“When can I retire?” “When can I take Social Security?”

Obviously, people want the option to retire as soon as they like—the earliest age generally being 62. But the decision to take Social Security retirement benefits can be complicated by your health, your marital status and your spouse’s Social Security plan.

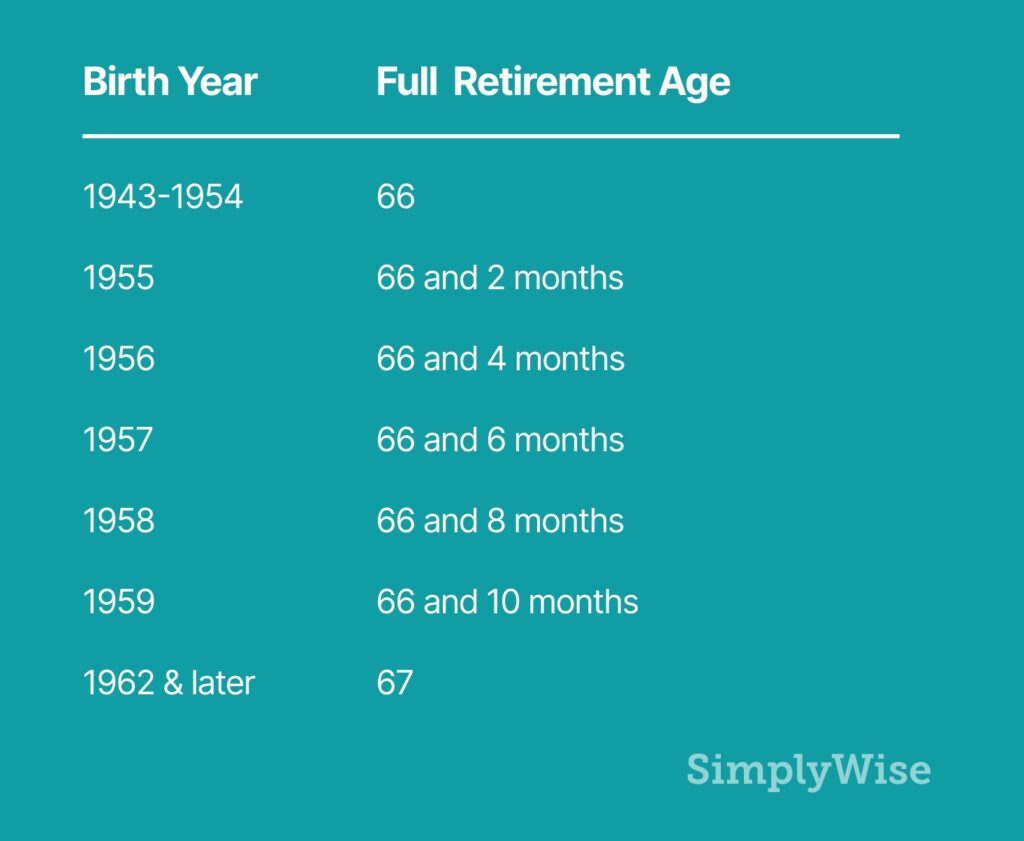

One of the key factors is the year you were born, as when you were born will determine your Full Retirement Age For people born between 1943 and 1954, for example, Full Retirement Age is 66. As shown below, the Full Retirement Age creeps up by two months for every year between 1955 and 1960. Everyone born after 1960 currently has a Full Retirement Age of 67.

Full retirement age doesn’t tell the full picture. As we will explain in this piece, retirement at each age has benefits and drawbacks.

Claiming Social Security at age 62

At age 62, the earliest point at which most people can claim benefits, you’ll receive around 70 percent of the amount that you would receive at your Full Retirement Age. If you were born in 1958, and your full benefit at retirement would be $1,000 a month, you would shrink your benefit to around $700 a month by retiring at age 62. Under most circumstances, once you claim your benefit, it stays at that amount for the rest of your life. Consequently, by retiring early you could lose out on $300 a month every month for the rest of your life.

After you turn 62, the amount of your Social Security benefit rises by about a half a percentage point each month. So, at age 63 you would receive about 77 percent of your benefit

If you work after claiming your benefit, one of two things can happen:

- If you earn less than the earnings limit, which for 2020 is $18,240, then your benefits will not be affected.

- If you earn more than the earnings limit, Social Security will deduct $1 for each $2 you earn over the limit. Social Security will, after full retirement, adjust your benefit to reflect this deduction so the money will eventually be restored to you.

Claiming Social Security at age 66

If you were born between 1943 and 1954, your Full Retirement Age is 66. Claiming at your Full Retirement Age will entitle you to your full benefit amount, but you can still wait to claim. If you wait further, you will garner delayed retirement benefits, which will increase your monthly benefit when you do start collecting.

At Full Retirement Age you can work without any deductions from your benefit amount. However, you may still be taxed on your benefit if you have other substantial income such as wages, self-employment, interest, or dividends. If so, the Internal Revenue Service taxes your “combined” income which is your adjusted gross income, plus nontaxable interest, plus half of your Social Security benefits.

If you file a federal tax return as an “individual” and your combined income is between $25,000 and $34,000, you will have to pay income tax on up to half your benefits. If your income is more than $34,000, up to 85 percent of your benefits might be taxable.

If you are married and file a joint return, and your income together is between $32,000 and $44,000, you may have to pay income tax on up to half your benefits. If your income exceeds $44,000 you may have to pay income tax on up to 85 percent of your benefits.

If you want to receive Social Security at your Full Retirement Age of 66, or 66 and some months, you should apply no more than four months ahead of your Full Retirement Age. However you should use the Social Security online retirement benefit application to sign up for Medicare three months before your 65th birthday.

Claiming Social Security at age 70

If you are able to delay claiming your Social Security benefit until you reach age 70, you will earn a significantly higher benefit. After your Full Retirement Age of 66 (or 67), your benefit goes up by eight percent each year. Consequently, if your full retirement benefit at age 66 was $1,000 per month, and you delay claiming your benefit, it will be $1,080 per month by age 67 or an additional $960 per year. If you delay until age 70, it will be 124 percent of your expected benefit or $1,240 a month. That comes out to $2,880 more each year.

Delaying past age 70 will not increase your benefit, however.

Claiming Social Security at age 65

Those whose Full Retirement Age is 65 are already that age or older. For those born after 1955 and before 1960, Full Retirement Age is 66 and some months. By retiring at age 65, those beneficiaries lose at least 12 months’ worth of increases. For those born in 1960 or after, Full Retirement Age is 67, so they lose up to 24 months of increases if they retire at age 65.

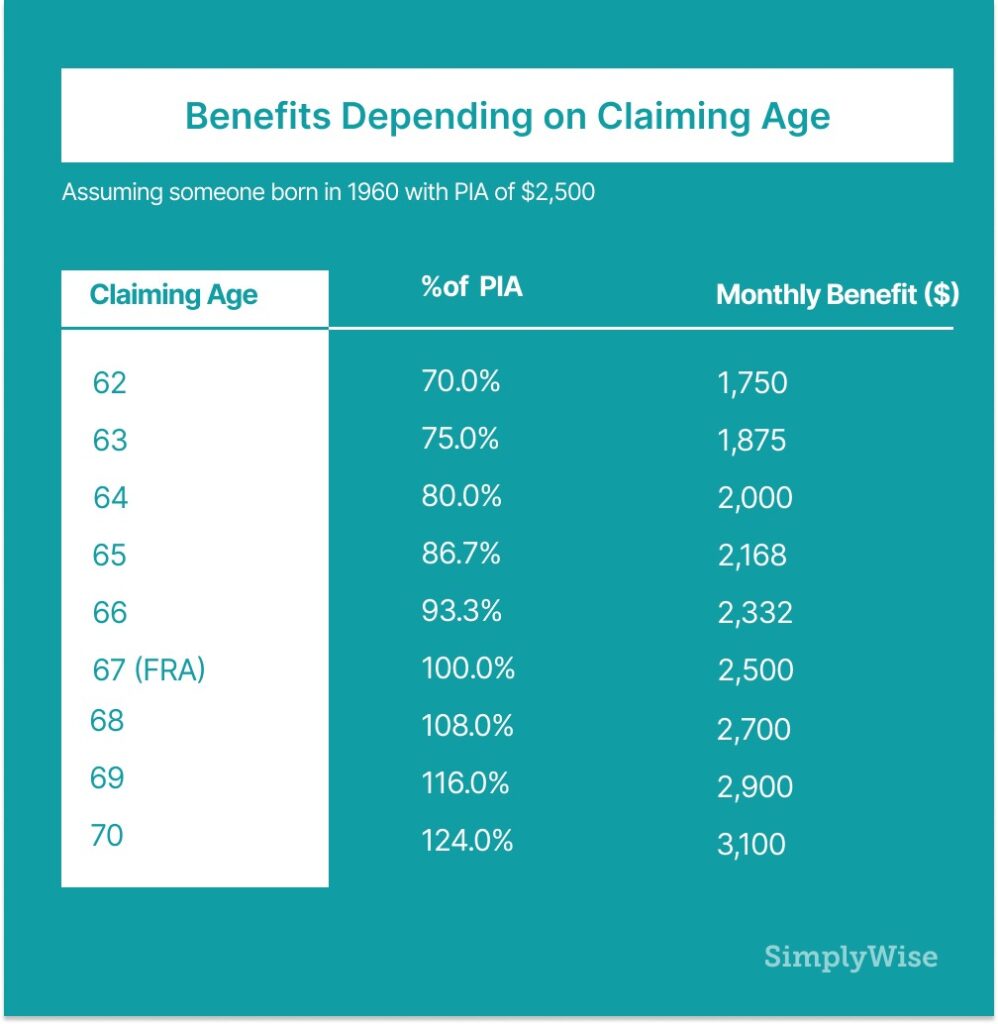

Below, we show how a person born in 1960 and entitled to a full benefit of $2,500 could see his or her monthly benefit change based on claiming age:

Deciding the best age to claim Social Security

There are many factors that determine the best time to claim your Social Security benefit. One that many people don’t have the answer to is how long they will live. If you do not expect to live into old age, taking your benefit early might be a good idea. However, if you do live a long time, the extra money you would receive will probably come in very handy.

Let’s take the example of one of our users, who we’ll call Lucy, whose full retirement benefit at age 67 is $1,000. If Lucy were to claim at 62, the earliest age possible, her monthly benefit would actually be closer to $700. Claiming at 62 means Lucy would collect money right away and by 67, she would receive five years of benefits, at $700 per month, totaling $42,000. If she were to wait until 67 to begin collecting, she wouldn’t accumulate $42,000 in Social Security earnings until 70 and a half years old; however, it would take her three and a half years – as opposed to five at the lower monthly amount – and over time, that difference continues to shrink.

In Lucy’s case, the breakeven point hits around 79; that is when her earnings by claiming at full retirement age would be equal to the earnings if she claimed the lower amount at 62. So for Lucy, if she believes she will live past 79, it might be wise to hold off on claiming her benefits.

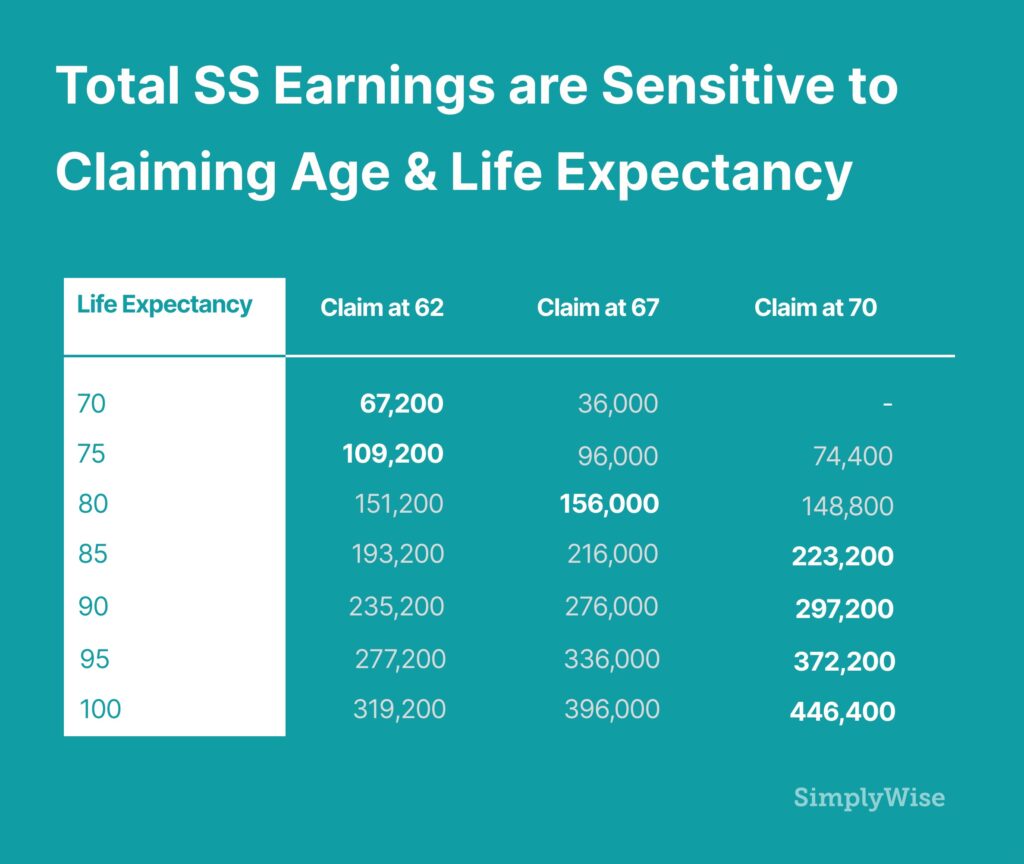

Below, you can see how total Social Security earnings are sensitive to claiming age and life expectancy. For those living past 85, it can make sense to postpone claiming until age 70, when monthly benefits will be maximized.

As mentioned above, however, other factors like plans to work and taxes may also enter the equation. Additionally, if Lucy were to make investment income off of her Social Security benefit income, this could alter her decision. And, of course, if you believe that the Social Security program could go broke, you might be encouraged to claim earlier.

Spousal benefits

Age plays a significant role in decisions for maximizing benefits for married couples. If you are a spouse and you claim benefits at age 62, your benefit will be reduced from 50 percent of your partner’s benefit to 34.2 percent. The same rules apply to spousal benefits for divorced spouses. If your spouse has the larger income, and they die before reaching the age of 62, you are entitled to apply for survivor benefits as of age 60, or 50 if you are disabled.

If you receive survivor benefits at age 60, you will receive 71.5 percent of the deceased worker’s full benefits. However, if you are also entitled to your own retirement benefit, and it is more than your survivor benefit would be, you may apply for your survivor benefit and use that until after Full Retirement Age or age 70, when your own benefit will have accrued to its highest dollar amount. The amount of each benefit and the number of months you receive it will determine what is the best strategy.

If you want to apply for Social Security benefits at age 62, the best way to apply is online. You must be at least 61 years and 9 months old to apply for retirement benefits, though if you are already age 62, you may be able to start your benefits in the month you apply. Benefits are paid the month after they are due, so if your benefit starts in June, you will receive it in July.

Disability benefits

If you are receiving Social Security disability benefits, they will automatically change to retirement benefits when you reach Full Retirement Age.

Takeaways

In 2019, an estimated 64 million Americans collected Social Security benefits, and 61% of Americans aged 60 to 70 view Social Security as an “extremely important” source of income. Nevertheless, a great deal of confusion exists around the rules and this often causes people to miss out on much needed money. Knowing how age impacts Social Security is important, but it is but a first step on a journey of education.

Increasingly, online blogs and free Social Security benefits calculators are emerging to help people avoid costly mistakes (we believe the SimplyWise Calculator is the best). Hopefully, with better education around the topic, Americans can maximize what they’ve earned.