Have you checked your bank or credit card statement and come across a puzzling transaction called “AMAZON MKTPLACE PMTS AMZN.COM/BILL WA“? In this blog post, we’ll break down what this charge is for, shed light on the company behind it, explore alternative transaction descriptions, and guide you through finding the corresponding receipts, so you can be sure this is a legitimate transaction and not fraud.

Amazon vs Amazon Marketplace

Think of Amazon and Amazon Marketplace as two separate sections within Amazon’s business. They’re linked, but each one operates independently are the key differences between the two:

Amazon

- Amazon.com is the primary online retail platform owned and operated by Amazon.

- Amazon sells products directly to customers through its own inventory, offering a wide range of products across various categories.

- Amazon is responsible for inventory management, order fulfillment, customer service, and returns for products sold directly by Amazon itself.

- Amazon also offers subscription services like Amazon Prime, Amazon Music, Amazon Video, and Amazon Kindle, among others.

- Amazon generates revenue from product sales, subscription fees, and various other services.

Amazon Marketplace:

- Amazon Marketplace is a platform within Amazon.com that allows third-party sellers to list and sell their products alongside those sold by Amazon itself.

- It provides a platform for individual and business sellers to reach a wide customer base without the need to build their own e-commerce websites.

- Third-party sellers can offer both new and used products, and they set their own prices.

- Amazon Marketplace handles the payment processing and often provides fulfillment services through programs like Fulfillment by Amazon (FBA).

- Sellers on the Amazon Marketplace pay various fees to Amazon, including referral fees and, if they use FBA, fulfillment fees.

- Amazon Marketplace significantly expands the product selection available on Amazon.com, making it a more comprehensive online marketplace.

In summary, Amazon sells products directly to consumers, manages its own inventory, and offers various services and subscription-based benefits. Amazon Marketplace, on the other hand, is a platform where third-party sellers can list their products for sale on Amazon’s website, leveraging Amazon’s customer base and infrastructure in exchange for fees. The combination of these two components makes Amazon one of the largest and most diverse online marketplaces in the world.

Identifying Amazon Charges

Amazon transactions on your credit card statement can appear in various ways, depending on the specific transaction and how it was processed. Here are some common descriptors you might see for Amazon charges:

AMAZON or Amazon.com: This is the most straightforward and commonly used descriptor for Amazon purchases made directly from the Amazon website.

AMZN: Amazon often uses this shortened version of its name for transactions.

AMZN Mktp US: This descriptor is often used for Amazon Marketplace purchases, indicating that the transaction was processed through Amazon’s marketplace.

AMZN Digital: This might appear for digital purchases, such as e-books, music, movies, or software from Amazon.

AMZN Prime Membership: If you have an Amazon Prime membership, your annual or monthly subscription fee may appear with this descriptor.

AWS Amazon Web Services: If you use Amazon Web Services (AWS) for cloud computing or hosting services, charges related to AWS will have this descriptor.

AMZN Prime Video: This descriptor can appear for charges related to Amazon Prime Video, a streaming service.

AMZN Fresh: For transactions related to Amazon Fresh, Amazon’s grocery delivery service.

AMZN Kindle: This might appear for charges related to Kindle e-books or Kindle device purchases.

AMZN Mktp CA: Similar to “AMZN Mktp US,” but for Amazon Marketplace purchases in Canada.

AMZN Music: For transactions related to Amazon Music, the music streaming service.

AMZN Appstore: If you make purchases from Amazon’s app store for Android devices, this descriptor might be used.

AMZN Digital Services: Used for various digital services provided by Amazon, such as digital downloads and subscriptions.

AmazonSmile: If you make purchases through AmazonSmile, a portion of the purchase goes to a charitable organization of your choice, and this descriptor may appear.

AMZN Payments: Sometimes used for payment-related transactions.

It’s important to note that the exact descriptor on your credit card statement may vary, and these are just some common examples. If you ever have a question about a specific charge, you can usually find more details in your Amazon account’s order history or contact Amazon customer support for assistance. Additionally, always keep an eye on your credit card statements to ensure that all charges are legitimate.

How to Find Fraudulent Charges

We recommend you use a smart-tool like the app SimplyWise!

It can be a lot of work to keep track of all the activity on your credit card/bank statement throughout the month, and apps like SimplyWise store and organize all your receipts and online transactions (including Amazon, Walmart, PayPal, and more!) to provide you with a complete and comprehensive view of your expenses as they occur.

Follow these simple steps to begin avoiding unauthorized charges and gaining better visibility into your spending:

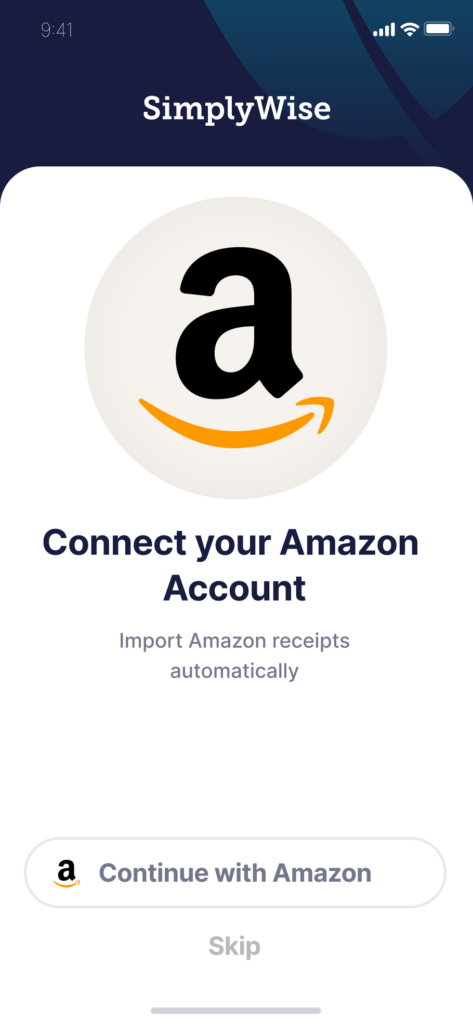

Step 1

- Download the SimplyWise app and connect your Amazon account.

See all your Amazon transactions at the touch of a button with the Amazon Connect feature within the app. There’s no limit to the number of transactions being imported into your SimplyWise account – so never fear if you’re a frequent Amazon flyer (like the rest of us)!

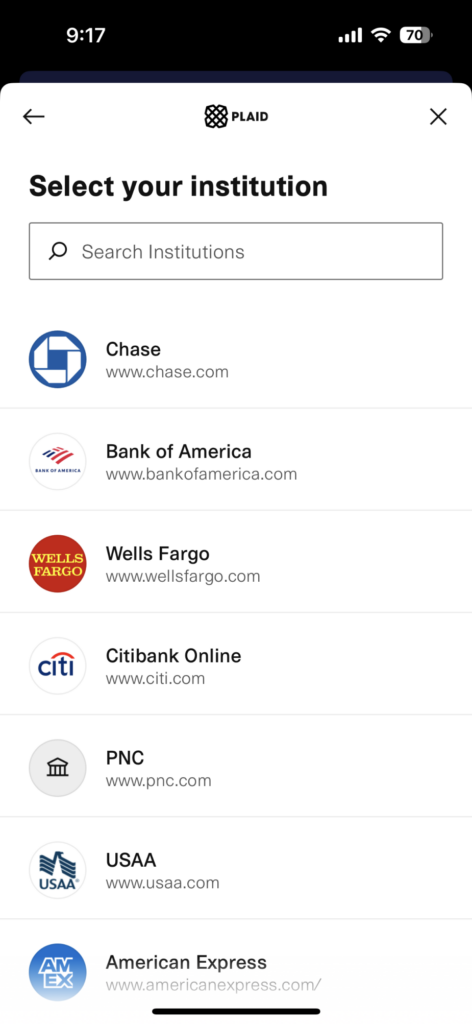

Step 2

- Connect to your bank account/credit card transactions through the secure (256 bit encryption) Reconciliation feature within the app.

Once you’ve connected your accounts to SimplyWise, you’ll be able to compare the transactions you’ve recorded in your SimplyWise account as well as the charges reported on your bank or credit card statements.

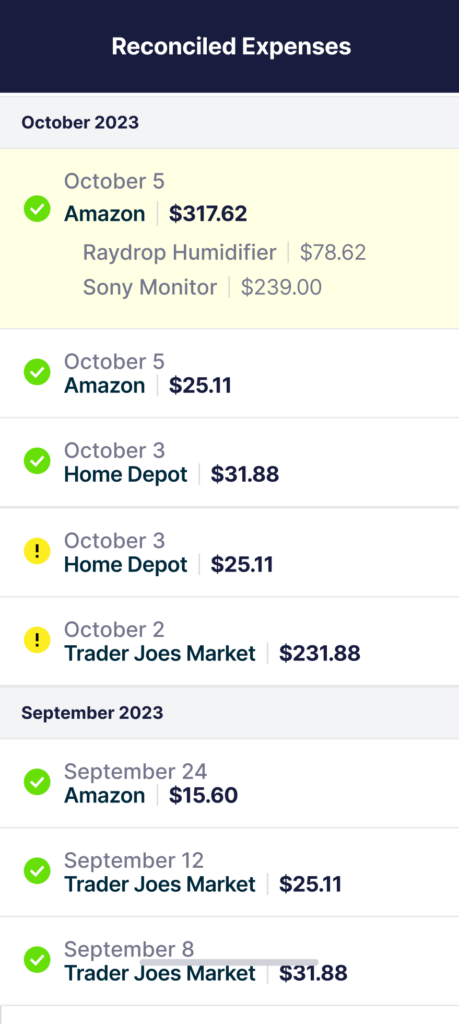

Step 3

- Reconcile the charges reported by your financial institution against what you’ve recorded in your SimplyWise account.

Find fraud quickly!

SimplyWise will match your transactions to your bank/credit card spending and check those items off.

If there are transactions reported by your bank that SimplyWise does not recognize, you’ll see those marked with an alert (!) icon. If after reviewing these charges, you still don’t recognize them, it’s time to call the bank!