It may seem logical that if you never worked — and therefore never paid into Social Security — that you would not be eligible to receive Social Security benefits. Well, that’s not the case. In fact, there are several different scenarios in which a person can receive Social Security benefits without ever having paid into the system, or even worked, for that matter.

Among the people eligible for Social Security without having worked are spouses and former spouses of people who are eligible for benefits, and survivors of beneficiaries along with their qualified children.

Retirement, disability or survivors benefits: Which do you qualify for?

Let’s start with retirement benefits and how a spouse or ex-spouse who has never worked can qualify for them. To claim Social Security spousal benefits, you’ll need to meet certain criteria, including being at least age 62 in most cases. Your spouse or ex-spouse also must be living. Keep in mind that the criteria for spousal benefits varies depending on whether you’re married or divorced.

Currently married

If you’re married, your spouse must already be collecting his or her Social Security benefits in order for you to claim spousal benefits.

To qualify for spousal benefits you must:

- Have an earned benefit that is lower than your potential spousal benefit

- Be married for at least one year

- Be age 62 or taking care of a child who is age 16 or younger or disabled, who is the child of your spouse and who is also receiving Social Security benefits based on the spouse’s work record

Divorced

If you’re divorced, your benefits aren’t connected, so you can claim spousal benefits even if your ex isn’t collecting Social Security yet and you do not need the consent of your ex-spouse. Both of you, however, must be at least age 62. If you’ve been divorced more than once, your benefit can be based on your highest-earning spouse if that marriage meets the qualifications.

To qualify for spousal benefits you must:

- Have been married to the relevant ex-spouse for at least 10 years

- Have been divorced for two years before you claim

- Be age 62 or older (the same goes for your ex-spouse)

- Be unmarried (your ex, however, can be remarried)

Your age matters

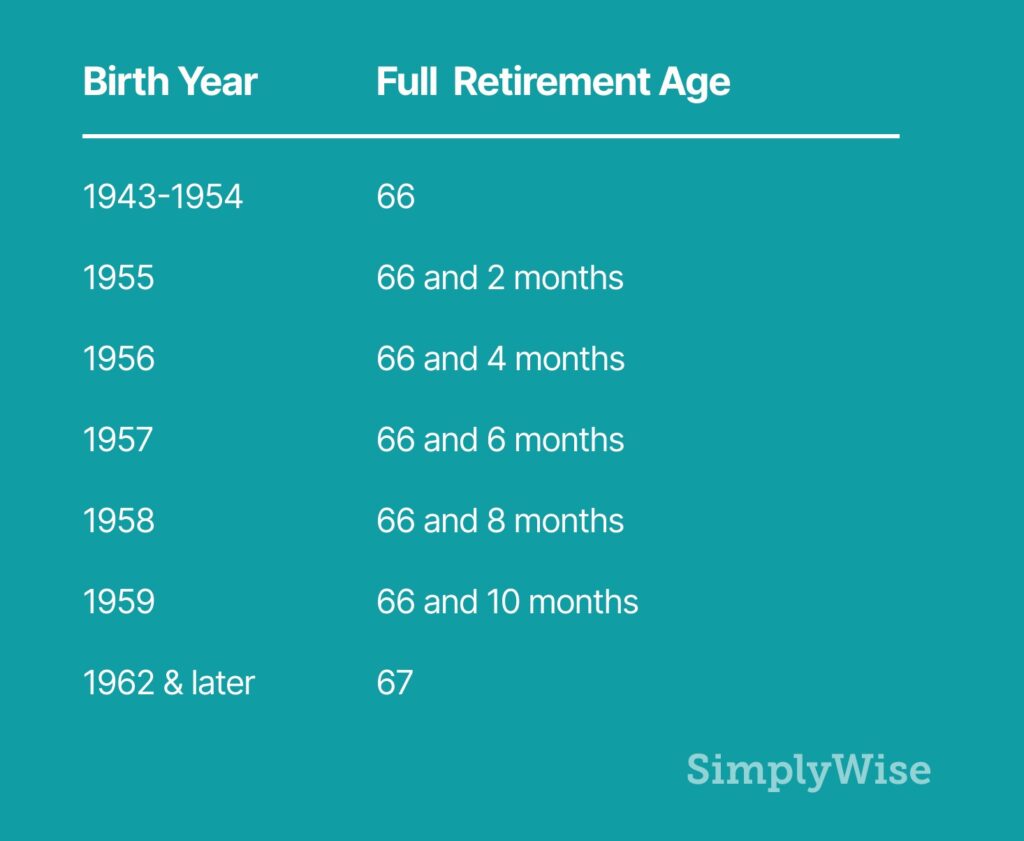

There are many variables regarding how and when you can apply for a spousal benefit, but one of the most important things to keep in mind is that spousal benefits are reduced for each month before your full retirement age that you begin receiving benefits. Your full retirement age is based on your birth year:

So if you claim at age 62, your earliest opportunity, you could receive as little as 32.5% of your spouse’s primary insurance amount, or PIA. That permanently reduces your spousal benefits. If your spouse also took his or her Social Security benefits early, your survivor benefits (those you can claim if your spouse dies) also will be permanently reduced.

When you reach full retirement age, you are eligible for 50% of your spouse’s PIA. The Social Security Administration offers a calculator to figure out the size of your spousal benefits depending on when you claim them.

Also keep in mind that spousal benefits don’t grow after full retirement age. Unlike earned benefits, which grow 8% every year between your full retirement age and age 70, your spousal benefit does not increase once you’ve reached full retirement age.

How disability benefits differ

Social Security Disability Insurance (SSDI) benefits are for people who are eligible for Social Security retirement benefits, but became disabled before they reached full retirement age. When a beneficiary begins to receive disability benefits, certain members of their family may also qualify for benefits, including:

- spouse

- divorced spouse

- children

- disabled children, and

- adult children disabled before age 22.

Keep in mind that any family members who may apply for these benefits will need to provide a Social Security number and possibly their birth certificate in order to prove their qualification.

According to the Social Security Administration website, “each family member may be eligible for a monthly benefit of up to 50 percent of your disability benefit amount. However, there is a limit to the amount we can pay your family.

“The total depends on your benefit amount and the number of family members who also qualify on your record. The total varies, but generally the total amount you and your family can receive is between 150 and 180 percent of your disability benefit.

“If the sum of the benefits payable on your account is greater than the family limit, the benefits to the family members will be reduced proportionately. Your benefit will not be affected.”

Survivors benefits

Social Security survivors benefits are available to spouses, ex-spouses, children and dependent parents of someone who worked and paid into the Social Security system. The amount of the benefits depends on the beneficiary’s age and relationship to the worker, as well as the lifetime earnings of the worker who died. The more the deceased worker earned, the higher the benefits will be.

There are many differences between spousal benefits and survivor benefits, but the simplest distinction is that spousal benefits are those you receive while your spouse is alive while survivors benefits are based on a deceased worker’s earnings.

If you are already receiving spousal benefits and your spouse dies, the Social Security Administration will automatically convert your benefits to survivors benefits after the death is reported to the office. You can’t receive both at the same time.

In some cases, the Social Security Administration may pay survivor benefits retroactively. Those situations include:

- Spouses younger than full retirement age who file for survivor benefits within one month of a spouse or ex-spouse’s death can receive one month of retroactive benefits.

- Widows or widowers who wait to file after they reach full retirement age can receive up to six months of retroactive benefits back to the month they reached full retirement age.

- Disabled widows and widowers who file before age 61 are eligible for up to 12 months of retroactive survivor benefits.

How long do benefits last?

Surviving spouses and divorced spouses receive survivors benefits until their death. Benefits for children who aren’t disabled end at age 18 or 19. Disabled children can continue to receive survivors benefits for life.

Just as Social Security retirement benefits aim to ensure workers can live a dignified life after they stop working, survivors benefits can provide stability and support to the family of a worker after he or she dies. The benefit can help give workers and their families a little bit of peace of mind both before and after a loss.