If you’ve lost a loved one, you may be entitled to Social Security widow benefits on their behalf. Six million family members receive survivor benefits as of 2020, and for many it’s a crucial income following the passing of a spouse or parent. The amount a widow or widower receives is variable and depends on the age that the surviving spouse claims.

In this article, we will help you understand how much you may be entitled to through survivor benefits. For a more comprehensive overview of how they work, see our guide to survivor benefits.

Who is eligible for survivor benefits from Social Security?

To collect survivor benefits as a widow or widower, you must qualify under one of the following rules:

- You are age 60 or older, and married to the deceased for at least 9 months

- Disabled and age 50 or older, and married to the deceased for at least 9 months

- Caring for the deceased spouse’s child who is younger than 16 or disabled

Additionally, minor children, dependent parents age 62 or older, and stepchildren or grandchildren may be eligible survivor benefits.

For a family member of the deceased to be eligible, the worker who died must have paid into the Social Security system during their career. Workers earn up to four credits a year (in 2020, $1,410 in income equals one credit). Once the worker has earned 40 credits, his or her family is fully insured under the program.

Survivor benefits by age and claim date

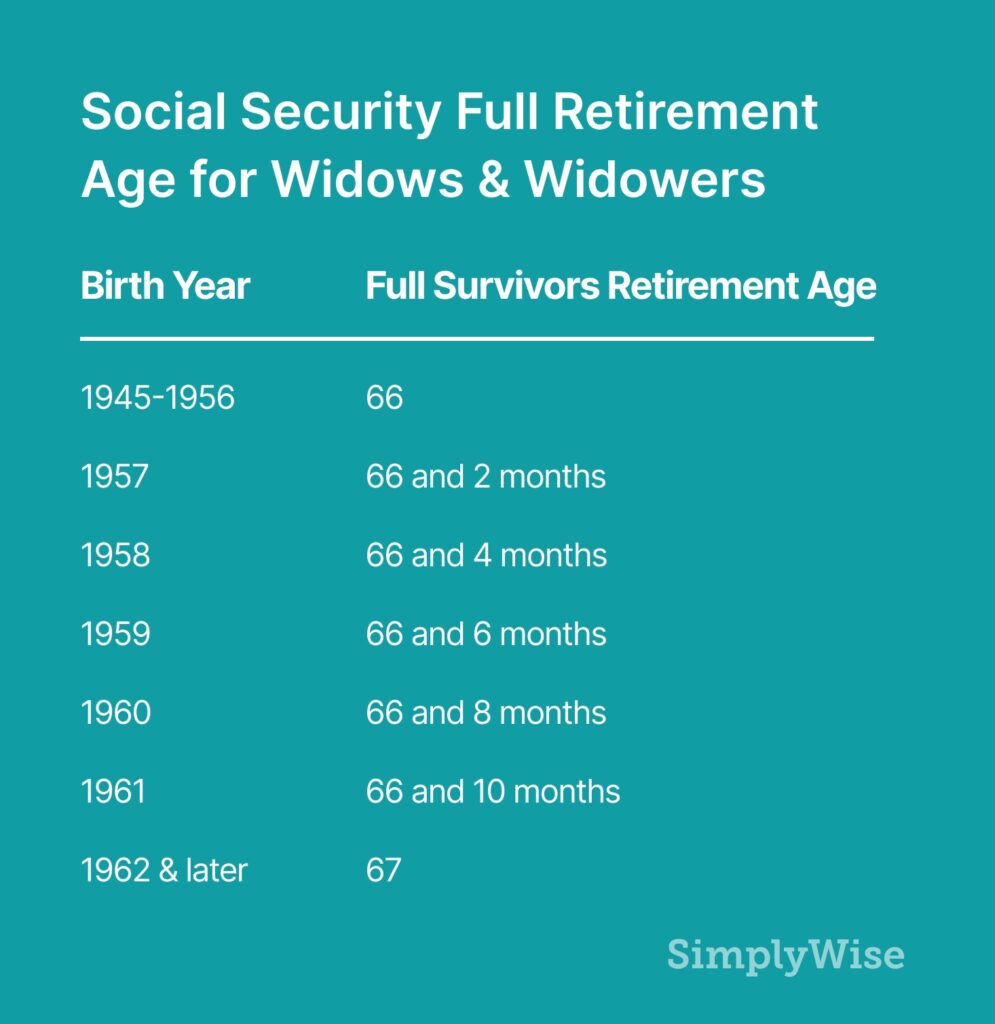

As a surviving spouse, you can receive up to 100% of a deceased spouse’s Social Security benefit but only if wait until your full retirement age (FRA) before collecting. This FRA is slightly different from your typical Social Security FRA, but similarly depends on your birthyear. See the chart below:

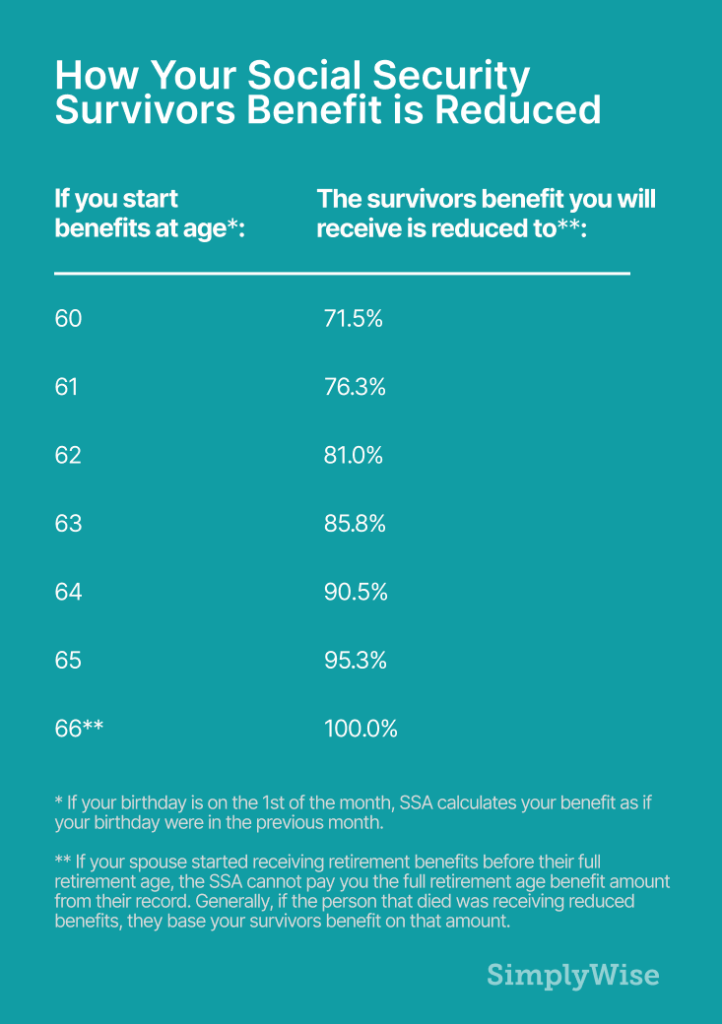

Many widows and widowers choose to claim survivor benefits before they reach their FRA. If you do so, your monthly benefit will be reduced depending on the number of months prior to your FRA that you claim. For someone born in 1955, whose FRA is 66, we show below the percentage of Social Security benefits that a widow would receive:

Note that unlike Social Security earned benefits (what you receive based on your own earnings), there is no incentive to wait until after your FRA to claim. Your survivor benefit will not increase by delaying your claim date further.

Calculating your Social Security widow benefits

Should you one day claim survivor benefits, the amount of your survivor benefit will not simply be added to your other Social Security benefits. Instead, the SSA will compare your earned benefit to your survivor benefit and award you the greater value of the two.

If you choose, you are allowed to claim your own benefit without claiming your survivor benefit, or vice versa. If one is larger than the other, this would allow you to claim the smaller benefit first and let the larger one continue to grow before claiming it. Claiming strategy is critical to maximizing your benefits as a widow or widower. We suggest simulating different scenarios before it’s time to collect your benefits.