For many people, especially those on a tight budget, the idea of applying for Social Security earned benefits or spousal benefits as early as age 62 can be very exciting. Being able to count on an extra $1,000 or more in income each month can make a huge difference in their financial lives. While it’s true you can apply for Social Security benefits as early as 62, it’s a good idea to sit down with a calculator—or even a financial planning expert—to look at all the factors. Frequently, the economic benefits of holding off on receiving those benefits are well worth the wait.

How your Social Security benefit is calculated

To qualify for Social Security earned benefits, you must have earned 40 credits during your working life. A credit is equal to a certain amount of earnings—in 2020 one credit is equal to $1,410 in earnings. You can earn up to four credits per year. So if you earn up to $5,640 a year for 10 years, you are eligible to receive SS benefits. Over the years, the amount you must earn to receive a credit has increased as wages have increased. Prior to 1978, for example, you had to earn $400 a year to qualify for four work credits.

Earning 40 credits means you’re eligible for SS retirement benefits, but that does not determine the amount you are eligible to receive. That amount is based on your lifetime earnings. The Social Security Administration adjusts or “indexes” your actual earnings to account for changes in average wages since the year the earnings were received. Your average indexed monthly earnings (AIME) during the 35 years in which you earned the most are then calculated, and a formula is applied to these earnings, arriving at your basic benefit, or “primary insurance amount” or PIA. This is how much you would receive at your Full Retirement Age — 65 or older, depending on your date of birth.

In 2020, that formula is:

- 90 percent of the first $960 of your AIME;

- plus 32 percent of any amount over $960 up to $5,785;

- plus 15 percent of any amount over $5,785.

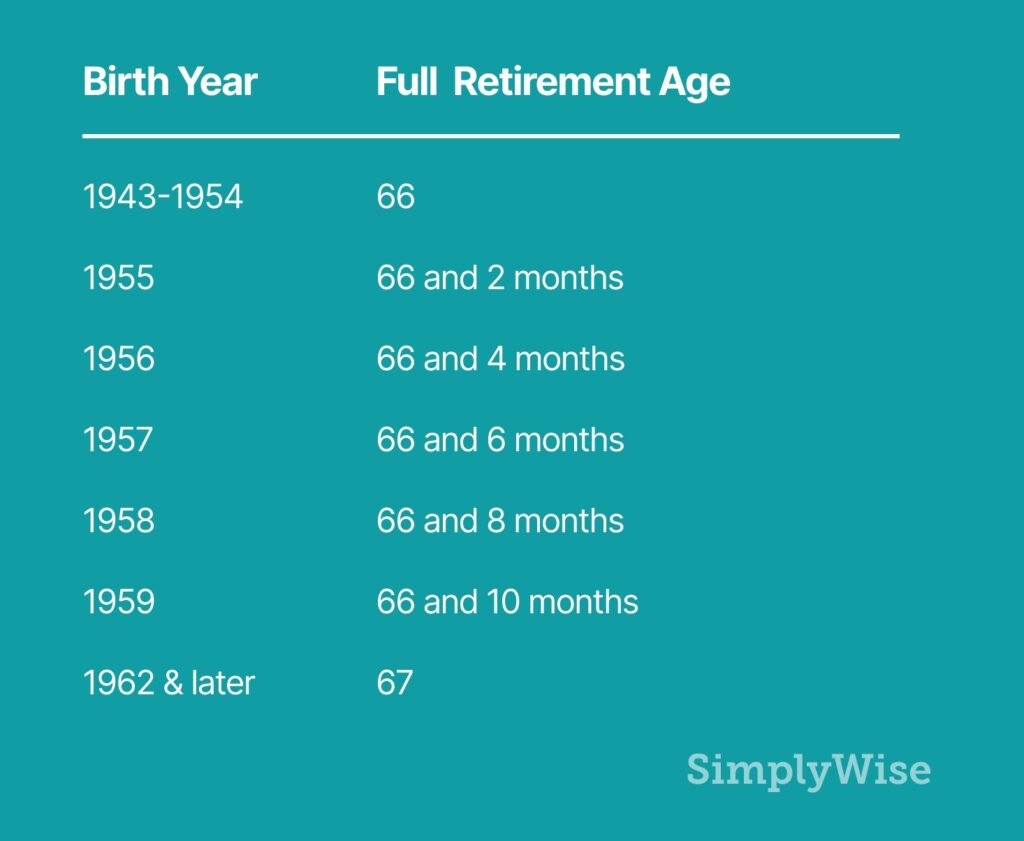

Keep in mind that this formula only counts the amount you earned up to the maximum taxable earnings. In 2020, that amount is $137,700. Also, take note that these figures provide the amount you should receive at full retirement. For those born after 1960, Full Retirement Age is 67. For those born between 1954 and 1960, Full Retirement Age is 66 and some months, depending on your birthday.

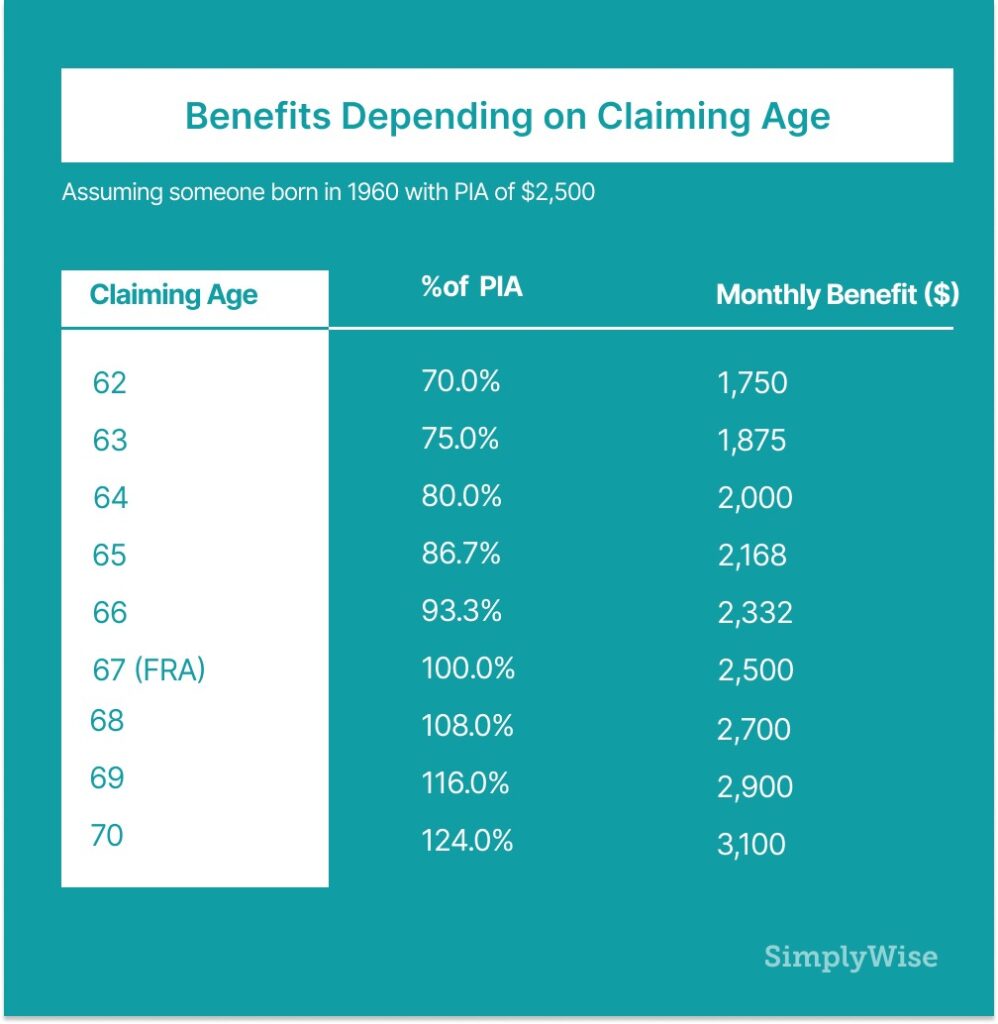

Age has a large impact on Social Security benefits. At full retirement you receive 100 percent of your PIA. But if you opt to take your benefits earlier than that, the amount will be less. For example, filing at age 62 reduces the amount you would receive by about 30 percent. The closer you are to Full Retirement Age when you file for benefits, the smaller the reduction in your benefits. But if you can wait until after Full Retirement Age, up to age 70, the amount of your benefit continues to increase.

Because of delayed retirement credits, which add 8 percent per year between Full Retirement Age and age 70, you could actually bring in 124 percent of your PIA. This is very important because, for many people, the amount they receive when they file for benefits will be frozen at that level for the rest of their lives. If you file at age 62, you’ll receive about 30 percent less in each check for the rest of your life than you would have received if you filed at Full Retirement Age. For example, let’s say your PIA is $1,500 per month, which is about average. That means you would bring in $18,000 per year at full retirement. But if you file at 62, you would lose about 30 percent, so only receive about $12,000 a year from then on.

For someone born in 1960 with a PIA of $2,500, their benefit depending on claiming age would look as follows:

Working and receiving benefits

The question of when to file for retirement benefits becomes more complicated if you plan to continue working. When you work and receive benefits before Full Retirement Age, you may only earn up to a certain amount before Social Security begins to reduce your benefit. In 2020 you may earn up to $18,240 before any benefits are deducted. But $1 is deducted for every $2 you earn above that earnings limit. So, if you earn $50,000, which is $31,760 above the limit, up to $15,880 will be deducted from your Social Security benefit. The good news is that once you reach Full Retirement Age, Social Security will add that money back onto your benefit. But your benefit amount may still be frozen at 70 percent of PIA and your chance to wait until age 70 when you would receive 124 percent of PIA is lost. In that case, you would have been much better off to wait to apply for benefits.

Another factor that makes a difference in when you should file for benefits is your potential earnings. While many people used to retire in their 60s, these days many people work into their 70s. Since Social Security gauges your benefit on your top 35 earning years, if you file for benefits at age 62 they will base your benefit on previous earning years. But the years after age 62 may be the highest earnings years of your life. Fortunately, Social Security will recalculate your benefit based on those earnings retroactive to January of the year you earned the money. Still your chance to file at age 70 is lost.

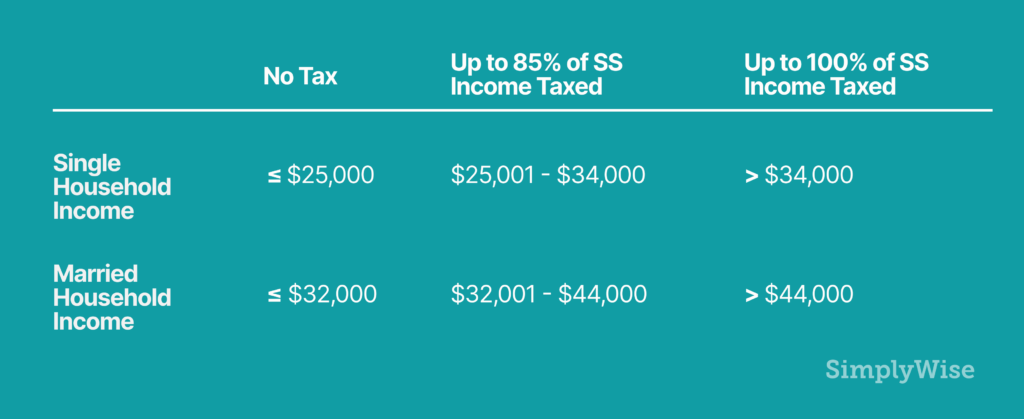

Once you reach Full Retirement Age, you may earn as much as you like and SS will not reduce your benefits. However, you may still be taxed on your earnings.

If you file a federal tax return as an “individual” and your total income is between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Or if your income is above

$34,000, up to 85 percent of your benefits may be taxable.

If you file a joint return, and you and your spouse have a combined income between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Or if It’s above $44,000, up to 85 percent of your benefits may be taxable. Combined income means:

Your adjusted gross income + nontaxable interest + 1/2 of your Social Security benefit

Factoring in life expectancy

Of course, all of these decisions are impacted by how long you will live. If you need the money to live, and do not expect to live much past age 70, it may be unwise to wait to take benefits.

Let’s say you that your life expectancy is 82 and your expected PIA at full retirement is $1,500 a month.

If you wait until your Full Retirement Age of 67 to take your benefit, you would receive $18,000 a year, totaling $270,000.

If you opt for early retirement at age 62, you would receive $12,000 a year for 20 years, totaling $240,000.

However, if you wait until age 70 when you will receive 124 percent of your PIA or $22,320 a year, you’ll wind up receiving $267,840 over 12 years. By waiting, you end up receiving almost the same amount of money you would at Full Retirement Age, but you’d also maximize your earnings by continuing to work. So, your standard of living overall may be greatly enhanced.

Takeaways

The rules around working and collecting Social Security are vital for many Americans. With over one in three Americans taking Social Security at 62 and seniors working at historic levels, understanding the effects are as important as ever. Additionally, you can use an online Social Security benefits calculator to help do the math on your own situation.