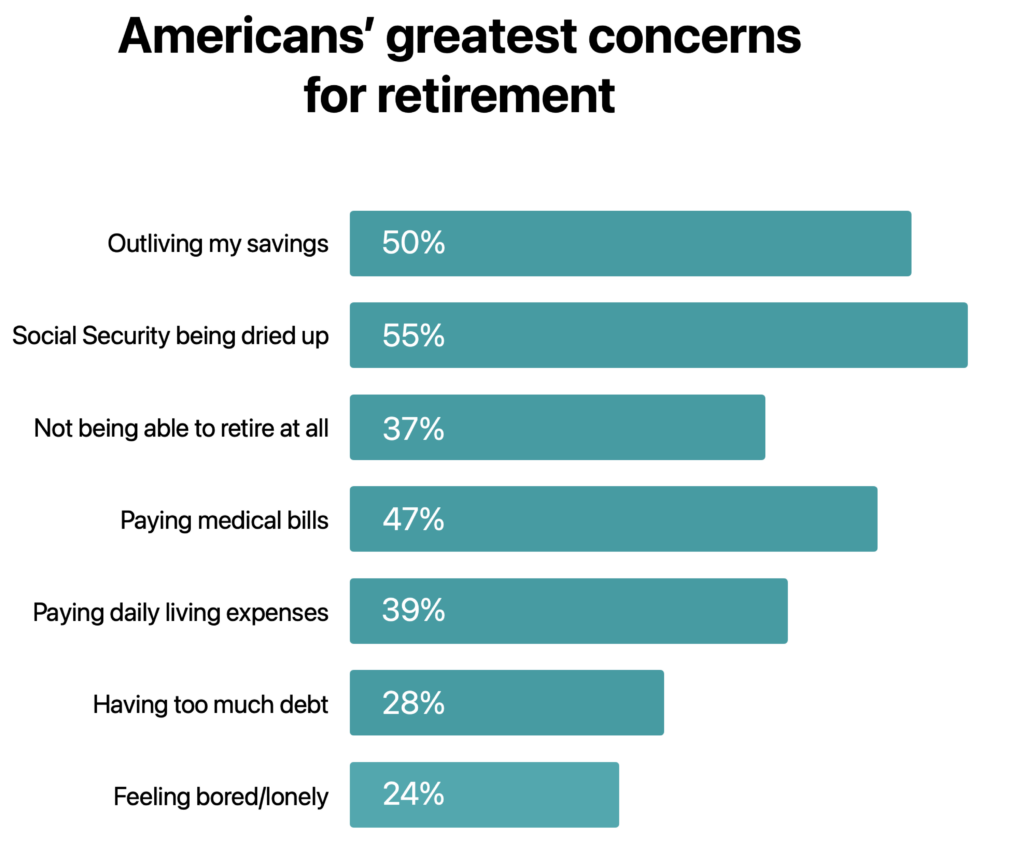

Americans’ greatest concerns for retirement were largely consistent with those found in our May survey. Half of respondents were concerned that they would outlive their retirement savings. Another 55% were concerned that Social Security would dry up before they retired. Four in ten Americans fear they will not be able to retire at all. Forty-one percent of Democrats versus 27% of Republicans were concerned they not be able to retire at all.

Paying everyday bills, particularly medical bills, remains a great anxiety. Fifty-two percent of people in their 50s reported being concerned about their ability to pay for medical expenses in retirement. And 42% of people in their 50s worry about paying daily living expenses in retirement. Perhaps their concern is merited. For those who are already retired, over a quarter reported they worry about their ability to pay daily living expenses. And repaying lenders remains a concern, with 28% worried about having too much debit in retirement.

Of course, beyond financial concerns, there are other realities to face in entering the next phase of one’s life. As in the recent May survey, a quarter of respondents worried about feeling bored or lonely in retirement. In fact, the latest census revealed that approximately one in five adults aged 65 to 74 lives alone. That figure doubles to around four in ten people for those 85 and older. While living alone does not necessarily translate to isolation, the reality is that social contact does typically decrease with age. This can be attributed to factors like decreased health or mobility; family living far away; the death of friends or family members. This isolation can lead to loneliness, which can have a severe impact on one’s health and even finances in retirement. For example, an AARP study revealed that social isolation costs $6.7 billion to Medicare every year. The study found loneliness to be a risk factor in health conditions including arthritis, high blood pressure, heart disease, and diabetes.

Declining quality of life in retirement

According to the Social Security Administration, retirement benefits are designed to replace approximately 40% of a worker’s wages in retirement. However, a majority of Americans, particularly those closest to retirement, plan to rely on Social Security for a majority of their retirement income. People in their 50s and 60s on average expect Social Security to represent over 50% of their retirement income. Millennials (born between 1982-2000) somewhat more conservatively believe Social Security will be 45% of their retirement income.

Considering the average Social Security benefit is $1,503 per month and the average American spends $5,102 per month, it’s no surprise that most Americans expect their quality of life to decline in retirement. In fact, half of all respondents believe their quality of life will suffer after they start collecting Social Security. For those not yet collecting Social Security benefits, 60% believe those benefits won’t allow them to maintain the same quality of life they enjoy today. While this concern varied by age, it was most pronounced for those in their 40s and 50s. The study found that 65% of those in their 40s believe their quality of life will decline in retirement. For people in their 50s, 60% believe life quality will worsen. And women were less confident than men that their savings and benefits would get them through retirement. Just 42% of women, compared to 52% of men, believed they could maintain their same lifestyle in retirement. And indeed, that concern may be merited. For those retired already, 1 in 3 are now worried they won’t be able to maintain their same quality of life throughout their retirement.

The overreliance on Social Security in retirement could hurt many in the future. In fact, the Social Security Board of Trustees reported earlier this year that its funds will be depleted by 2035. That does not mean the end of Social Security. But it does mean its cash reserves will be gone, and it will only be able to dole out what it collects in taxes each year. If that happens, according to the Trustees, the Administration will only be able to pay beneficiaries 79% of the money they are owed. Its reserves are running out due to demographic trends.

Generation X (the generation behind Baby Boomers) is much smaller than the Boomers swelling the ranks of retirement beneficiaries. Translated: there are less workers paying in taxes to fund those benefits. Therefore, current tax revenues won’t cover benefits and Social Security will have to tap the surplus. Add the current soaring unemployment numbers and it becomes hard for Americans to imagine what the future of Social Security—and their retirement—will look like.

More Americans are delaying retirement and Social Security

So what does all of this mean for Americans nearing retiring age today? Well, many Americans are interpreting the current crisis as a call to postpone retirement. One in four are planning to postpone retirement altogether, as in the May 2020 survey.

For many others, retirement simply won’t mean the end of work. The July Index found that more Americans than ever are planning to work into retirement. Today, 72% of workers plan to work after they claim Social Security retirement benefits—up from 67% this May. The rise in delaying retirement may be attributed to the fact that only 58% of workers surveyed are making what they made prior to COVID-19. That number is worse for minorities; just 50% of Hispanic Americans and 45% of Black Americans are at the same income level they were pre-COVID. By comparison, 67% of White Americans are at the same income level they were pre-COVID.

In fact, there was a significant difference with regards to working in retirement along racial lines. People of color (POC)—defined here as Americans who identify as Hispanic, Black or African American, Asian/Pacific Islander, Native Americans and Alaskan Natives) are the most likely to work in retirement. Indeed, 74% of POCs plan to work. White people, on the other hand, are the least likely to work in retirement, with 58% planning to work.

Beyond decisions to work or not in retirement, Americans are also considering delaying Social Security. One in five Americans are now planning to delaying claiming their retirement benefits. Those numbers are more extreme for those who have lost or been furloughed from their jobs due to COVID-19. A full 30% of those fired or furloughed will delay claiming Social Security retirement benefits.

In fact, there are important factors to weigh in considering when to claim. One’s monthly benefit from Social Security can considerably vary depending on the age chosen to start benefits. For example, if you claim your monthly benefit before your Full Retirement Age (and you can start claiming your Social Security benefits as early as 62), your monthly benefit will be lower. However, you will receive it for a longer period of time. If you claim your monthly benefit after reaching your Full Retirement Age, you’ll receive what is called “Delayed Retirement Credits”. DRCs translate to a much larger monthly check (though for a shorter period of time). So those Americans making the decision today to delay retirement benefits will claim higher amounts when they do collect. Specifically, their benefits will increase 8% for every year they wait.

Of course, while it may not be what you had imagined, working during retirement is not necessarily a bad thing. Working for seniors can provide much more than a paycheck; it gives structure, job satisfaction, and opportunities for social interaction.

The coronavirus impact on savings

Delaying retirement to allow benefits to grow is one important way to insure enough retirement income. But with today’s uncertainty, your own savings and income is more important than ever to get through the “golden years”. That said, the act of saving, which is always challenging, is even harder now with the crisis.

Consistent with the May 2020 Index, one out of three respondents saved $0 for retirement in the last year. Of those recently let go due to coronavirus, 55% have saved less than $500 for retirement in the last year. For low to middle income individuals, the numbers were worse. Of respondents whose annual income is below $50,000, 65% saved less than $500 for retirement in the last year.

Tapping long-term savings to pay the bills

For many, the “rainy day” for which they set aside emergency savings has arrived. Given the economic climate, one in ten respondents are now planning to withdraw from their emergency savings. For those let go due to the coronavirus pandemic, one in five are planning to withdraw from emergency savings.

Yet even more Americans are planning to tap their retirement savings. Fifteen percent said they plan to dig into their retirement savings. Even more are planning to specifically tap their 401(k). In fact, more Americans today, compared to May of this year, are now planning to withdraw from their 401(k). In May, 20% planned for early withdrawal. In the July 2020 survey, 24% of those who have a 401(k) are now considering withdrawing. For those laid off due to the coronavirus, 41% are considering tapping their 401(k). And 23% of Americans in their 50s are planning to take out from their 401(k), up from the 14% reported in May 2020.

This may be due to coronavirus-related legislation facilitating retirement withdrawals. Normally, withdrawing from your 401(k) or other retirement account before you are 59 ½ years old means a 10% penalty on the amount taken. The CARES Act, however, waives that 10% penalty on withdrawals up to $100,000 for distributions made to an individual throughout 2020. However, it does essentially mean borrowing from your future self, as the cash you take out won’t have the opportunity to grow and compound over time.

Perhaps for that reason, many are looking to other assets to pay the bills right now. For example, one in ten are now considering selling their home. Another 12% of homeowners today are looking to refinance. Of Social Security beneficiaries, many of whom are dependent on their fixed income and retirement portfolios, 14% are now considering selling their home to cover expenses. Another 16% of beneficiaries are considering refinancing their home to cover expenses today.

Paycheck-to-paycheck Americans lack the savings they need

But at the end of the day, the majority of Americans are paycheck to paycheck, and lack the savings or assets to tap right now.

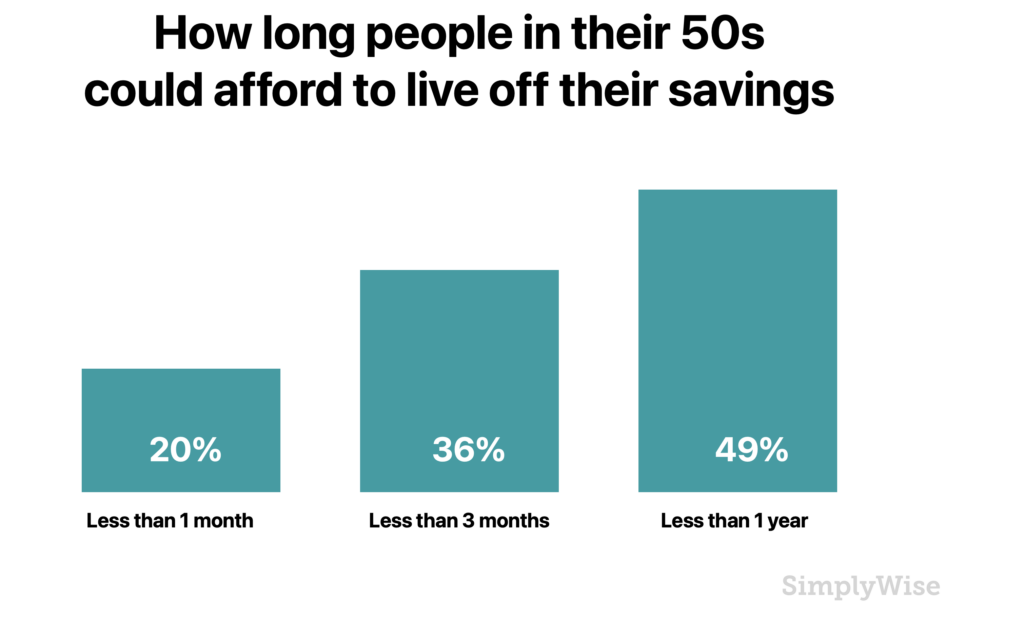

Our July Index asked respondents “How long could you afford to not work and live off your savings?” and the responses were stark. Thirty-five percent could not last more than a month on their savings. An incredible 79% said their savings would get them through less than a year. One in five people say their savings would last them less than two weeks.

More, when asked if they would be able to come up with $500 in cash today, 42% of respondents could not. That number was up from 38% this May. To come up with that kind of money, the 42% would need to sell something or take out a loan. Half of women—versus 37% of men—could not come up with $500 cash today without selling something or taking out a loan.

For most citizens—even pre-pandemic—there’s nothing left over each month to put into long-term savings. In fact, according to the Bureau of Labor Statistics, for workers who are in the upper half of the country’s wage distribution (those earning a minimum of $36,000 on a full-time basis), 75% participate in a retirement plan. However, for workers in the bottom quarter of that salary distribution (whose salaries average $24,000), just 25% participate in a retirement plan.

Racial, gender and age disparities in savings

Our July Index found that a shocking one in three Americans saved nothing for retirement in the last year. Yet the savings numbers were even worse across older and minority populations.

For starters, the Index found that 26% of people in their 50s had saved $0 for retirement this past year. Worse, 80% in general, including 80% of people in their 50s said they could not last more than a year off of their savings. And for those over age 60, just 56% have more than a year’s worth of savings. These numbers are troubling; financial advisors typically recommend saving the most for retirement during your 50s and early 60s. This is because those are often a worker’s peak earning years, and because you are eligible to contribute beyond your retirement account’s maximum annual contribution limit.

There was also a racial divide in savings. A full 48% of Black Americans and 43% of Hispanic Americans could survive less than a month on savings. On the other hand, 33% of whites could survive less than a month on savings. And when asked whether they could come up with $500 cash today, this shortfall was worst for Black Americans, 63% of whom could not. It was least pronounced for White Americans, just 35% of whom could not come up with that money.

And there was a notable gender divide in savings. Half of all women surveyed saved under $500 for retirement in the last year, versus just 34% of men. And when asked if they could come up with $500 cash today, 47% of women (compared to 37% of men) were unable. Moreover, 25% of women say their savings would last them less than twoweeks, versus just 12% of men. This may be driven by the fact that on average, women earn less, work fewer years, and take less investment risk. Indeed, a 2017 study found that women were most vulnerable, with 81% living paycheck to paycheck (compared with 75% of men). Women make, on average, 85% of what their male counterparts do. They are also more likely than men to have part-time jobs. This renders them ineligible to participate in retirement savings plans. Women also continue to be more likely than their male counterparts to pause their careers for caregiving duties – both caring for children and, later in life, for aging family members. If they do return to work, they typically find it hard to make up the lost time in their earnings and savings. This translates to women having just 70% of what men have in overall retirement income.

Americans are pessimistic about their financial future

Unemployment disparity

The reality is that the economy today is hurting Americans across the country. Job security is of course a grave challenge for Americans today, which may likely continue. And yet, like the pandemic itself, the economic impact of the virus has drastically varied depending on factors including age and ethnicity.

Our survey found that where 12% of White Americans have lost their jobs or been furloughed due to the virus, 20% of American POC have been fired or furloughed over the pandemic.

Further, for Americans in their 60s—seniors who for health or discrimination reasons may have the hardest time being re-hired—one in five have been furloughed or fired due to COVID-19. One in ten have been fired from their job over the pandemic. And 25% have had their income reduced due to COVID-19. That the coronavirus unemployment rate appears higher for seniors may be indicative of companies looking to cut those with higher salaries and potentially greater insurance costs.

A second stimulus check is badly needed

When asked whether another stimulus check was necessary for their finances, an overwhelming majority reported a dire need for the money.

Half of Americans say another stimulus check is “very important” to their finances. For those laid off due to COVID-19, 66% consider another stimulus check very important for their financial situation.

Again, there was a gender and racial divide, as well as differences based on political party. Forty-three percent of men compared to 54% of women consider another check very important. Forty-five percent of White Americans say another stimulus check is very important versus 67% of Black Americans. And 56% of Democrats versus 44% of Republicans believe a second check is very important for their situation. For those who have been furloughed or let go from their jobs due to COVID-19, 65% say another check is very important to their current financial situation.

Economic optimism at a low point

While the U.S. economy is officially in a recession, many economists have noted that it may last just a few months. These more optimistic economists have cited better-than-expected jobs numbers in May and June and predicted renewed growth in the third quarter of 2020.

Yet for the majority of our survey respondents, the real recession is yet to come. In fact, 72% of those surveyed in the July Index believe it is likely the recession will continue into the next year.

The question prompted differences among political party and age bracket. Democrats ranked among the highest group; 83%, versus 60% of Republicans, believe it is likely to see a continued recession over the next year. For Independent voters, that number was 78%. And for those in their 60s, 70% believe a recession will likely continue. And just 7% of Americans believed that a recession continuing into the next year is “unlikely”.

However, even in light of today’s uncertainty, there are some brighter spots. On one hand, forty-two percent of Americans are planning to save more. Forty-seven percent of women, compared to 38% of men, are planning to save more. On the other hand, one in five are planning to invest more in the stock market. Twenty-five percent of men versus 15% of women are planning to invest more today. And another 10% of Americans are now planning to donate more to charities.

Takeaways

Since the start of the pandemic, so much has changed about the way we live our lives, and indeed, what it means to live in this new reality. The human toll from the coronavirus continues to climb. The government is working on policies to ease the burden on citizens and businesses impacted by the virus. But the new rules and regulations can feel confusing to navigate.

As things change so much day to day right now, it’s no surprise that Americans are struggling to think about and save for any kind of future today. Yet the insecurity is why it is more important than ever to put aside what you can and educate yourself on your options for saving and retirement today.

Americans who are not yet retired but whose finances have been impacted by the pandemic can use this time to review their expenses. Determine how much cash will be needed in retirement, and make any necessary adjustments to savings and portfolio asset allocations. For those who are eligible but not yet on Social Security, this is a good time to consider how to maximize your benefits. You can use a Social Security calculator and checklist to determine any earned, spousal or survivor benefits for which you’re eligible.

“When the only certainty is uncertainty, keeping yourself educated and informed about how to maximize your savings and income will ensure that your life today and future planning remain on track,” says SimplyWise CEO Sam Abbas.

Methodology

SimplyWise conducted its July 2020 Retirement Confidence Index online, as a random sample survey of 1,128 Americans aged 18 and above. The survey was fielded July 3-6, 2020. It was intended to explore how citizens are looking at retirement, Social Security, and savings today, particularly in light of the current crisis.

See the results of the May 2020 SimplyWise Retirement Confidence Index here.