September 2020

The current public heath, economic, and political reality in the United States has created enormous uncertainty for many Americans. A majority of citizens lack the savings to last them even three months. That savings gap is even more drastic when it comes to retirement. Indeed, the pandemic has wrought havoc on the retirement plans of many, driving some into early retirement and forcing others to postpone long-anticipated retirement plans. A majority of people today are more concerned than ever about retirement. According to the September 2020 SimplyWise Retirement Confidence Index, 58% of Americans are more concerned about retirement today compared to a year ago. The bi-monthly study polled 1,154 Americans ages 18+ between September 8-10, 2020. It explored how people are looking at retirement, Social Security, and savings today, particularly in light of COVID-19.

Key Findings

- 15% of people who lost their job due to COVID-19 are now planning to retire earlier than anticipated—and 1 in 10 people in their 50s and 60s are now planning to retire earlier than expected.

- 58% of people in their 50s are not confident they’ll be able to maintain their same quality of life in retirement.

- 30% of people in their 50s saved $0 for retirement in the last year—and 43% of them couldn’t last more than a month off their savings.

- 27% of Americans are now considering tapping their 401(k)—a pandemic high.

- 45% of Hispanic, 39% of Black and 34% of White Americans couldn’t last a month off their savings.

- 36% of Americans think the economy is going to get worse in the next 6 months. And 51% believe it’s likely the stock market will decline 20% over the next 6 months.

- 63% of Americans feel confident in the future of Social Security if Biden is elected. Only 44% feel confident if Trump is re-elected.

The majority of Americans remain concerned over retirement

Retirement confidence remains low

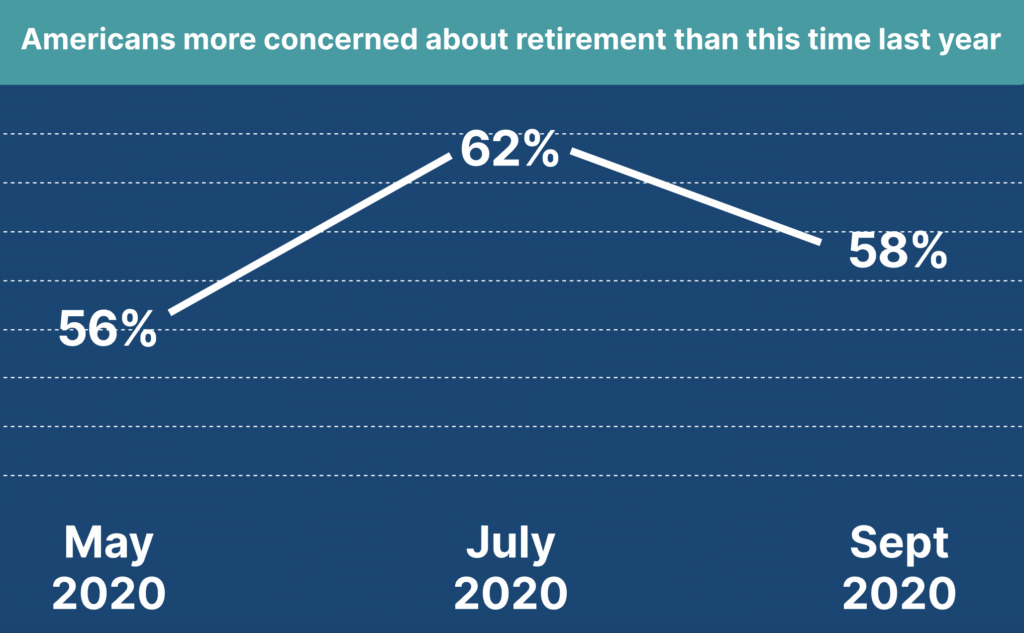

An overwhelming 58% of people are more concerned about retirement today than they were at this time last year. That is compared to the 56% in this year’s May Index and 62% in the July Index who reported being more concerned.

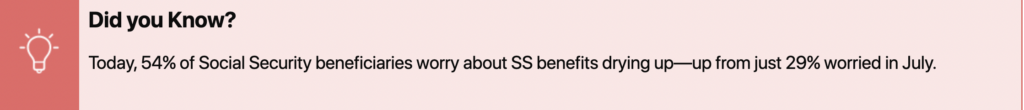

For those not yet claiming Social Security benefits, financial concerns are among the highest anxieties around retirement. Fifty-seven percent worry about Social Security drying up, and 52% worry they will outlive their savings. For Americans who are currently on Social Security, 54% now worry about their benefits drying up—a significant increase from the 29% reported in July. Forty-seven percent are concerned about their ability to pay for medical bills in retirement. Another 47% are concerned about their ability to pay daily living expenses when they retire.

The reported concern was worst for those closest to retirement. For Americans in their 50s, 65% are now worried that Social Security will be dried up by the time they retire. And 50% of them are concerned about paying for daily living expenses in retirement. A full 58% of people in their 50s are not confident they’ll be able to maintain the same quality of life they enjoy today once they begin retirement.

Similar to the results of the May 2020 and July 2020 Indices, the September Index found that 43% of American workers fear they will not be able to retire at all. That number is even higher for younger workers. In fact, 47% of millennials today fear they will be working their whole lives.

State of Work in Retirement

Many Americans nearing retiring age have had their employment or finances upended by the pandemic. Of people in their 50s, 29% are now planning to postpone retirement given the current economic climate. For others, COVID-19 has forced them into early retirement, whether because of health concerns or their employers. Of those who lost their job due to the pandemic, 15% are now planning to retire earlier than they anticipated. Of all Americans in their 50s and 60s, one in ten are now planning to retire earlier than they had anticipated.

For many more, retirement simply won’t mean the end of work. The September Index found that more Americans than ever are planning to work into retirement. Today, 73% of workers plan to work after they claim Social Security retirement benefits. That is up from 67% this May and 72% in July. Plans to delay retirement may be attributed to the fact that only 63% of workers surveyed are making what they made prior to COVID-19.

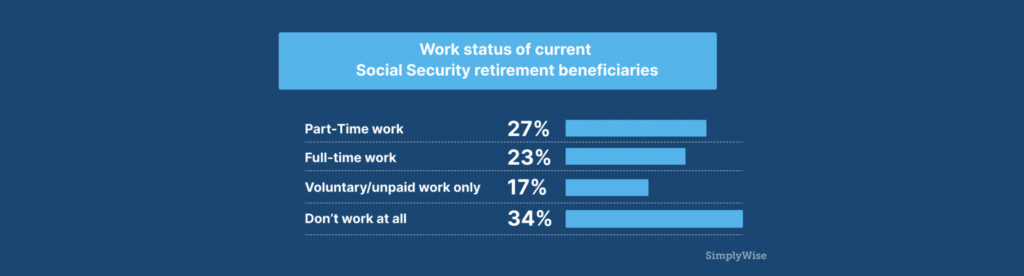

Interestingly, for current Social Security retirement beneficiaries in their 60s and 70s, the numbers look different. Half of our survey respondents who are collecting retirement benefits today and in that age group are working, with the majority working part time.

The number of those working in “retirement” is indeed high. However, the disconnect with the 73% who plan to work and the 50% who are in reality working in retirement could be due to a few factors. For example, this could be yet another indicator of the anxiety of financial planning for retirement. In fact, many people count on having their work income into their 60s and 70s. And yet, health issues or unexpected job losses (like many are facing today) can force one into early retirement.

State of Savings

The September Index found that 30% of Americans saved nothing for retirement in the last year. In fact, the majority (56%) saved under $1,000 in the last year. The results were similar to those of May and July, when one in three Americans saved $0 for retirement.

The savings numbers were even more dismal for older populations. Of Americans in their 50s, 30% saved $0 for retirement in the last year. And 43% of people in their 50s couldn’t last more than a month off their savings. These numbers are particularly troubling; financial advisors recommend saving the most for retirement during your 50s and early 60s. This is because those are often a worker’s peak earning years, and a time when they are eligible to contribute beyond their retirement account’s maximum annual contribution limit.

There was also a gender and racial divide in saving. When asked how long they could afford to not work and live off their savings, 36% of all Americans could not last a month. For men, however, 31% could last just a month compared to 40% of women. For Hispanic and Black Americans, 45% and 39% respectively could last a month off their savings. That is compared to just 34% of White and 32% of Asian Americans.

And for American workers currently furloughed or unemployed due to COVID-19, a stark 45% could not last a month off their savings. And 26% could not last even two weeks off their savings.

Growing Financial Insecurity

Despite the stock market volatility resulting in recent record highs, the reality for most Americans is that the pandemic has ravaged employment opportunities and savings, and created new opportunity for scams and targeted fraud. In fact, 42% of Americans would not be able to come up with $500 cash right now without selling something or taking out a loan. This number is slightly up from the 38% recorded in May and the 40% recorded in July.

That number is also worse for people whose jobs or income have been impacted by the pandemic. While the unemployment rate has fallen sharply, many Americans are still out of work or furloughed. And many more are working but with paycuts compared to their pre-COVID-19 salaries. Our September Index found that of those currently working today, 27% are working at a reduced income level compared to what they made pre-pandemic. For workers furloughed or let go due to COVID-19, 63% could not come up with $500 cash today. That is up from 56% in July. And it is compared to just 30% of people who currently work today who could not come up with that money.

For many, the “rainy day” for which they set aside emergency savings has arrived. Given the economic climate, 12% of respondents are now planning to withdraw from their emergency savings. For those let go due to the coronavirus pandemic, 24% are planning to withdraw from emergency savings.

Yet even more Americans are planning to tap their retirement savings. Fourteen percent said they plan to dig into their retirement accounts. While financial advisors encourage those in their 50s to be saving at maximum levels to “catch up” on their retirement savings, our survey found that a high of 13% in that age group are instead withdrawing from those savings to pay the bills today.

Even more are planning to specifically tap their 401(k). A pandemic high of 27% of Americans in September reported that they are planning early withdrawal of their 401(k). Again, there was a racial divide in plans to tap 401(k)s. Of Black Americans, 40% are planning to withdraw, compared to 28% of Hispanic Americans and just 18% of White Americans.

For those laid off due to the coronavirus, a record 49% are considering tapping their 401(k). That is compared to 39% in July. Current financial pressures have pushed these minority groups—who typically have smaller nest eggs than White Americans—as well as recently laid off workers to need to deplete their future savings further.

Increases in turning to these long-term savings accounts may be due to coronavirus-related legislation facilitating retirement withdrawals. Normally, withdrawing from your 401(k) or other retirement account before you are 59 ½ years old means a 10% penalty on the amount taken. The CARES Act, however, waives that 10% penalty on withdrawals up to $100,000 for distributions made to an individual throughout 2020. However, it does essentially mean borrowing from your future self, as the cash you take out won’t have the opportunity to grow and compound over time.

Perhaps for that reason, many are looking to other assets to pay the bills right now. For example, as in the May and July surveys, one in ten are now considering selling their home. Another 10% are looking to refinance their mortgage. Of Social Security beneficiaries, many of whom are dependent on their fixed income and retirement portfolios, 13% are now considering selling their home to cover expenses. Another 14% of beneficiaries are considering refinancing their home to cover expenses today.

While the pandemic has squeezed many Americans, quarantining measures have accelerated the adoption of online banking and financial services. Many people are downloading their bank’s apps for the first time, and are taking advantage of features like auto-savings that remove any of the stress or physical work involved in saving. In fact, 42% of all Americans say they are now taking care of “much more” of their banking online compared to the start of the pandemic. The results are evenly split across age groups; all Americans are being driven by today’s crisis and stay-at-home policies to handle more of their finances on their computers and phones.

Of course, handling finances online can go far beyond one’s own bank or credit card sites and apps. A number of financial technology (“fintech”) websites and applications have gained popularity in recent years. These services range from allowing the buying and selling of stocks online, to sending money securely over the internet to family, friends, or merchants. Indeed, these apps and services represent an opportunity, especially in today’s crisis, for people to better budget, renegotiate bills, cancel unwanted subscriptions, and find discounts and deals on everyday expenses.

Concern for the future of Social Security

While the U.S. economy is officially in a recession as of February 2020, it has gradually been recovering, with slight improvements across various indicators like consumer spending. Yet for many Americans, the real recession is yet to come. In fact, our July Index found that 72% believe it is likely the recession will continue into the next year. The September Index revealed that 36% of Americans believe the economy will get worse in the next 6 months, where just 28% believe it will get better. Economic outlook was, however, divided along party lines. Of Democrats, 43% believe the economy will get worse, where 43% of Republicans believe it will get better.

Results looked similar when respondents were asked about their expected outlook for the stock market. Over half of Americans believe it is likely the market will decline 20% in the next six months. In fact, only 5% of respondents said they believe it is very unlikely that the market declines in the coming months. Again, Democrats were more pessimistic on the economy; 63% believe it is likely the market will decline 20% in the next 6 months, versus just 38% of Republicans.

The economic outlook, divided along political lines, carries over into concern for the future of government programs, particularly Social Security. In fact, the Social Security Board of Trustees reported earlier this year that its funds will be depleted by 2035. That does not mean Social Security will end at that time. It does, however, mean that its cash reserves will be gone, and it will only be able to dole out what it collects in taxes each year. If that happens, according to the Trustees, the Administration will only be able to pay beneficiaries 79% of the money they are owed. Its reserves are running out due to demographic trends. Generation X (the generation behind Baby Boomers) is much smaller than the Boomers swelling the ranks of retirement beneficiaries. Translated: there are less workers paying in taxes to fund those benefits. Therefore, current tax revenues won’t cover benefits and Social Security will have to tap the surplus.

Moreover, in August, President Trump signed an executive memorandum to defer the collection of the payroll taxes that workers pay to help fund Social Security. The order was meant to ease the burden on workers. However, our September study found that 86% of Americans are concerned that the payroll tax will hurt Social Security in the long term.

Coupled with the current unemployment level and the upcoming presidential election, it’s hard for many Americans to imagine what the future of Social Security and retirement will look like. Many feel their benefits are dependent on the outcome of the November vote. If Biden is elected, 63% of Americans say they feel confident in the future of the program, versus 44% if Trump is re-elected. Twenty-two percent of Americans say they are “not at all confident” in its future if Biden is elected, versus 38% feel “not at all confident” if Trump is elected.

As with the economy, results were divided by political party—most starkly amongst seniors. Of all senior citizens (defined here as age 60+), 59% feel confident in the future of Social Security if Biden is elected, and 43% feel confident if Trump is elected. However, for Democratic seniors, just 11% are confident if Trump wins, versus an incredible 95% who feel confident if Biden wins. Almost in exact reverse, for Republican seniors, 81% feel confident if Trump wins, and just 13% feel confident if Biden wins. The sharp divide on economic outlook and Social Security could be an important factor in this November’s election.

Social Security office closures due to COVID-19

All local Social Security offices are closed due to COVID-19 as of March 17, 2020. This policy is meant to protect both the vulnerable individuals they serve as well as the Social Security Administration (SSA) employees. However, in-person visits can be scheduled (by appointment only) for “dire need situations,” according to the SSA. Services normally available by phone or online remain in operation.

We break down, by state, the latest COVID-specific information for local offices:

Takeaways

More than six months since the COVID-19 pandemic sent towns and cities across the U.S. into lockdown, the pandemic continues to change the way we live our lives. With the presidential election mere weeks away, uncertainty continues to loom over the nation. Pandemic-era policies are working to ease some of this burden on citizens and businesses impacted by the virus. Yet these new rules and regulations can be confusing to navigate.

While things continue to change every day, many Americans are struggling to think about and save for any kind of future. This is especially true for the many in their 50s and 60s who have had retirement goals and plans upended by the virus. Yet today’s insecurity is in fact why it is more important than ever to continue to put aside what you can while understanding what you’re owed from Social Security. “Navigating these uncertain times for ourselves and our families requires staying educated about the changing regulations and your options for saving and retirement today,” says SimplyWise CEO Sam Abbas. Americans who are not yet retired but whose finances have been impacted by the pandemic can use this time to review their expenses. Determine how much cash will be needed in retirement and make any necessary adjustments to savings and portfolio asset allocations. For those who are eligible but not yet on Social Security, it is a good time to consider how to maximize your benefits. You can use a Social Security calculator to determine any earned, spousal or survivor benefits for which you’re eligible.

The COVID-19 pandemic has altered so much about the way we live, work, and think about the future. While things change, educating yourself and staying aware and informed is key to ensuring your life and future planning stay on track.