Knowing what you’re owed can help you to plan for retirement as well as maximize your own benefits. However, figuring out that number can be confusing. The average Social Security retirement benefit is $1,514 in 2020. But that number can vary greatly, going up to $3,790 per month. It largely depends on your personal lifetime earnings or that of your spouse (or ex), as well as when you claim.

So if you’ve ever asked “How is Social Security calculated?” this is the guide for you. Read on to see how the Social Security Administration calculates those earned, spousal and survivor benefits.

How is Social Security calculated for retirement?

Retirement benefits (or “earned benefits”) are based on a worker’s earnings, and the age that they decide to claim.

The Social Security Administration bases those benefits on the highest 35 years of a worker’s salary history. (If someone worked less than 35 years, all of their working years will be used.) The maximum amount of earnings a worker can use toward Social Security changes every year. In 2020, that maximum is $137,700.

That 35-year total is divided by 12 to reach the “average indexed monthly earnings” (AIME). That AIME figure is then used in a formula. In 2020, to calculate your benefits, you multiply the first $960 of average indexed monthly earnings by 90%, and the remaining earnings up to $5,785 by 32%. Any earnings over $5,785 are multiplied by 15%. The sum of those amounts if your primary insurance amount (PIA).

Your PIA is what your monthly benefit would be if you started collecting Social Security at your full retirement age (FRA). Your full retirement age is calculated based on your birth year:

If the person claiming spousal benefits did not work, the Social Security Administration calculates half of their ex’s PIA. They then adjust it (between 32.5% and 50%) based on the age of the claiming spouse.

If both spouses worked, then the Social Security Administration first pays out benefits based on the earnings record of the personal claiming spousal benefits. Then, any spousal benefit is layered on top of that, to total up to half of the higher-earning spouse’s PIA. If the primary insurance amount of the spouse seeking to claim spousal benefits is greater than half of their spouse’s primary insurance amount, they are not entitled to a spousal benefit. So take as an example a divorced couple where the lower-earning person’s PIA is $1,100, and the higher-earning person’s PIA is $2,000. Because the $2,000 PIA is greater than half of the lower-earning ex’s PIA, the lower earning person will not receive a spousal benefit.

If the person claiming benefits continues to work while receiving benefits, the retirement benefit earnings limit still applies until your full retirement age. If you also receive a pension based on work not covered by Social Security, such as government work, your Social Security benefit on your ex-spouse’s record may be affected.

The major difference with spousal benefits if you are divorced is that your ex-spouse doesn’t have to file for retirement benefits for you to be able to collect spousal benefits. That means you can claim spousal benefits as long as both you and your ex are at least 62 years old.

How are Social Security survivor benefits calculated for widows and widowers?

If someone’s spouse or ex-spouse dies and had earned benefits higher than the living spouse, then that “survivor” may be eligible for survivors benefits.

How much someone receives in survivor benefits depends on the lifetime earnings of the deceased worker and whether they claimed Social Security before they passed. If the deceased hadn’t yet claimed Social Security benefits, their survivor(s) could be eligible for a percentage of the benefit the deceased would have received at full retirement age. If the deceased did not claim benefits and lived past their full retirement age, the survivors benefit will be higher because the deceased would have earned delayed retirement credits.

However, if the deceased had started benefits before their death, their survivors will receive a percentage of the actual benefit the deceased worker received. How much they will receive varies depending on exactly what age the deceased claimed their benefits.

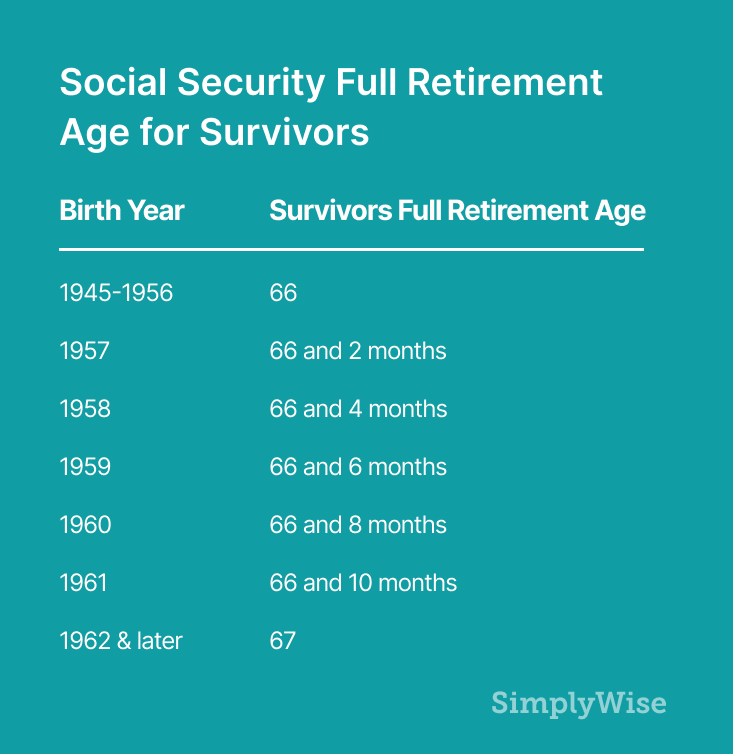

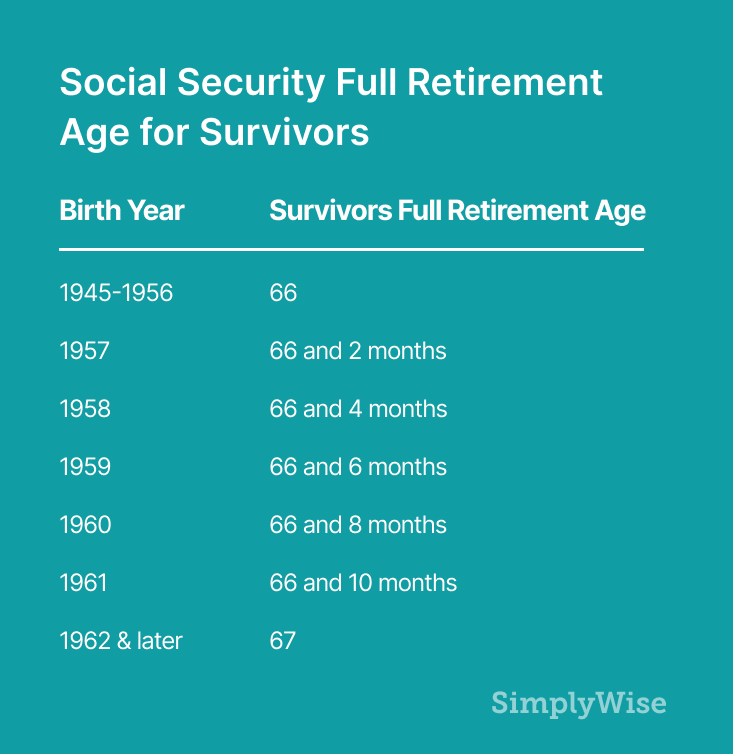

Moreover, if a survivor claims this benefit before their survivors full retirement age, the benefits are reduced by a percentage based on their birth year. (See the survivors full retirement age by birth year below. Note that survivor benefits have a different full retirement age than other Social Security benefits.)

The precise percentage of benefits a survivor receives is as follows:

- A widow, widower or eligible divorced spouse, at survivors full retirement age or older: 100%

- A widow, widower, or eligible divorced spouse, age 60+, but younger than survivors full retirement age: 71% to 99%

- A disabled widow, widower, or eligible divorced spouse, aged 50-59: 71.5%

- A widow, widower, or eligible divorced spouse, any age, with a child younger than age 16, or a disabled child: 75%

- An unmarried child younger than age 18 (or 19 if in high school): 75%

- Dependent parents, aged 62+: 82.5% for one surviving parent; 75% each for two surviving parents

Knowing what you’re owed can help you to plan for retirement as well as maximize your own benefits. However, figuring out that number can be confusing. The average Social Security retirement benefit is $1,514 in 2020. But that number can vary greatly, going up to $3,790 per month. It largely depends on your personal lifetime earnings or that of your spouse (or ex), as well as when you claim.

So if you’ve ever asked “How is Social Security calculated?” this is the guide for you. Read on to see how the Social Security Administration calculates those earned, spousal and survivor benefits.

How is Social Security calculated for retirement?

Retirement benefits (or “earned benefits”) are based on a worker’s earnings, and the age that they decide to claim.

The Social Security Administration bases those benefits on the highest 35 years of a worker’s salary history. (If someone worked less than 35 years, all of their working years will be used.) The maximum amount of earnings a worker can use toward Social Security changes every year. In 2020, that maximum is $137,700.

That 35-year total is divided by 12 to reach the “average indexed monthly earnings” (AIME). That AIME figure is then used in a formula. In 2020, to calculate your benefits, you multiply the first $960 of average indexed monthly earnings by 90%, and the remaining earnings up to $5,785 by 32%. Any earnings over $5,785 are multiplied by 15%. The sum of those amounts if your primary insurance amount (PIA).

Your PIA is what your monthly benefit would be if you started collecting Social Security at your full retirement age (FRA). Your full retirement age is calculated based on your birth year:

The other factor that determines your Social Security benefit amount is how old you are when you claim.

You can claim earned benefits as early as age 62, the minimum retirement age. However, if you claim before your full retirement age, your monthly benefits will be lower. If you claim later than full retirement age, your benefits will be higher. Every year you wait to retire after your FRA, your benefits increase 8%.

How are spousal benefits calculated for Social Security for married people?

If someone is married to a worker eligible for Social Security benefits, they may be able to claim spousal benefits based on their worker spouse’s earnings. Social Security spousal benefits are based on the worker spouse’s earnings and the age of the claiming spouse. Note that spousal benefits do not in any way decrease your spouse’s retirement benefit.

To qualify for Social Security spousal benefits:

- Both the higher-earning worker and the claiming spouse must be at least 62

- The couple must have been married for at least one year

- The higher-earning worker spouse must already be receiving their earned benefit

Depending on the age that the spouse claims, the benefits can range between 32.5%-50% of the worker spouse’s primary insurance amount (PIA). (Remember: the PIA is the retirement benefit a worker is eligible for at their full retirement age.) As with earned benefits, you’ll receive less than the full spousal benefit if you decide to claim before your full retirement age. But unlike earned benefits, you don’t receive more if you wait to claim spousal past full retirement age. In fact you’ll actually be forfeiting some money by waiting longer.

If only one spouse worked, then the Social Security Administration calculates half of the worker spouse’s PIA and adjusts it (between 32.5% and 50%) based on the age of the claiming spouse.

If both spouses worked, then the Social Security Administration first pays out benefits on one’s own earnings record. Then, any spousal benefit is layered on top of that, to total up to half of the higher-earning spouse’s PIA. If the primary insurance amount of the spouse seeking to claim spousal benefits is greater than half of their spouse’s primary insurance amount, they are not entitled to a spousal benefit. So take as an example a couple where the lower-earning spouse’s PIA is $1,100, and the higher-earning spouse’s PIA is $2,000. Because the $2,000 PIA is greater than half of the lower-earning spouse’s PIA, the lower earning spouse will not receive a spousal benefit.

Note that there used to be a loophole where a couple could file for earned benefits and spousal benefits separately. However, Congress closed that loophole for anyone born after 1953. Today when you file for benefits, you have to file for all benefits to which you are entitled (this is called “deemed filing”). In other words, if you file for your spousal benefit, you have to file for your earned benefit at the same time, and vice versa. However, there are numerous strategies you can consider when trying to maximize your benefits as a married couple.

How are spousal benefits calculated for Social Security if you are divorced?

If someone is divorced from a worker eligible for Social Security benefits, they may be able to claim spousal benefits based on their ex-spouse’s earnings. Social Security spousal benefits for exes are based on that worker spouse’s earnings and the age of the claiming spouse. Note that spousal benefits do not in any way decrease your ex’s own retirement benefits.

To qualify for Social Security spousal benefits as a divorced spouse:

- The marriage must have lasted at least 10 consecutive years

- The applicant and the worker must be at least 62 years old

- The worker spouse must be eligible for retirement benefits

Depending on the age that the spouse claims, the benefits can range between 32.5%-50% of the ex-spouse’s primary insurance amount (PIA). (Remember: the PIA is the retirement benefit a worker is eligible for at their full retirement age.) As with earned benefits, you’ll receive less than the full spousal benefit if you decide to claim before your own full retirement age. But unlike earned benefits, you don’t receive more if you wait to claim spousal benefits after reaching full retirement age. In fact you’ll actually be forfeiting some money by waiting longer.

If the person claiming spousal benefits did not work, the Social Security Administration calculates half of their ex’s PIA. They then adjust it (between 32.5% and 50%) based on the age of the claiming spouse.

If both spouses worked, then the Social Security Administration first pays out benefits based on the earnings record of the personal claiming spousal benefits. Then, any spousal benefit is layered on top of that, to total up to half of the higher-earning spouse’s PIA. If the primary insurance amount of the spouse seeking to claim spousal benefits is greater than half of their spouse’s primary insurance amount, they are not entitled to a spousal benefit. So take as an example a divorced couple where the lower-earning person’s PIA is $1,100, and the higher-earning person’s PIA is $2,000. Because the $2,000 PIA is greater than half of the lower-earning ex’s PIA, the lower earning person will not receive a spousal benefit.

If the person claiming benefits continues to work while receiving benefits, the retirement benefit earnings limit still applies until your full retirement age. If you also receive a pension based on work not covered by Social Security, such as government work, your Social Security benefit on your ex-spouse’s record may be affected.

The major difference with spousal benefits if you are divorced is that your ex-spouse doesn’t have to file for retirement benefits for you to be able to collect spousal benefits. That means you can claim spousal benefits as long as both you and your ex are at least 62 years old.

How are Social Security survivor benefits calculated for widows and widowers?

If someone’s spouse or ex-spouse dies and had earned benefits higher than the living spouse, then that “survivor” may be eligible for survivors benefits.

How much someone receives in survivor benefits depends on the lifetime earnings of the deceased worker and whether they claimed Social Security before they passed. If the deceased hadn’t yet claimed Social Security benefits, their survivor(s) could be eligible for a percentage of the benefit the deceased would have received at full retirement age. If the deceased did not claim benefits and lived past their full retirement age, the survivors benefit will be higher because the deceased would have earned delayed retirement credits.

However, if the deceased had started benefits before their death, their survivors will receive a percentage of the actual benefit the deceased worker received. How much they will receive varies depending on exactly what age the deceased claimed their benefits.

Moreover, if a survivor claims this benefit before their survivors full retirement age, the benefits are reduced by a percentage based on their birth year. (See the survivors full retirement age by birth year below. Note that survivor benefits have a different full retirement age than other Social Security benefits.)

The precise percentage of benefits a survivor receives is as follows:

- A widow, widower or eligible divorced spouse, at survivors full retirement age or older: 100%

- A widow, widower, or eligible divorced spouse, age 60+, but younger than survivors full retirement age: 71% to 99%

- A disabled widow, widower, or eligible divorced spouse, aged 50-59: 71.5%

- A widow, widower, or eligible divorced spouse, any age, with a child younger than age 16, or a disabled child: 75%

- An unmarried child younger than age 18 (or 19 if in high school): 75%

- Dependent parents, aged 62+: 82.5% for one surviving parent; 75% each for two surviving parents