Divorce is often the subject of questions we receive, and it is the subject of some of the costliest and most common Social Security mistakes. The following is one such example:

“I am divorced. Can my ex-wife collect on my Social Security benefit and how will this affect the income that I receive?”

In order to respond in full to the question from this user, who we will call Jerry, we will add the full context of his situation:

- Jerry and his ex-wife Ann were both born in 1955 and are now 65 years old; Full Retirement Age for them is 66 and 2 months

- Jerry’s PIA (Primary Insurance Amount; the Social Security benefit he will be eligible for based on his earnings record at Full Retirement Age) is $3,200

- Ann’s PIA is $1,300

- Jerry and Ann divorced five years ago, after 15 years of marriage, and neither has remarried

- Neither Jerry nor Ann have started collecting Social Security retirement benefits

Spousal benefit eligibility for divorced spouses

One out of three seniors believe that divorced spouses cannot collect spousal benefits, but they are wrong. The truth is that eligibility for spousal benefits is quite similar for both divorced and married spouses. In the case of Jerry and Ann, not only is Ann currently eligible to receive spousal benefits, but she is also at an advantage for having been divorced. Let’s analyze.

If you are divorced, the basic conditions you must meet are:

- Have an earned benefit lower than half the other spouse’s PIA

- Have been married to the relevant ex-spouse for at least 10 years

- Have been divorced for at least two years before you claim OR have an ex-spouse already collecting Social Security retirement benefits

- Be unmarried

- Be age 62 or older (the same goes for your ex-spouse)

For Jerry, he isn’t eligible for spousal benefits, since his earned benefit is greater than Ann’s PIA. Ann, however, meets all the criteria: Her earned benefit is lower than her potential spousal benefit (we will cover this in more detail shortly), she was married for over 10 years before the divorce, she remains unmarried and she is older than 62. Importantly, she is actually only eligible to collect spousal benefits now because she got divorced; if the case were the same but she were still married to Jerry, her spousal benefits would not kick in until Jerry claimed his own benefits. But since she is divorced and has been for over two years, she is already eligible.

Calculating Ann’s spousal benefit

The amount that Ann is entitled to receive is based on Jerry’s PIA, Ann’s PIA and when Ann decides to claim Social Security. As we mentioned above, PIA represents the amount that you are eligible to receive in earned Social Security retirement income per month if you claim at Full Retirement Age. The Social Security Administration will multiply your PIA by a factor, depending on when you decide to start collecting Social Security benefit; you can start collecting benefits at 62, but the longer you wait, the more the monthly amount will grow, until you hit 70.

The maximum spousal benefit for Ann would be half of Jerry’s PIA (or earned benefit at Full Retirement Age).

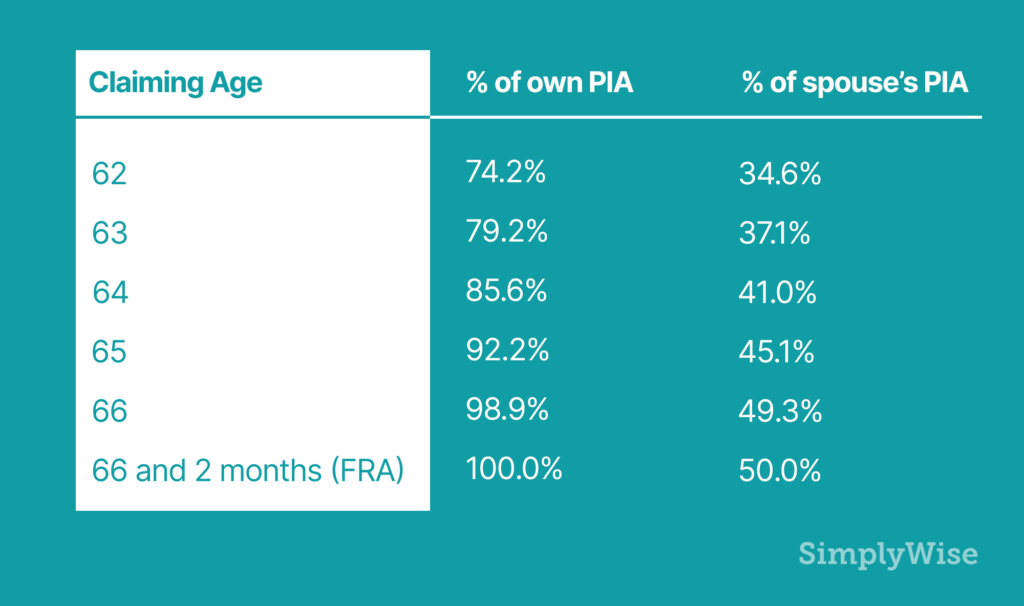

The table below shows how the multiplier works for Social Security earned benefits and spousal benefits for people born in 1955, as both Jerry and Ann were:

Since Jerry and Ann are both 65, they could theoretically start collecting 92.2% of their PIA or 45.1% of their spouse’s benefit. Let’s calculate Ann’s benefit options:

Earned benefit = 92.2% x $1,300 (her PIA) = $1,199

Spousal benefit = 45.1% x $3,200 (Jerry’s PIA) = $1,443

Since her spousal benefit would entitle her to more money, Ann would collect her spousal benefit and receive $1,443 if she started this month.

Claiming strategies and loopholes

There are two commonly cited Social Security spousal benefit loopholes, both of which are either partially or completely closed.

The first was in regards to “deemed filing”, which is the rule that states that when you file for Social Security earned benefits or spousal benefits, you must also file for the other at the same time. There used to be an exception, where if you hit Full Retirement Age and hadn’t claimed any benefits, you could claim just your spousal benefits. However, a 2015 law changed the rules so that anyone born after January 1, 1954 is affected by deemed filing rules even after reaching Full Retirement Age. Not only has Ann not reached Full Retirement Age, but here birthday also disqualifies her from using this strategy.

The second loophole that the law ended was a practice called file and suspend. File and suspend was a popular method used by married couples to get the most out of their Social Security benefits. In that scenario, the higher earning spouse would file for earned retirement benefits when he or she reached Full Retirement Age, but then suspend those benefits. His or her spouse, however, was still allowed to start collecting spousal benefits. Meanwhile, the higher earning spouse would delay taking Social Security for as long as possible to grow their earned benefits. This loophole is entirely closed and would not make sense for divorced couples who aren’t combining income and don’t require that the higher earning spouse claim earned benefits before the other spouse can collect spousal benefits.

For both Ann and Jerry, decisions around when to claim should be based on their expected life spans, earnings expectations and how much they need the money to cover expenses.

Impact of spousal benefit on higher earning ex-spouse

Jerry also inquired about his own benefit and if it would be impacted if Ann were able to collect spousal benefits. The answer is simple: No, there will be no impact. This is also the case for married spouses.

Takeaways

Millions of Americans have paid into the Social Security system. Unfortunately, confusion is common, highlighted by misconceptions around spousal benefits, survivors benefits, taxes on Social Security, maximizing Social Security while working and more. Some of these mistakes can cost recipients upwards of $80,000.

Increasingly, online Social Security blogs and free calculators are emerging to help people avoid costly mistakes (we believe the SimplyWise Calculator is the best). Hopefully, with better education around the topic, Americans can maximize what they’ve earned.