The $2 trillion stimulus package signed into law on March 27 is meant to put cash directly into the pockets of the millions of Americans and businesses who have been impacted by the coronavirus. A record 3.3 million citizens recently filed unemployment claims, shattering the previous all-time high of 695,000 claims in 1982.

The stimulus checks being sent out will provide up to $1,200 for adults and $2,400 for married couples (including Social Security recipients), and $500 per child. While we do not yet know when the checks will arrive, they will go a long way to helping the many who are desperate for cash in the wake of this coronavirus.

Do the stimulus checks go far enough?

The latest SimplyWise survey, conducted March 26 through 28, found that 40% of Americans have had their income impacted (lost or reduced) by the coronavirus. Of those who have lost their jobs due to the virus, 43% are not confident that they will be employed within the next three months. For those still employed, 11% now consider their job “at risk.”

Unfortunately, this lack of confidence and certainty is unsurprising.

Forecasters are expecting millions more jobs to be lost as businesses shutter due to the pandemic. Some economists believe unemployment could rise to 30% next quarter.

This explains the stark results of our survey, which found that 63% of Americans would need another stimulus check within the next 3 months.

For 15% of Americans, another relief check will be needed in just two weeks.

But until we know whether another check is coming, what resources are there for people who are struggling right now?

Paying for basics

Of course, the stimulus checks will be important to meet people’s most immediate needs. And economists and analysts advise the checks be spent on just that: groceries, rent, prescriptions, gas, utilities.

While the majority of those polled who are receiving checks said they would be spending their check on those basic necessities (53%), a good portion of those receiving a check said they will use the money to make late payments on loans and mortgages (17%).

While paying off debt is always critical, many companies and banks have offered to help people impacted by the coronavirus by allowing for late payments on bills and loans. You can find the list of lenders who are allowing people to skip payments here, and companies who are allowing delayed bill payments here.

Filling the gaps during the pandemic

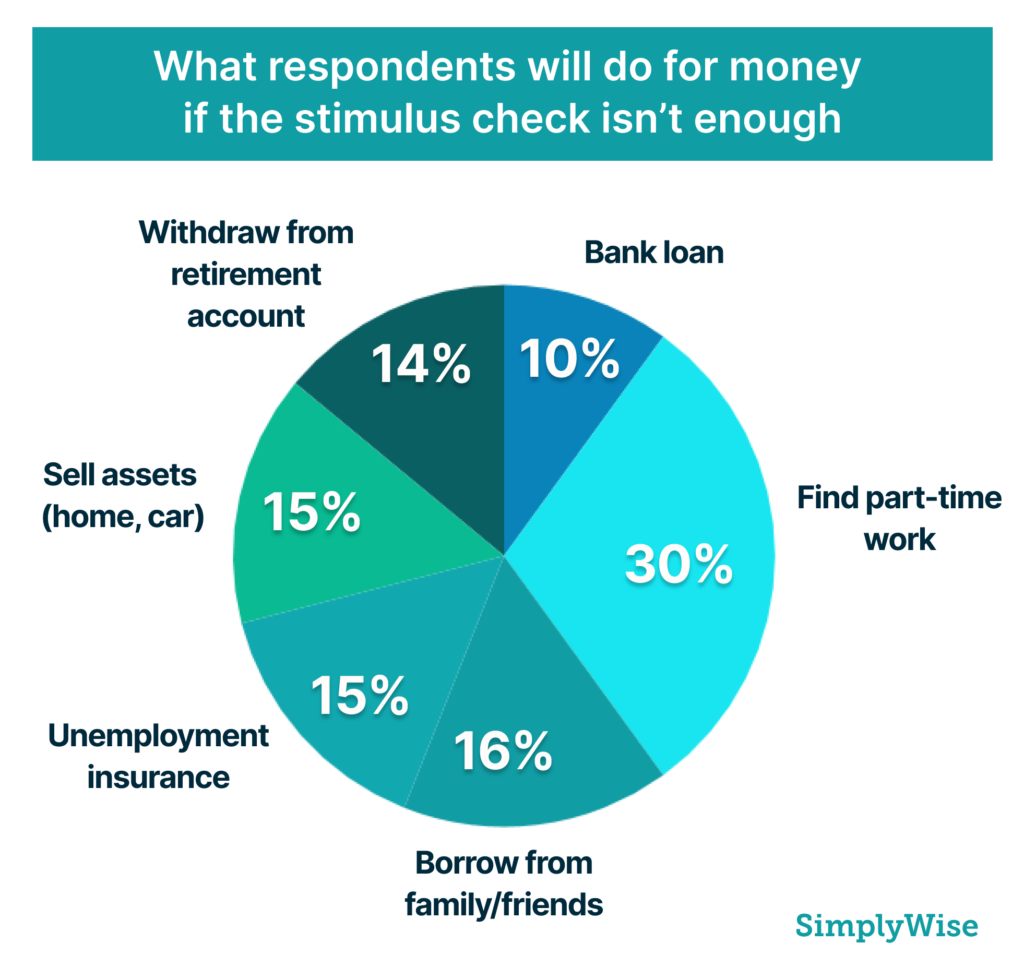

Relief on loans and payments is invaluable. But with unemployment figures rising, where else are people turning for extra income today?

The majority of our survey respondents (30%) reported that they would look for part-time work to fill in the gaps in their budget. Sixteen percent plan to borrow from a family member or friend, while 15% will look to sell assets, including their home or car. Another 15% are planning to apply for unemployment insurance, and 14% will consider withdrawing from their retirement account. Just 10% of those surveyed said they would go to the bank for a loan.

Part-time work

While recruiting may feel bleak, a number of companies are hiring right now. New Jersey and Los Angeles have created job portals that list work opportunities for anyone unemployed or underemployed due to Covid-19. Stores like CVS, Walmart, and Dollar Tree are also bringing on tens of thousands of workers. There are also a number of ways to make money online from legitimate sources. You can find more information on full- or part time work opportunities that have emerged here.

Selling a home or car

On one hand, online marketplaces, from eBay to Etsy, make it easier than ever to start your own “store” and sell for cash. Of course, buyers may be hesitant to purchase non-essential goods, and shipping delays are now the norm. If you’re wondering “is now a good time to sell a house”, there are important questions to answer before moving forward, including whether you have enough home equity. You must also consider that, given today’s uncertainty and social distancing, the sale of just about anything would have to be through a video tour or inspection, which could make things difficult.

Taking out a loan

Loans are certainly an option right now, whether from friends, family, or the bank. If you’re in a position to do so, going to loved ones with the financial means can be a good way to get a better interest rate.

However, in taking a loan from a family member, we recommend considering the dynamics at stake, and having a written contract with a promise to repay.

With regards to bank loans, banks may soon be offering more options to help people in the wake of the virus. However, it’s important to do your research and look at not only the price of the loan but also the payback period and how it is set up. For example, single payment loans may be more difficult to pay back, versus a loan that you repay over installments.

Withdrawing from retirement accounts

Finally, there is the possibility of withdrawing from a retirement account. This has been made easier in recent weeks by the CARES Act, which removes the typical 10% penalty for early withdrawals from retirement accounts and allows for more generous loans (up to $100,000) from those savings. You will still owe income taxes on the withdrawn funds, but the payback period on the taxes has been extended to three years. However, taking money from retirement savings can mean borrowing against your future self, because the cash taken out won’t have the opportunity to grow and compound over time. Before making this move, it is wise to consider all of your options and, if possible, speak to an advisor.

What else you can do, with or without another stimulus check

We do not yet know if there will be another stimulus check. Amid the economic uncertainty, for those unsure what to do with their assets and savings, remember to consider all options before making a decision. Making a move like selling your home or withdrawing from a retirement account might help in the short-term, but could wind up hurting your personal finances down the road. If possible, consult with a financial professional.

For those who are eligible for Social Security – while we don’t necessarily recommend taking benefits earlier – this is a good time to consider how you can maximize your Social Security benefits. That means understanding and calculating what your options are for earned benefits, spousal benefits and survivor benefits. One of the best ways to see what you’re owed is to use an online Social Security calculator.

Given the uncertainty today, it’s understandable to feel overwhelmed or have trouble thinking clearly about your savings and investments. That’s why, more than ever, it’s important to stay positive and take care of yourself. Frame this time at home as a moment to educate yourself about your Social Security options and plan for your future. In the days ahead, staying informed, aware, and empathetic is paramount to making it through the crisis and keeping your financial and retirement planning – and your life – on track.